Market News

Stock Market Weekly Recap: SENSEX, NIFTY close lower in eventful week; IT shares rebound

.png)

5 min read | Updated on November 09, 2024, 10:12 IST

SUMMARY

In the coming week, investors will monitor key economic data like the Index of Industrial Production (IIP) and inflation. The final phase of the current earnings season may also affect investor sentiment to some extent.

Stock list

- Trent, Asian Paints, Coal India, Grasim Industries and Hero MotoCorp were major losers this week.

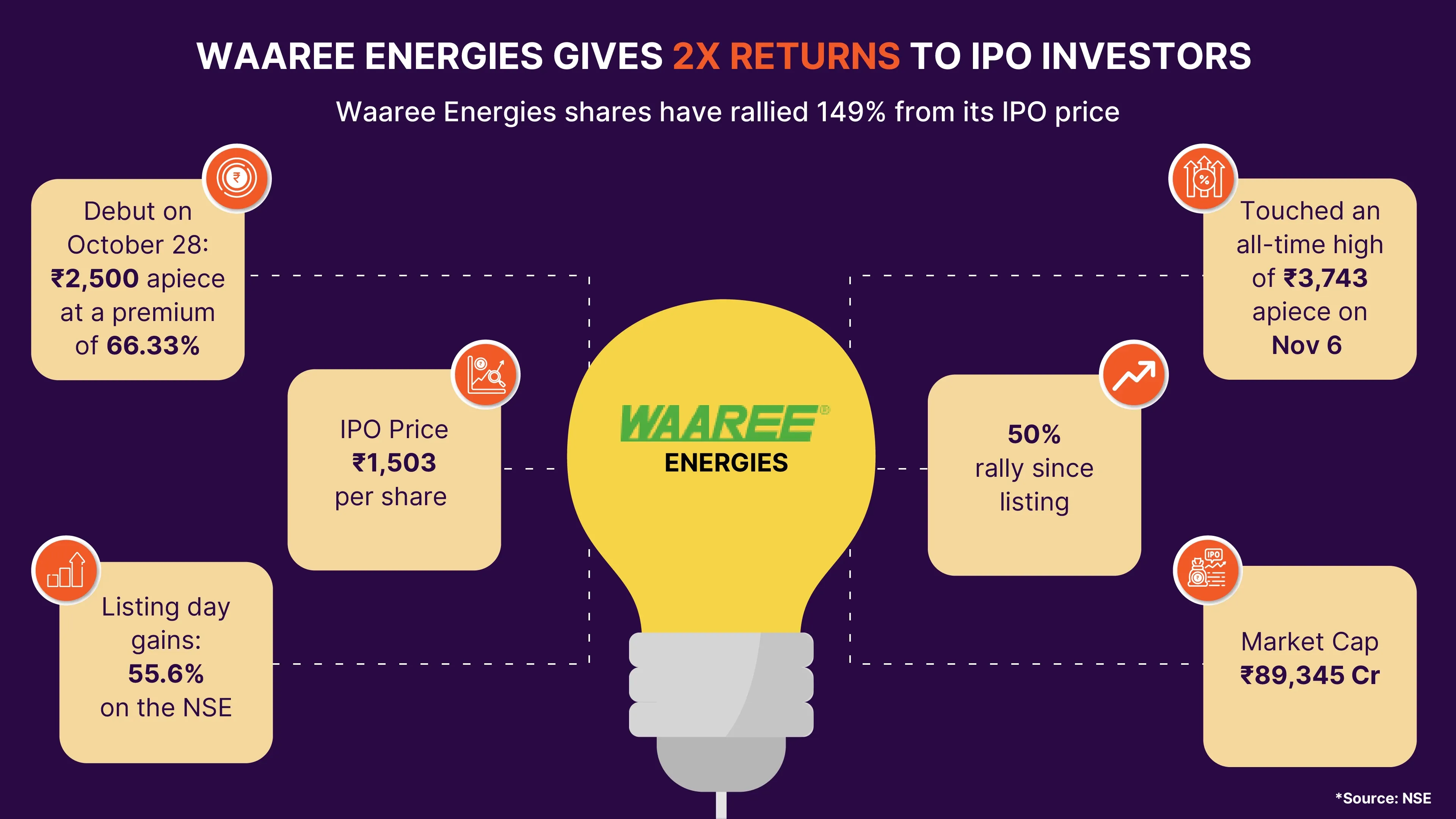

- Waaree Energies rallied for seven straight days after listing, more than doubling IPO investors’ money.

