What are Index Futures?

Written by Upstox Desk

Published on February 10, 2026 | 6 min read

The index futures are futures contracts that derive their value from underlying assets like stocks, commodities and currencies. In the case of an index, the underlying itself derives its value from the constituents (stocks). Similar to other future contracts, a trader can enter into a contract to buy or sell an underlying asset at a specific price in future. Let's understand this with the help of an example of Nifty50.

-

Underlying Index (Spot) = Nifty50

-

Derives its value from 50 large-cap stocks traded on NSE

-

Derivative contract = Nifty Futures (derives its value from underlying asset or spot price)

-

Nifty Index Futures derives its value from the underlying index

-

Specific price = The price to buy or sell the contract

-

Future date = The date on which the contract will expire

The Nifty50 index reflects the price level of all the 50 constituents. It means that if the value of the Nifty50 (underlying) goes up, the value of futures will also rise. And similarly, if the Nifty50 falls, the value of the futures will also decline.

Types of Index Futures contracts

Let us look at some of the major index futures contracts that a trader can trade in the Indian stock market.

Sr. no | Derivatives on Indices | Symbol | Lot size | Summary |

| 1 | NIFTY FINANCIAL SERVICES | FINNIFTY | 40 | The index includes banks, financial institutions, insurance and housing finance companies along with other financial services. |

| 2 | NIFTY MIDCAP SELECT | MIDCPNIFTY | 75 | Based on the Nifty Midcap companies which tracks the performance of 25 stocks within the Nifty Midcap 150 index. |

| 3 | NIFTY 50 | NIFTY | 50 | The Index is made up of the top 50 listed companies based on free-float market capitalisation. |

| 4 | NIFTY BANK | BANKNIFTY | 25 | The Bank Nifty represents the 12 large-cap stocks from the banking sector which trade on NSE. |

Key components of Index Futures

In India, Nifty50 and Bank Nifty are the major index futures which are actively traded. Like any other futures contract, index futures comprises 4 key components:

- Lot size

- Total contract value

- Margin

- Expiry

Let’s understand all these components in a detailed manner.

Lot size

The lot size refers to the minimum number of units that form up to 1 contract. It is the minimum number of shares which we can buy or sell before entering into a contract, as future contracts are always traded in multiples of lots. The lot size of the Nifty50 contract is 50, meaning that one Nifty50 contract is equivalent to 50 shares of the Nifty50. The lot size is specified by exchanges and is different for all securities and asset classes.

Total contract value

The total contract value is obtained by multiplying the lot size with the price of the contract. Let's assume that the Nifty50 futures is currently trading at 16,000, and the lot size of the index is 50. So, the total contract value of the Nifty50 will be ₹8,00,000 (lot size * current price). It is important to note that while calculating the total contract value, the lot size must be multiplied by the futures price, not the spot price.

Margin

The margins are imposed by exchanges to protect the buyer and the seller from counterparty risks. Simply put, avoiding any default in payments. The buyer and the seller are charged a certain percentage of the total contract value, which is decided by the exchange based on the volatility and price movement of the underlying.

For instance, let's assume that the Nifty50 June futures contract is trading at 16,000 and the lot size of the Nifty50's futures contract is 50, then the total value of the contract will be ₹8,00,000 (futures price * lot size). Now, if the margin fixed by the exchange is 25% of the total contract value, then it would mean that both the buyer and the seller will have to deposit ₹2,00,000 as the initial margin before entering into the trade. The initial margin will be deducted from the buyer's and seller's trading accounts.

In addition to margins, the traders keep an additional cash balance to settle the mark-to-market obligations. It is a process in which the profit or loss made on an open position (contract) is adjusted on the same day from the trader's account. Remember, in case the cash balance of the trading account goes below a certain threshold, the exchange can call for additional funds..

Expiry

The expiry or the expiration date of the futures contract is the date up to which the contract between the buyer and the seller remains valid. For example, the Nifty50's futures contracts are available for a maximum of 3-months —near (first), next (second) and a far (third) month contract. The last Thursday of every month is the expiry date of the futures contract. If last Thursday is a holiday, then all the contracts are settled on the previous trading day.

Let’s understand how to trade in index futures with the help of an example

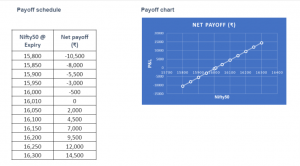

Mr Hardik, a trader, has a bullish view of the markets. He buys one lot of the Nifty50 futures at ₹16,010 of the current month's expiry. Let's assume that the Nifty50 spot is currently trading at ₹15,990.

Scenario 1: Nifty50 rises to ₹16,200

In this scenario, Mr. Hardik's view turned out to be correct. The Nifty50 spot moved up, which means that the price of the futures contract will also increase. As a result, Mr. Hardik's net gain from this contract will be ₹9,500.

Profit/loss = (selling price – entry price) * lot size = (16,200 – 16,010) * 50 = ₹9,500

Scenario 2: Nifty50 stays flat and closes at ₹16,010

Here, Mr. Hardik's view was incorrect. The Nifty50 spot closed at 16,010 on expiry, which was his entry price. In this scenario, both Mr. Hardik and the seller will not make any profit or loss.

Profit/loss = (selling price – entry price) * lot size = (16,010 – 16,010) * 50 = ₹0

Scenario 3: Nifty50 declines to ₹15,800

In this case, Mr. Hardik's view on the index was wrong, and he couldn't read the market movement correctly. As a result, Mr Hardik will incur a loss and will have to pay the seller ₹15,800 on expiry.

Profit/loss = (selling price – entry price) * lot size = (15,800 – 16,010) * 50 = - ₹10,500

Similarly, a short futures strategy would entail the exact opposite payoff, where the trader would expect to profit from a potential down move of the underlying.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.