As one of India's most used financial services, cheques serve as a medium of exchange and proof of ownership. Since they are straightforward, individuals in both urban and rural areas may utilize them. Cancelled cheques are one cheque you can use to open a bank account or apply for a loan.

Cancelled cheques are vital documents banks and other financial institutions need to verify the customer's banking information. It would be best if you never underestimated their importance. The purpose of a cancelled cheque is to demonstrate to the lender the authenticity of your bank account information.

This article discusses the benefits of cancelled cheques, the process of creating them, and the situations in which you will need one.

What Is a Cheque?

A cheque is a negotiable document that instructs a bank to transfer money from the account of the drawer to the account of the person to whom it is issued, on the order of the designated person, or to the bearer of the cheque if no other payee is designated.

While the digital age has made it possible to complete any business deal quickly, many people still prefer to use cheques for payment because they lack confidence in online methods or find them unpleasant.

Parties Involved in Processing a Cheque

-

Drawer of the cheque: The drawer of a cheque is the person who signs the cheque or gives instructions to the bank to pay a certain amount.

-

Drawee of the cheque: The drawee of a cheque is the financial institution that is obligated to make the payment indicated on the cheque.

-

Payee: Payee refers to the individual or organization that receives the funds sent by the bank.

There are two other parties to a cheque in addition to the ones above:

When the drawer writes a self-cheque, the drawer and payee can be the same person.

Cheque Types

The types of cheques include open, self-cheques, bank, crossed, stale, cancelled, and many more.

-

Bearer Cheque: Banks can accept payments from the issuer of these cheques without requiring authorization. A bearer may cash this cheque if they present it to an authorized bank.

-

Blank Cheque: A blank cheque does not contain any other details and is only signed by the issuer. It carries a high level of risk since it can be used to issue cheques to oneself if someone finds it.

-

Order Cheque: Payees can cash only these types of cheques. The person whose name appears on the cheque can cash it.

-

Open Cheque: An uncrossed cheque can be encashed at any bank, and the payment can be made to the individual carrying it. The issuer must sign the cheque on both the front and back. The cheque can also be transferred from the original payee to another payee.

-

Crossed Cheque: It is also called a payee cheque account. The words' account payee' is written in two parallel lines at the top left corner. As a result, these cheques are the safest to issue since they ensure payment is made only to the person whose name appears on the cheque.

-

Post-dated Cheque: There is a later date for cashing this type of cheque, so it can be used to meet financial obligations in the future. The cheque is valid for three months from the encashed date, even if the bearer presents it to the bank immediately. The bank processes the payment only on the date mentioned on the cheque.

-

Stale Cheque: The validity of a cheque expires three months after it is issued; called a stale cheque. Such cheques cannot be used to withdraw money.

-

Banker's Cheque: A banker's cheque guarantees payment and is issued by the bank.

-

Self Cheque: Self-cheques have the word "self" written in the drawee column and can only be drawn from the issuer's bank.

-

Traveller's Cheque: Foreigners can use these cheques instead of hard cash on vacation. They are issued by one bank and can be cashed at a foreign bank in the form of currency. The traveller's cheque has no expiration date and can be used anytime.

Let's discuss what a cancelled cheque is and how to write it.

What is a Cancelled Cheque?

The term cancelled cheque means a check that has been cancelled when two parallel lines with the word "cancelled" are drawn across its front. If a cheque has been miswritten, it may be cancelled, which is why it is called a cancelled cheque.

A cheque does not need anything else except the term "cancelled". It does not require your signature or any notation. A cancelled cheque is a piece of evidence that the person in question has a bank account.

The term "cancelled cheque" is also used when a cheque has been cashed. When a cheque is cashed in, it is officially cancelled by the bank. Once a cheque is cancelled, it can no longer be used for further withdrawals.

Cheques are usually cancelled to prevent them from being used fraudulently. However, even though they can't be used to withdraw money from a bank, they still contain sensitive information that might be stolen and misused online.

How to Cancel a Cheque?