- Costliest stock Elcid Investments shares breach ₹3 lakh mark.

Hey there! We are back with a recap of the markets, which had an action-packed week marked by volatility.

Benchmark indices, SENSEX and NIFTY, closed marginally lower this week amid continued selling by foreign institutional investors (FIIs) and weak quarterly results. Concerns over premium valuations in Indian equities and potential value appreciation in other Asian markets triggered the flight of FIIs this week.

Stock markets turned volatile amid key events like the US presidential polls and the US Fed policy meeting. NIFTY tanked 156 points, while SENSEX lost 240 points in the event-heavy week.

While weaker-than-expected financial results by bluechips remained a concern on the home front, a rebound in domestic manufacturing activity provided support.

Also, a 25 basis point rate cut by the US Fed and Donald Trump's return to office as US President for a second term eased the impact on stock markets to some extent.

Stock indices tanked more than 1% on Monday after the Diwali festival due to FII selling and caution ahead of the US elections. Weak Q2 earnings also dampened investor sentiment. SENSEX tanked 941 points to settle at a three-month low.

NIFTY shed 300 points to close below the 24,000 level for the first time since August 6.

Stock markets staged a spirited recovery on Tuesday on late buying in banking and metal shares. NIFTY rebounded nearly 200 points to close above 24,200, while SENSEX gained 694 points to settle above 79,000. Buying was led by domestic investors, while FII selling restricted gains ahead of the US elections.

Donald Trump's lead in the US presidential election results triggered a rally in IT and pharma shares, helping SENSEX and NIFTY jump more than 1% on Wednesday. SENSEX gained 901 points to reclaim the 80,000 level, and NIFTY jumped 270 points to close near the 24,500 levels.

All the sectors added to the rally with NIFTY IT leading the chart.

The euphoria over the Trump win waned soon, with concerns over duty hikes, strong dollar pushing US bond yields and protectionist measures hitting IT firms coming to the fore.

SENSEX and NIFTY tanked more than 1% on Thursday as IT and pharma shares came under selling pressure.

Stock markets remained in the grip of bears in restrictive trade on Friday. SENSEX lost 55 points to settle at 79,486.32, while NIFTY dropped 51 points to end at 24,148.2.

Among NIFTY sectoral indices, realty, media, oil & gas, and FMCG declined the most.

IT shares buck weak trend: TCS, Tech Mahindra, HCL Tech lead gainers

Waaree Energies more than doubles IPO investors’ money

The stock posted a straight seven-day rally since listing till November 6, rising by around 150%. The stock came under profit booking on Thursday to tank around 8% and settle at ₹3,348.65. Shares of Waaree Energies touched an all-time high of ₹3,743 apiece on the NSE on Thursday.

On Friday, the stock declined more than 6% to settle the week at ₹3,110 apiece on the NSE.

Elcid Investments hit lifetime high after scaling ₹3 lakh peak

Shares of Elcid Investments, the most expensive stock on Indian exchanges, hit an all-time high of ₹3,32,399.95 apiece on the BSE on Friday after a nearly 5% jump. The stock has been on a gaining streak since October 29, when it underwent a special re-listing, which saw a dramatic more than 66,85,452% exponential increase on that day.

The stock breached the ₹3 lakh mark for the first time on November 6.

The relisting of Elcid Investments was under the BSE measure to facilitate price discovery for select investment holding companies. The price of shares skyrocketed from ₹3.53 per share to ₹2,25,000 on October 29 after a special call auction. The stock closed at ₹2,36,250 apiece on that day.

The week ahead

In the coming week, investors will monitor key economic data like the Index of Industrial Production (IIP) and inflation. The final phase of the current earnings season may also affect investor sentiment to some extent. Investors will also closely monitor the direction taken by the FIIs and indications of US policy moves after Donald Trump's victory in the Presidential poll.

Next Story