Introduction to the Equity Collar

Introduction to the Collar

What if you own a stock and are interested in protecting yourself against a potential downward movement in the stock price but are concerned with having to pay a premium to buy the put option? If this describes your situation, then you can enter into a collar – also known as an equity collar. The collar is a combination of the covered call strategy and the protective put strategy. To reduce the price of the protective put, you will short a call option. This credit reduces the cost of the downside protection.

How do you construct a Collar?

The Collar or Equity Collar option strategy is comprised of three components: a long stock position, a long put option, and a short call option. The put option that is purchased will be at the current price of the stock (at-the-money) or lower price than the stock (out-of-the-money). Most commonly, a trader will enter a collar using an out-of-the-money put option, but this could vary based on the situation and the trader’s risk tolerance. The call option that is shorted will almost always be out-of-the-money to allow for upward price appreciation of the underlying stock.

Unlike many other multi-legged option strategies, the collar does not require the trader to have the long put and short call at equidistant strike prices from the underlying stock’s price. This means that the trader could buy a put and short a call that are +5 / +2 strikes out-of-the-money, +2 / +1 strikes out-of-the-money, etc.

Illustration 1

Source: Upstox

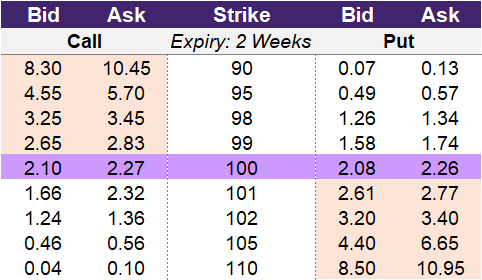

Source: UpstoxLet’s walk through an example equity collar strategy using the data in illustration 1 above. Let’s assume that you are concerned with a potential near-term 2% reduction in price. A put option at the 98-strike price will cost 1.34 to purchase. To offset this, you would sell a call option. Maybe you think that the most the stock could go up is 5% during this same time period. You decide to sell the 105-strike price and receive a credit of 0.46 for the short call. By doing this, you have now protected yourself against a downside move of more than 2%, and in return, it costs you 0.88 to enter into the strategy as well as foregoing any potential gains in stock price of more than 5%.

One thing to keep in mind is that collars don’t have to be net debit (cash outlay) strategies. You can enter into a collar as a credit depending on the strikes selected. Typically, a credit collar will require you to purchase a put that is more out-of-the-money than the call that is shorted. In the prior example, we entered into a 98-105 collar where the call was more out-of-the-money than the put. If you instead entered into a 98-101 collar where the call is less out-of-the-money than the put, this would be a net credit strategy. Instead of paying 0.88 for the collar, you would receive a credit of 0.32. This is because you would pay 1.34 for the put option and get paid 1.66 for the call option. Of course, the trade-off is the stock only can rise by 1% before your gains are capped.

Why would a trader use a collar?

A trader would enter into a collar if the following points are true:

- The trader owns a stock.

- They want to keep owning the stock.

- They are concerned about near-term downward price movements in the stock.

- They don’t want to enter into a protective put due to the cost of this strategy.

- They are comfortable with giving up potential stock appreciation by selling a call.

What is the max profit of a collar?

Key Formula:

- Equity Collar Max Profit = Short Call Strike Price – Underlying Price of Trade Entry + Short Call Premium Received – Long Put Premium Paid

The maximum upside of a collar is similar to a covered call. This means that if the underlying stock is performing well and moves significantly above the shorted call’s strike price, then the trader won’t participate in these gains in the underlying stock. This is because any gain in the underlying stock will be offset by the loss of the shorted call option above the strike price.

In our example using the data from illustration 1, we shorted the 105-strike call option and purchased the 98-strike put option. The net premium paid was 0.88. Therefore, the max profit for this trade is 105 – 100 – 0.88, which is 4.12.

How much can you lose trading a collar?

Key Formula:

- Equity Collar Maximum Loss = Long Put Strike Price – Underlying Price at Trade Entry + Short Call Premium Received – Long Put Premium Paid

The max loss for the equity collar is similar to that of the protective put strategy. The difference is that the cost of entering the collar will be lower than that of a comparable protective put strategy. In illustration 1, you paid 0.88 to enter into the collar. Since the long put strike price selected was 98, if the underlying falls from 100 to this strike price, you would lose 2 from the decrease in stock price. In total, you would lose 2.88: 2 from the stock price and 0.88 from the hedge to cap your stock losses at 2.

What is the breakeven point when entering a collar?

Key Formula:

- Equity Collar Breakeven Point = Underlying Price + Short Call Premium Received – Long Put Premium Paid

The collar strategy has one breakeven point. To calculate the breakeven point for this strategy, you start with the underlying price and add the premium received from the short call and subtract the premium paid for the long put. If the sum of the short call and long put premiums results in a net debit, then the breakeven point will be above the underlying price. If the sum of the short call and long put premiums results in a net credit, then the breakeven point will be below the underlying price.

