What is Long Combo Option Trading Strategy

Written by Upstox Desk

Published on February 10, 2026 | 5 min read

The long call combo option strategy is a two-legged option strategy which is deployed when traders carry a bullish outlook on the markets, coupled with significant expansion of implied volatility. The spread is fairly easy to deploy but managing the spread requires deeper understanding of options as it involves selling or writing options. The spread is initiated by selling an Out-of-the-Money put option and buying an Out-of-the-Money call option, having the same expiry and underlying asset.

The difference between the put and the call strike offers the holder of spread some protection when the price of underlying asset moves unfavorably or lower. The long combo spread is usually deployed as a temporary hedge against an already pre-existing long position of underlying asset. The capital outlay of this spread is considered economical as the premium earned from short put option position is used to subsidize the buying cost of the long call option position.

Illustration:

The Nifty50 is at 17,100. The long combo option strategy is deployed by taking a long position in Out-of-the-Money call option at strike 17,200 for ₹97 and shorting an Out-of-the-Money put option at strike 17,000 for ₹118.

| Strategy | Index | Action | Strike | Premium (₹) |

| Long Combo Spread | Nifty50 | Sell Put | 17,000 (strike 1) | 118 |

| Buy Call | 17,200 (strike 2) | -97 | ||

| Net Premium | 21 |

The spread generates a net credit and inflow of premium amounting to ₹ 21.

Breakeven point = strike 1 - net premium received = 17,000 - 21 = 16,979

Max potential profit = Unlimited

Max potential loss = Unlimited

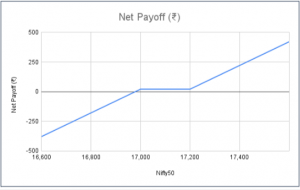

Payoff Schedule

Nifty50 @ Expiry | Net Payoff (₹) |

| 16,600 | -379 |

| 16,700 | -279 |

16,800 | -179 |

| 16,900 | -79 |

17,000 | 21 |

| 17,100 | 21 |

17,200 | 21 |

| 17,300 | 121 |

17,400 | 221 |

| 17,500 | 321 |

17,600 | 421 |

Payoff Chart

Scenario 1 – Nifty50 expires at 17,400

The short put option expires worthless and we are able to retain the premium received. The long call option position also results in profit as the option is now deep In-the-Money and fetching at least 200 points of intrinsic value (17,400 – 17,200 = 200) in addition to the premium collected

Profit = (Price of underlying – strike 2 + net premium received) * lot size = (17,400 – 17,200 + 21) * 50 = (221 * 50) = ₹ 11,050

Scenario 2 – Nifty50 expires at 17,100

Again the short put option expires worthless leading to preservation of premium earned upfront. The long call option also expires worthless as the underlying prices have settled below the strike price. Therefore, when the spread expires between the two strikes it would make profit to the tune of premium received.

Profit = net premium received * lot size = 21 * 50 = ₹ 1,050

Scenario 3 – Nifty50 expires at 16,800

The short put option position will bleed the spread till the price keeps on falling, the premium collected upfront is forfeited and the long call option, which is now Out-of-the-Money expires worthless. Any further decline in price could potentially lead to additional losses.

Loss = (Price of underlying – strike 1 + net premium received) * lot size = (16,800 – 17,000 + 21) * 50 = (-200 + 21) * 50 = - ₹ 8,950

Conclusion

- As explained earlier, long combo spread is an option strategy with a bullish outlook. The outcome leading to the decline in the price of underlying can result in max potential loss and in case of rise in prices; it has the potential to deliver unlimited profits.

- The strategy offers two pronged advantages; the short put option position can partly or fully cover the cost of buying the call option. This invariably leads to reduction in cost of deploying the strategy. Besides this, if the price of underlying increases.

- The strategy is easy to deploy but as one of the legs involves selling or writing options, it would be advisable to exercise utmost caution and risk management while trading the spread.

- While being bullish on the price outlook, the traders or investors also assume a mild increase in implied volatility. But since the strategy involves taking a long and short option position on the same underlying asset, the impact of implied volatility is minimal.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.