Why Traders Shouldn’t Avoid the Importance of Time Decay?

Written by Upstox Desk

Published on July 31, 2025 | 5 min read

Summary

Time decay (or theta) is how we measure the rate of decline in the value of an options contract because of the passage of time. In this article, we deep dive into the understanding of the same and how it can affect an options trader. An options trader needs to do proper research about extrinsic value, intrinsic value, etc. and account for time decay before deciding to opt for options trading.

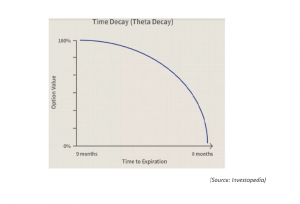

As time moves closer to maturity/expiry, an option in trading loses its value provided all other factors stay constant. Time decay is also called theta decay and is a critical concept for options traders to understand as it impacts the profitability of options positions. This is especially true for those that rely on time-based valuation of their options.

The only way for you to resist time decay risks is to understand them and stay aware. Let’s talk about how it works and what you should understand.

How does time decay work?

An option's time value is basically the amount of time that plays into the value or the premium for the option. Theta is the decrease in the value of an option as it approaches the expiration date. To put it in other words, since there is lesser time for an investor to enjoy profit from the option, time value decreases or time decay increases as the expiration date gets closer.

(Source: Investopedia)

To get more insights on how time decay works, let's break it down step by step:

- Time Value Component: An option's premium has two main components:

- Intrinsic value- the amount by which an option is in-the-money (the option's strike price minus the current market price of the underlying asset).

- Time value- the premium that’s indicative of the options’ potential for price change before expiration.

- Changing Probability: As time passes, the probability of changing the underlying asset's price significantly either increases or decreases. When an option is far from its expiration, there's more time for the price to change a higher probability of it becoming profitable. Conversely, nearer to the expiration, there's less time for significant price changes reducing the probability of the option gaining profitability.

- Decay Process: Time decay accelerates as the option's expiration date gets closer. The rate at which the option's time value diminishes is relatively slow initially and then picks up speed as the expiration date draws near. This speed is particularly noticeable in the final days before expiration.

- Impact on Premium: As the option gets closer to expiration, the time value of the premium gradually diminishes and thus reduces the option's overall premium. For options with shorter expiration, this effect is more pronounced while for options with longer expiration periods, it is less significant.

- Expiry Effect: If the option is out-of-the-money at expiration, meaning it has no intrinsic value, the premium becomes zero as the time value has completely eroded. Therefore, keep in mind that out-of-the-money options become worthless at expiry.

- Strategies and Considerations: As you may have surmised, you need to be aware of the time decay of an option before purchasing it. You must gain a clear understanding of when significant price movements can occur. This will not only help avoid the value erosion of their positions but also maximize the profitability potential of the option. Note that for option sellers (writers), time decay is beneficial as it gives them a chance to profit off its premium erosion over time.

Other Considerations

There are a few extraneous time decay factors traders must be conscious of in both short-term and long-term options.

Time decay is impacted by factors such as tick value and stock price. Deep in-the-money (ITM) options have less time value, due to their dominant intrinsic value. At the same time, deep out-of-the-money (OTM) options have a lower likelihood of becoming profitable and hence their time value is less. An option’s time value decreases as it moves further ITM or OTM. However, at-the-money (ATM) options are closer to becoming either ITM or OTM and tend to have higher time value.

Conversely, higher stock prices mean larger tick values. This means that the premium of an option tied to a stock will change by a larger amount for any given tick change in the stock price. With this, tick value is directly related to the sensitivity of an option's premium to changes in the underlying stock price.

Conclusion

You may end up overlooking time decay as its effect is delayed and not immediate. If you hold long positions, it will work against you, and you would need to adjust and readjust your strategies to avoid losses. If you want time decay to work in your favour, then you need to be a short-term option seller as time decay is more noticeable in short-term options.

The key is, as always, to gain knowledge and experience. Embrace the learning process, hone your skills, and adapt your strategies to use time decay to your advantage. This way, you'll be better equipped to make informed decisions that align with your trading goals and risk tolerance. Remember, time is of the essence, and with the right knowledge, you'll be well on your way to becoming a more proficient and successful options trader.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.