Market News

NIFTY50 consolidates around 25,300 as volatility stays under 13

.png)

2 min read | Updated on September 16, 2024, 18:24 IST

SUMMARY

The options data of NIFTY50’s weekly expiry saw significant call and put base at 25,400 strike. The buildup indicates traders expecting NIFTY50 to remain range-bound ahead of the US Fed’s policy meeting on 18 September.

Stock list

Frontline indices retreat from the dNIFTY50 consolidates around 25,300 as volatility stays dnder 13ay’s high, trade with modest gains

After a positive start, markets traded within a narrow range and ended marginally in the green. The NIFTY50 index formed a doji candle on the daily chart, reflecting indecision ahead of the U.S. Federal Reserve’s policy meeting later in the week.

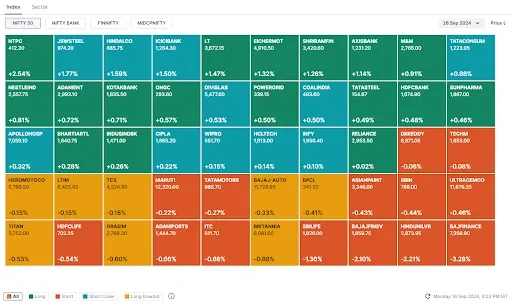

Sector-wise, defensives indices were on the back foot, with FMCG (-0.7%) and IT (-0.1%) closing in red, while Energy (+0.8%) and Metals (+0.6%) saw strong gains.

On the technical front, NIFTY50 formed a doji candlestick near its all-time high, indicating a potential pause. The index is consolidating at higher levels, with immediate support around the 25,150 to 25,200 zone. Sustaining this zone on a closing basis could allow the index to maintain its bullish momentum.

-

Top gainer and loser in NIFTY50: NTPC (+2.5%) and Bajaj Finance (-3.3%)

-

Top gainer and loser in NIFTY Midcap 100: Dixon Technologies (+6.8%) and LIC Housing Finance (-5.7%)

-

Top gainer and loser in NIFTY Smallcap 100: Angel One (+5.0%) and PNB Housing Finance (-6.5%)

Key highlights of the day

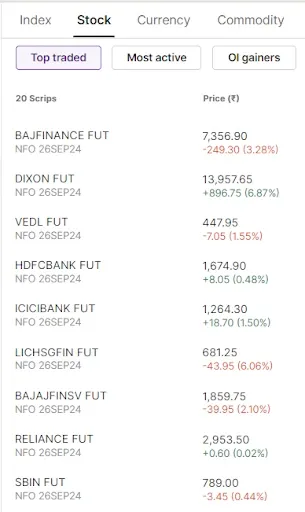

Top traded futures contracts

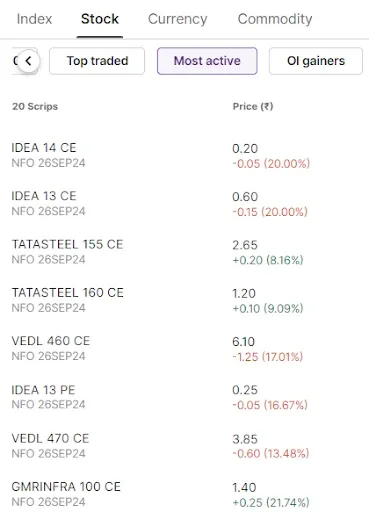

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): KPIT Technolgies, Bajaj Finance, Godrej Consumer Products, Hindustan Unilever and Mankind Pharma

📈Open=Low (Bull power): Delhivery, Adani Total Gas and Adani Enterprises

🏗️Fresh 52 week-high: BSE, Dixon Technologies, Info-Edge (Naukri), Fortis Healthcare and Marico

⚠️Fresh 52-week-low: N/A

See you tomorrow!

About The Author

Next Story