Upstox Originals

Sector rotation signals strength in Nifty Commodities

4 min read | Updated on February 14, 2025, 18:55 IST

SUMMARY

As markets continue to correct, investors look for pockets of opportunities that could help their portfolios. The Nifty Commodities Index is showing early signs of strength, suggesting it could outperform even if the broader market stays weak. A key support level has held firm, and indicators point to a possible recovery. Additionally, a recent pullback in the U.S. dollar could support commodities by stabilising prices.

The Nifty Commodities Index is showing early signs of strength

The equity markets remain under pressure as the Nifty50 heads toward a negative close for the week despite recovering over 200 points from its lowest level. The index continues to face resistance at the 50-day moving average (DMA) on the daily chart. It remains capped by the 50-week moving average (MA) at 23,781 on the weekly timeframe. The risk of a downward retracement persists as long as the index stays below the 23,800 mark. A breach of the 23,000 level on the downside could trigger further market weakness.

Sector rotation and emerging strength in Nifty Commodities

Given the current technical setup, sector rotation becomes a crucial factor in navigating market conditions. Positioning within relatively stronger sectors is essential to achieving relative outperformance, particularly in an environment where the broader market remains vulnerable to corrections.

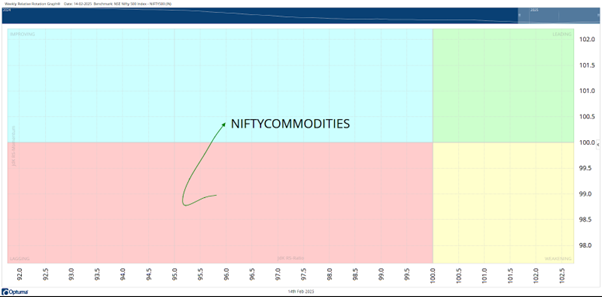

An analysis of the Relative Rotation Graph (RRG) indicates that the Nifty Commodities Index has moved into the Improving Quadrant when benchmarked against the broader Nifty 500 Index. This transition holds significant implications, as it suggests the potential onset of a phase of relative outperformance. Even if broader market weakness persists, the commodities space could exhibit resilience and demonstrate strong relative strength against the overall market trend.

Early signs of reversal in Nifty Commodities Index

The daily chart of the Nifty Commodities Index indicates early signs of a potential reversal. Following a period of consolidation after forming a low at 7,597 in early January, the index has recently exhibited a bullish hammer-like candle with a long lower shadow. While the presence of a small upper shadow prevents it from being classified as a textbook hammer, the emergence of a candle with a pronounced lower shadow suggests the possibility of a reversal.

Additionally, the formation of this candle near a key pattern support reinforces the credibility of the support zone. The Relative Strength (RS) line has also shown a notable shift in momentum; after remaining flat for some time, it has started to rise and has now moved above its 50-period moving average, further strengthening the case for a potential recovery.

A broader view of the weekly charts further strengthens the positive outlook for the Nifty Commodities Index. After retracing from its peak of 9,896 in September last year, the index initially found support at the 100-week moving average (MA) in January. Since then, it has managed to sustain this support level through subsequent weeks, with the 100-week MA currently positioned at 7,701. This consistent adherence to a long-term support level indicates increased possibilities of this key support staying defended.

Additionally, a bullish divergence between the Relative Strength Index (RSI) and price suggests potential upside momentum. While the weekly MACD remains bearish and below its signal line, the narrowing histogram indicates a slowdown in downward momentum.

Impact of the U.S. Dollar on commodities and market dynamics

The value of the U.S. dollar has a direct influence on commodity prices, as most global commodities are priced in dollars. A stronger dollar typically exerts downward pressure on commodity prices, making them more expensive for holders of other currencies, while a weaker dollar provides support by making them more affordable.

Since September last year, the Dollar Index (DXY) has experienced a significant uptrend, rising from a low of 100.17 to a peak of 110.17 in early January. However, it now appears to have formed a temporary top and has begun to retrace. This moderation in the dollar’s strength could provide further support for the commodities sector, potentially allowing it to establish a base at current levels and stabilise after recent corrections.

Key stocks to watch out for

As the commodities sector shows signs of relative strength, certain stocks within this space warrant close attention in the coming weeks and months. Stocks such as COALINDIA, RELIANCE, ONGC, GRASIM, JSWSTEEL, UPL, PIDILITIND, HINDALCO, NTPC, and PIIND have either staged a notable rebound from their recent lows or are in the process of attempting a trend reversal. Some of these stocks are also exhibiting bullish divergences on key technical indicators, signaling the possibility of a bottom formation and a shift in momentum.

As the commodities space continues to strengthen, these stocks could present an opportunity for investors.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story