In certain circumstances, it is necessary to cancel a cheque to avoid its misuse. When cancelling a cheque, the following procedures should be followed:

-

Step 1: You must remove a new cheque form from the cheque leaf to cancel a cheque. Do not sign the cheque.

-

Step 2: Take a pen and draw two lines parallel to the cheque.

-

Step 3: Type "CANCELLED" in all capital letters between those lines.

You should remember that even after you've drawn parallel lines across a cheque, the account number, account holder's name, IFSC code, MIRC code, bank name, branch location, etc., should still be visible.

If you need to cancel a cheque due to an error, you may follow the steps outlined above, beginning with Step 2.

Cancelled cheques cannot be used to withdraw funds, but they can still be misused in several fraudulent ways. You should ensure that the person or institution you give your cancelled cheques is highly reliable.

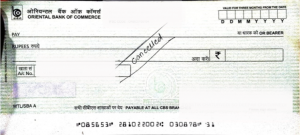

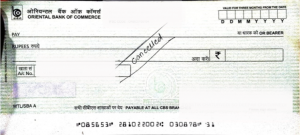

Cancelled Cheque Example

In essence, it is the same as a traditional cheque. Its components are as follows:

-

Bank Name

-

Branch Name

-

Account Holder's Name

-

The Account Number

-

The IFSC code

-

The MICR code

There is something different about a cancelled cheque, however. The word "cancelled" will be placed between two parallel lines on the cheque for an added security measure. Below is a cancelled cheque example.

## **What Does a Cancelled Cheque Signify?**

Often, a cancelled cheque will be accepted as proof of identity when opening a bank account for the first time. This can often be used to confirm your bank account information.

When is a Cancelled Cheque Required?

The word "cancelled cheque" is one you've probably seen often while dealing with financial institutions. Cancelled cheques may be used for more than just financial purposes. Below, we've included some of the most frequent uses for a cancelled cheque.

For Know Your Customer (KYC) Requirements:

In financial institutions and organizations, knowing your customer is vital. KYC is a concept you are probably familiar with. Many banks and financial institutions may ask customers for identification documents to ensure they engage in lawful financial transactions.

When purchasing

stocks,

mutual funds, or other market-linked investments, a cancelled cheque verifies your identity as a bank account holder and proof of your banking credentials.

To verify the identity of the account holder, the existence of the account, the account number, and the branch location, financial institutions require this document.

For Electronic Clearance Services (ECS):

You can transfer money between accounts electronically through the Electronic Clearance Service or ECS. A business or investment company automatically deducts a certain amount from your checking account regularly (monthly, quarterly, semiannually, or annually) according to a predetermined schedule.

The funds will be automatically deducted from your checking or savings account if you have authorized ECS to pay your monthly bills, such as electricity, water, or internet.

A cancelled cheque may be requested by the provider or investment company. This is if you choose to have the money taken from your bank account instead of sending it to them.

This way, the service provider or investment business will receive the relevant data. These data will then be entered into their ECS system. This will allow money to be automatically withdrawn at the scheduled time.

For EMI:

People often use credit to make purchases and repay them over time in manageable chunks. Many loans, such as mortgages, auto loans, student loans, etc., offer EMI payment options instead of a single monthly payment.

You will need a cancelled cheque to finalize the paperwork for allocating these monthly payment alternatives.

For Demat Account:

Investors can store their digital shares in a

Demat account. However, you cannot simply ask a bank to open one of these accounts. Your application must include supporting documents such as a photo ID and proof of your address. Additionally, you will need to provide a cancelled cheque.

This will be sent along with any necessary paperwork to a stock brokerage firm. Using the information on the cheque, the company will set up automatic debit and credit transfers to your Demat account. This will enable you to make paperless transfers between your savings and Demat accounts.

For Withdrawal from the Employee Provident Fund (EPF):

If you wish to withdraw funds from your EPF account after its maturity date or before its scheduled withdrawal date, you will need a completed withdrawal form and a cancelled cheque.

