Market News

Kotak Mahindra Bank Q4 Results Highlights: Net profit rises 18% YoY to ₹4,133 crore, NII up 13%; dividend declared

.png)

9 min read | Updated on May 04, 2024, 14:33 IST

SUMMARY

Kotak Mahindra Bank Q4 Results: The bank's board has recommended a dividend of "₹2 per equity share" having face value of ₹5 each for FY24, subject to approval of shareholders. The record date to determine the eligible shareholders and timeline of payout was not shared.

Stock list

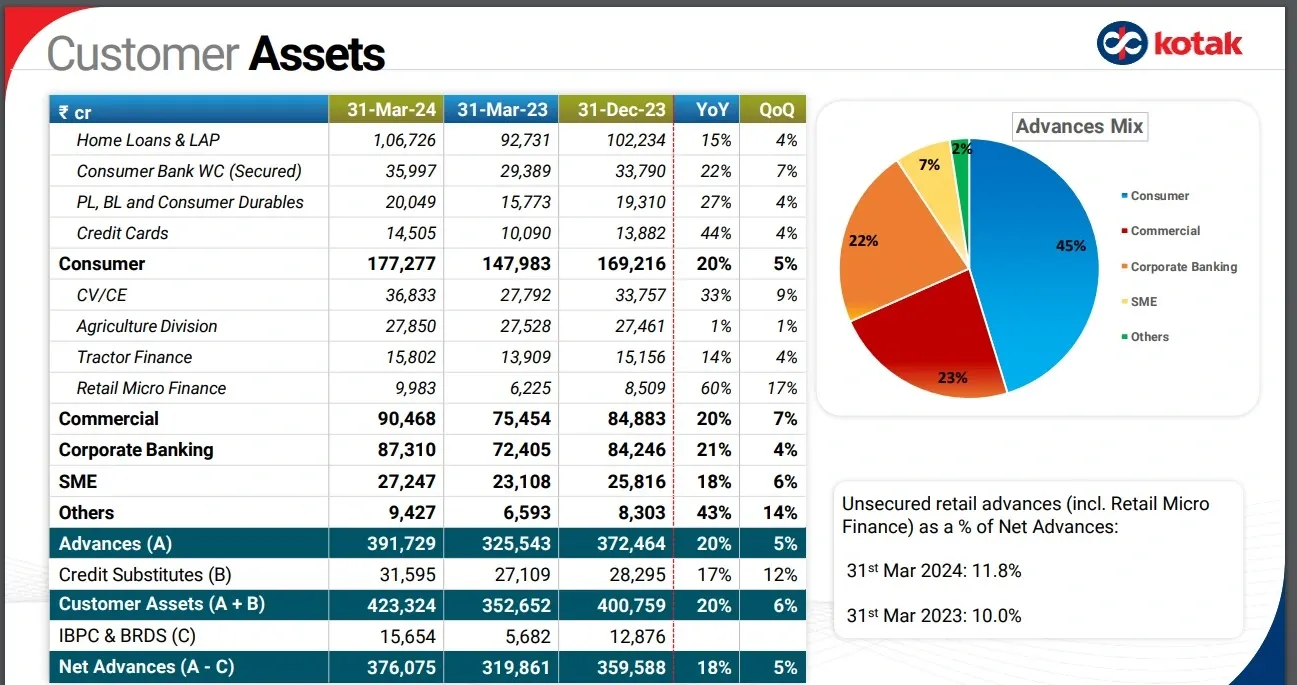

The standalone net profit in FY24 came in at ₹13,782 crore, higher by 26% as compared to FY23 (Image: kotak.com)

Kotak Mahindra Bank's standalone net profit came in at ₹4,133 crore in the quarter ended March 31, 2024, higher by 18% as against the year-ago period. The net interest income increased by 13% YoY to ₹6,909 crore, as compared to ₹6,103 crore in Q4FY23.

"As of March 31, 2024, Kotak Mahindra Bank has a national footprint of 1,948 branches and 3,291 ATMs (including cash recyclers), and branches in GIFT City and DIFC (Dubai)," the bank said in a press release.

The RBI order on April 24, that bars the bank from onboarding new customers through online channels and issue fresh credit cards, does not impact "servicing and cross-sell of products (excl. new credit cards) to the existing customer base through all channels", Kotak Mahindra Bank said in a statement.

The restrictions also do not bar the onboarding of new customers through other offline channels.

Sharing the way forward, the lender said it is "totally committed to working with all our regulators to achieve the required technology standards".

The bank will "step-up investments to fortify its IT systems", it said, adding that the focus is on accelerate execution of the "comprehensive plan for core banking resilience", demonstrating "sustainable compliance to baseline cybersecurity framework for banks", and continuing to "strengthen digital payment security controls".

-

Advances increased 20% YoY to ₹3.91 lakh crore as of March 31, 2024 from ₹3.25 lakh crore in the year-ago period.

-

Customer assets, which comprises advances and credit substitutes, increased 20% YoY to ₹4.23 lakh crore at the end of Q4FY24 from ₹3.52 lakh crore at the end of Q4FY23.

-

Unsecured retail advances (including retail micro finance) as a percentage of net advances stood at 11.8% as of March 31, 2024, which is higher as compared to 10% as of March 31, 2023.

-

The capital adequacy ratio of the bank, as per Basel III, stood at 20.5% at the end of the fourth quarter.

-

The standalone Return on Assets (ROA) stood at 2.97% in Q4FY24, and the Return on Equity (ROE) was 17.54% at the end of quarter.