In our example, the breakeven point is 100.88. This is because the underlying price was 100, and the net debit paid to enter into the collar was 0.88.

What is the profit formula for a collar?

Key Formula:

- Equity Collar Profit = Underlying Stock Profit + Short Call Profit + Long Put Profit

- Underlying Stock Profit = Current Stock Price – Stock Price when Collar Entered

- Short Call Profit = Short Call Credit Received – Max(0 Underlying Price – Strike Price)

- Long Put Profit = Max(0 Strike Price – Underlying Price) – Premium Paid

To determine the profit for the collar strategy, you need to combine the P&L calculations for the three components – the underlying stock, the short call, and the long put.

What is the payoff diagram for a collar?

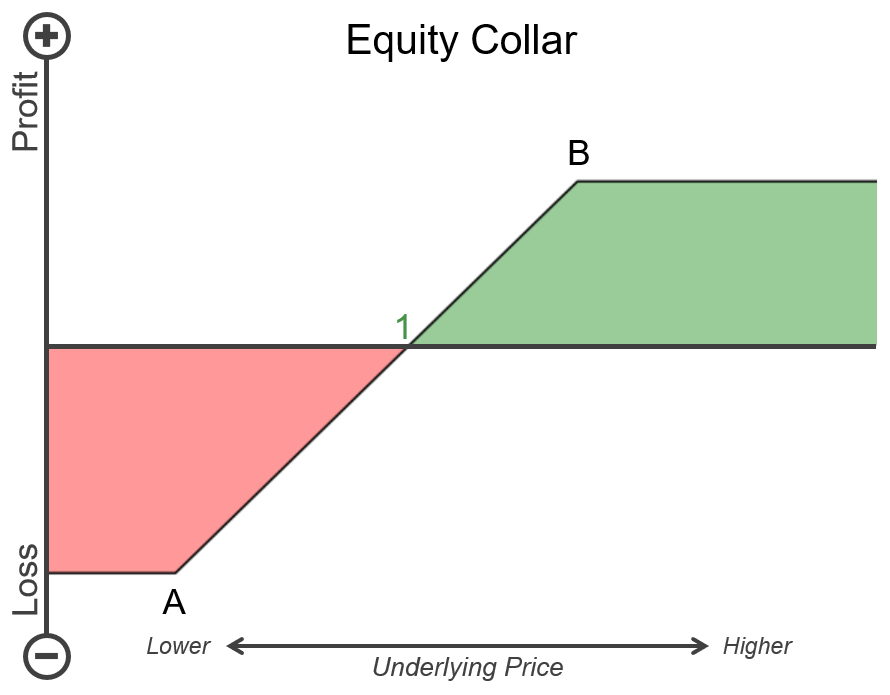

An example of the payoff diagram for the equity collar is shown in illustration 2. Point A is the strike price of the long put. If the underlying reaches this price, the trader will be at the maximum loss for this strategy. In the payoff diagram, areas of potential loss are shown in red. Point B is the strike price of the short call option. If the underlying rises to this price, then the trader will be at the maximum gain for this strategy. Areas of green represent potential profit. Point 1 is the breakeven point for this strategy. The horizontal axis is the price of the underlying stock. As the stock price rises or moves to the right in the diagram, the trader will have less of a loss until they breakeven at point 1 and then will be profitable.

Illustration 2

Source: Upstox

Source: UpstoxWhat is the point of max profit for a collar?

Key Formula:

- Price of Underlying >= Short Call Strike Price

The collar strategy will be the most profitable if the underlying stock price is at or above the short call strike price. Once the underlying is above the short call strike, you forego any future gains in the stock price because your gains will be offset one-for-one by losses as a result of the short call. In our example from illustration 1, you shorted the 105-strike call option. Therefore, your gains are capped at a stock price of 105.

What is the point of max loss for a collar?

Key Formula:

- Price of Underlying = Long Put Strike Price

A collar is a strategy that has a fixed max loss. The point of the maximum loss for the collar is the strike price of the long put. If the underlying price falls below this strike price, the trader cannot lose any more. In our example from illustration 1, the long put strike price was 98. This means that in this example, the point of max loss is 98.

Summary

- A collar strategy involves selling a call option and buying a put option on a stock that you own.

- The benefit of the collar strategy compared to the protective put strategy is that the cost to enter into the collar is reduced due to the credit received from the short call. This lowers the breakeven point of the collar versus a comparable protective put strategy.

- The drawback of the collar strategy is that you are capping any potential upside of the stock price by selling a call option.

- This strategy has both a fixed max loss and fixed max gain.

- Depending on the strike prices selected for the long put and short call, you can structure a collar as a net debit (cash outlay), net credit (cash inflow), or zero-cost strategy.

Is this chapter helpful?

- Home/

- Introduction to the Equity Collar