For Starting a New Bank Account:

There might be a time when your bank will want you to provide a cancelled cheque as part of the documentation needed to set up an account. Regardless of whether you have a checking or savings account, you may have to provide this at some point in the process.

For Insurance Policy:

Insurance is a concept that is well known and has many potential applications. A cancelled cheque will be required if you purchase insurance policies such as life, health, or money back.

Insurance payments will be automatically taken from your bank account. Some insurance providers require a cancelled cheque as part of the purchase process.

For Loan disbursements:

Borrowing money is common, and it is possible to use personal loans to finance a wedding or home purchase and further one's education. As of right now, no lending company provides cash loans.

The funds from your loan will be deposited into your bank account directly. They need a copy of the cancelled cheque to deposit the money into your bank account electronically.

What is the Difference Between a Stop Payment and a Cancelled Cheque?

| STOP Payment | CANCELLED Cheque |

|---|

| Cheques issued for STOP Payment are transactional. | The cheque is worthless as a method of payment in this instance. |

| There is no written word "CANCELLED.". | There is a written word "CANCELLED". |

| You can use it when there are insufficient funds in your account against a cheque to make a payment, when your cheque is misplaced, or if you want to stop a payment intentionally. | It provides information such as the account holder's name, account number, the bank's name, IFSC code, MICR code, and the branch's address. |

| When cancelling a cheque payment, a bank may charge a small fee. | The bank charges no fees. |

| To stop a cheque from being paid, you must instruct the bank in writing through a 'Stop Payment' order. | Since the order does not have transactional authority, the bank cannot use it to make a payment in this case. |

| The account holder's signature will appear on a cheque against which a 'stop payment' order has been issued. | Signing the cancelled cheque, as a rule, is unnecessary, but some organizations may request a signature. |

What Information Can Be Obtained From a Cancelled Cheque?

However, it is essential to note that a cancelled cheque does not necessarily have any monetary value, but it can provide a lot of information about a person.

Using a cancelled cheque, you can obtain the following information:

Fraudulent Use of Cancelled Cheques

Banks and other financial institutions usually use cancelled cheques as a Know Your Customer (KYC) tool. However, cancellations of cheques have been used fraudulently in some cases. Due to this, the original issuer should never sign the cancelled cheque.

An issuer should always ask if a photocopy of the account holder's passbook or a scanned version of the cheque is acceptable in place of a cancelled cheque since the purpose of a cancelled cheque is to confirm the account's existence.

Wrapping Up

When a cheque is cancelled, no one can access your account unauthorized. A cancelled cheque can still provide you with financial information such as your bank account number, the account holder's name, the IFSC code, and the MICR code.

You should always avoid signing cancelled cheques because it makes it easier for criminals to forge them. However, if someone insists on requiring your signature on the cancelled cheque leaf, obtain a declaration supporting the same.

FAQs

Should I sign the cancelled cheque?

You are not required to sign a cancelled cheque because it is merely proof and not a transaction. There is no need to sign or write anything on a cancelled cheque, including your signature, amount, payee's name, or any other information.

Can my bank cancel my cheque?

The bank cannot cancel your cheque on your behalf. It is your responsibility to cancel the cheque. If you don't have a cheque, your bank can provide you with a chequebook so that you can cancel a cheque.

Can red ink be used to cancel a cheque?

Using blue or black ink when writing or cancelling a cheque is always advisable. Any other colour will be rejected by banks, non-banking financial companies (NBFCs), or other financial institutions.

By drawing two parallel lines across a cheque, is it considered cancelled?

For a cheque to be considered a cancelled cheque, it must have the word 'cancelled' written between the lines. This will ensure that the bank will accept it as a cancelled cheque and that it will not be misused.

Is it possible to use my cancelled cheque again?

If one has a cancelled cheque, it can be reused multiple times. Even a scanned copy of a cancelled cheque can be used occasionally.

## **What Does a Cancelled Cheque Signify?**

## **What Does a Cancelled Cheque Signify?**