-

The gross non-performing assets (NPA) ratio stood at 1.39% at the end of the fourth quarter, marking an improvement as compared to 1.78% in the year-ago period.

-

The net NPA ratio stood at 0.34%, marginally lower as against 0.37% last year.

-

The current account and savings account (CASA) ratio as of March 31, 2024 stood at 45.5%, Kotak Mahindra Bank said in a release.

-

Average current deposits grew to ₹60,160 crore in Q4FY24, as up 3% from ₹58,415 crore in Q4FY23.

-

Average savings deposits grew to ₹1,23,457 crore in Q4FY24 from ₹1,17,824 crore in Q4FY23.

up 5% YoY. Average Term deposit grew to ₹ 224,703 crore for Q4FY24 compared to ₹ 166,644 crore for Q4FY23 up 35% YoY

The net Interest Income (NII) for FY24 increased to ₹25,993 crore, from ₹21,552 crore in FY23, marking a surge of 21% year-on-year.

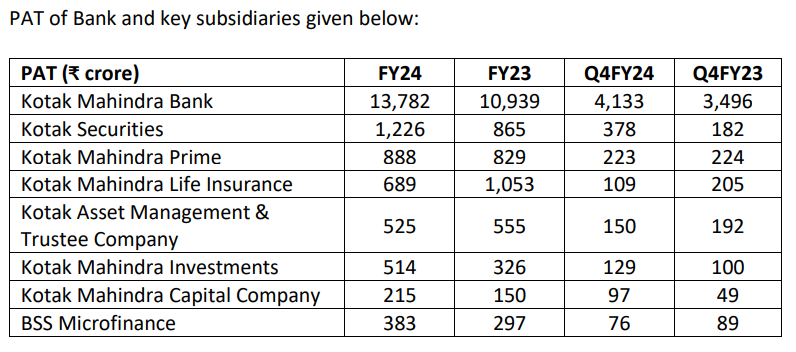

The private lender's standalone net profit in the full fiscal year ended March 31, 2024 (FY24) came in at ₹13,782 crore, higher by 26% as against ₹10,939 crore in FY23.

Consolidated profit after tax (PAT) of Kotak Mahindra Bank in Q4FY24 came in at ₹5,337 crore, up 17% YoY from ₹4,566 crore in Q4FY23.

Sequentially, the PAT increased by from ₹4,265 crore in the December 2023 quarter.

The board of directors of the bank has recommended dividend of "₹2 per equity share" having face value of ₹5 for the year ended March 31, 2024, subject to approval of shareholders.

The record date to determine the eligible shareholders and timeline of payout was not shared.

The net interest income (NII) increased by 13% YoY to ₹6,909 crore, as compared to ₹6,103 crore in Q4FY23. The NII increased by 5% as compared to the preceding December 2023 quarter, when it stood at ₹6,554 crore.

The net interest margin (NIM) stood at 5.28% in the March 2024 quarter, the bank said in a release. In the year-ago period, it stood at 5.75%.

The standalone net profit of Kotak Mahindra Bank climbed by 22% year-on-year to ₹4,133 crore in Q4FY24, as against ₹3,496 crore in Q4FY23.

Sequentially, the net profit in the March 2024 quarter increased by 38%, as against ₹3,005 crore in Q3FY24.

The bank's shares have edged lower at the stock market in the aftermath of the RBI’s curbs on issuance of new credit cards, and onboarding customers through digital channels. The shares also dipped following the resignation of its joint MD KVS Manian. In the past one month, the stock has declined by 11.3%, whereas, the year-to-date drop has been sharper at 18.8%.

The net interest income (NII) is expected to increase 10% year-on-year, aided by loan growth, as per an average of estimates shared by six brokerages. The NII is seen at ₹6,690 crore in Q4FY24, as compared to ₹6,103 crore in Q4FY23.

The private lender's net profit is likely to decline on account of shrinking margins and higher cost of funds, analysts said. An average of estimates shared by six brokerages indicate a 6% year-on-year decline to₹3,283 crore, as against ₹3,496 crore in the year-ago quarter.

In Q3FY24, Kotak Mahindra Bank had reported a net profit of ₹2,792 crore, up 7.6% year-on-year (YoY). The lender's net interest income had climbed by 16% YoY to ₹6,554 crore.

Kotak Mahindra Bank, one of the country’s leading private lenders, is scheduled to declare the results of the fourth quarter of financial year 2023-24 (Q4FY24) today, May 4. Along with the quarterly performance, the bank’s board will also consider and approve the release of the earnings scorecard for the entire fiscal year ended March 31, 2024. Stay tuned here for the latest updates.

Kotak Mahindra Bank Q4 results preview

Shrinking margins and higher cost of funds are likely to drag the bank’s net profit, which is expected to decline by 6% year-on-year, as per an average of estimates shared by six brokerages. The net profit in Q4FY24 is seen at ₹3,283 crore, as against ₹3,496 crore in Q4FY23.

The net interest income (NII), however, is estimated to increase 10% year-on-year, aided by loan growth. The NII is seen at ₹6,690 crore in the March 2024 quarter, as against ₹6,103 crore in the year-ago period.

Kotak Mahindra Bank shares

The lender’s shares have been edging lower at the stock market in the aftermath of the RBI’s curbs. The shares also dipped following the resignation of its joint MD KVS Manian. In the past one month, the stock has declined by 11.3%, whereas, the year-to-date drop has been sharper at 18.8%.

Over the past one year, Kotak Mahindra Bank has declined by around 21% at the bourses. On May 3, the lender’s shares settled at ₹1,546.7 apiece, lower by 1.84% as against the previous day’s close.

About The Author

Next Story