Market News

Reliance Industries Q3: Check earnings preview and options strategy ahead of Q3 results

.png)

4 min read | Updated on January 16, 2025, 09:27 IST

SUMMARY

The options market pricing is ±3.8% ahead of its 30 January expiry. This indicates that traders anticipate Reliance to trade between the range of ₹1,300 and ₹1,200. Positional traders can monitor this range as a breakout from these levels will provide further clues.

Stock list

RIL's biggest acquisition in the last five years has been buyout of local cable TV and internet service providers Hathway Cable and Datacom Ltd for $981 million

Reliance Industries is set to announce its December quarter results on Thursday, January 16, with experts predicting a high single-digit growth in net profit. Consolidated Q3 revenue is expected to see a slight rise of 0.5-1% quarter-on-quarter, reaching ₹2.33-2.37 lakh crore. Year-on-year, revenue may grow by 3-5%, compared to ₹2.35 lakh crore in Q2FY25 and ₹2.27 lakh crore in Q3FY24.

Net profit is projected to increase by 5-8% sequentially to ₹17,300-17,900 crore, though it might decline from ₹19,641 crore reported in Q3FY24. In Q2FY25, Reliance posted a net profit of ₹16,563 crore. Consolidated EBITDA is estimated to range between ₹40,200-40,500 crore, marking a 5-7% rise.

This growth is attributed to strong refining margins in the oil-to-chemicals business and higher average revenue per user (ARPU) in the telecom segment, supported by tariff hikes for prepaid and postpaid plans in Q2FY25.

Investors will closely watch Reliance’s Q3 results to assess the performance of its key segments—retail, telecom, and oil refining. Management's commentary on the business outlook will also be a focal point.

Ahead of the results, Reliance shares traded 0.23% higher at ₹1,255 at 9:20 am on January 16. The stock has gained over 3.3% this month but was down 5.96% for 2024, underperforming the NIFTY50, which has risen 8.8% during the same period.

Technical view

Reliance Industries slipped over 22% in the last six months from its all-time high of July 2024. It is currently trading near the crucial support zone of ₹1,200, which aligns with the 200 weekly EMA. Meanwhile, as per the daily chart, Reliance is at a crucial juncture. Traders can monitor the crucial support zone of ₹1,200 and resistance of 50-day EMA. A break of this range on a closing basis will provide directional clues.

Options build-up

Meanwhile, the open interest (OI) build-up for the 30 January expiry has the highest call base at the 3,000 strike, indicating that the stock may face resistance around this level. On the other hand, the highest put OI is placed at the 1,200 strike.

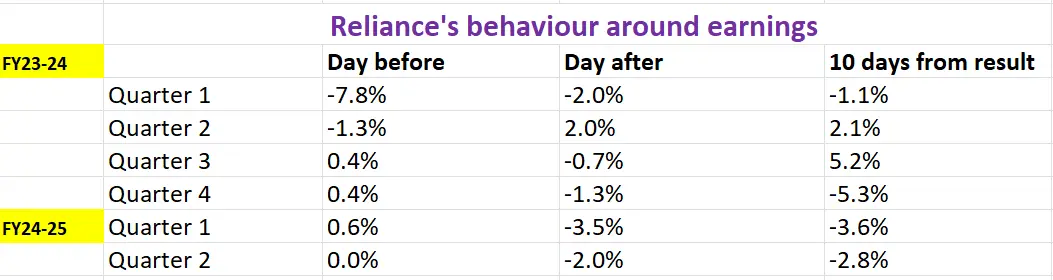

Before discussing strategies, let's review Reliance Industries' share price movements around its earnings announcements over the last six quarters.

Options strategy for Reliance

Based on options data suggesting a potential price movement of ±3.8%, traders can choose either a long or short volatility strategy.

Disclaimer

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story