Options Trading Strategies: Vertical Spreads and Synthetic option spreads

Written by Upstox Desk

Published on October 24, 2025 | 9 min read

Options allow earning returns with less capital requirement than stocks and can limit the risk through the use of strategies. In fact, certain high-profit, low-risk strategies can be deployed at a substantially low cost when compared to futures.

Therefore, options are considered as “go-to” financial derivatives for traders and investors alike for trading or hedging their portfolios in the most efficient and low-cost manner. Options spreads are the most commonly deployed strategies and therefore a part of every trader’s arsenal.

What are Vertical option spreads?

A vertical option spreads is a direction based option strategy that allows traders to take advantage of market bias by buying and selling options with the same quantity, underlying and expiration. The bought and sold options are usually of the same type viz; call or put. However, the strike price of the long and short options is different.

The ’vertical’ in the name implies the position of strike price that is bought and sold – one lower and other is higher. It is important to remember the option spreads are initiated with the same expiration months, otherwise if strikes are positioned for different expiration months – the spread would get converted into a Calendar spread, which is a different strategy altogether.

The spreads are broadly characterized in three parts;

- Credit or debit

- Bull or bear

- Call or put

The credit spread is when there is a net premium inflow or “credit” while initiating option strategy. This is done by selling At-the-money option strike, which possess highest time value and therefore, higher premium and buying Out-of-the-money option strike, which only possess time value and therefore have lower premium. A debit spread is exactly opposite to this, in here the there is a net outflow of premium, meaning the spread is initiated by buying At-the-money option strike that have a higher premium and selling Out-of-the-money that have a lower premium.

A Bull spread, as the name suggests, profits when the market is in uptrend. A Bear spread profits from the market down trend. The risk-reward in these spreads is pre-determined and limited.

The Call or Put spread refers to the instrument type being used to create spread. Generally, the value of call option increases with the increase in market levels and value of put increases with decline in market levels. However, with vertical spreads it is possible to generate profit with either call or put options in all kinds of market scenarios; bullish, bearish, volatile and range bound. The prefix, bull or bear, indicating which side the market is expected to move, followed by the type of option i.e. call or put, indicate the directional view and instruments used in the spread. Thus, a combination of these structures would signify the strategy. Namely;

- Bull Call spread

- Bear Call spread

- Bull Put spread

- Bear Put spread

Bull Call Spread

Bull Call Spread or long call vertical spread has a bullish outlook as the name suggests and is a risk-defined strategy. The long call vertical spread is created by purchasing the call option of an In-the-money strike price and shorting a call option of an Out-of-the-money strike price. The short call strike price is higher than the long call strike price. It reduces the net premium paid but caps the maximum potential profit of the long call position. The long call at lower strike price helps benefit from rise in underlying and limits the loss arising on the short call position at higher strike price.

Illustration:

Nifty50 is currently trading at 17,650. A Bull Call spread can be initiated by purchasing call option at ITM Strike of 17,600 at ₹106 and shorting an OTM strike of 17,800 at ₹38

| Strategy | Index | Action | Strike | Premium |

Bull Call Spread | Nifty50 | Buy Call | 17,600 (strike 1) | -106 |

| Sell Call | 17,800 (strike 2) | 38 | ||

Net Premium | -68 |

This results in net outflow of premium of ₹68. The long call option is expensive on account of intrinsic value and time value. The short call option is cheap as it possesses only time value.

The breakeven point = Strike 1 + Net premium paid = 17,600 + 68 = 17,668

Max Profit = (Strike 2 – Strike 1 – Net premium paid) = (17,800 – 17,600 – 68) = ₹132

Max Loss = Net premium paid = ₹68

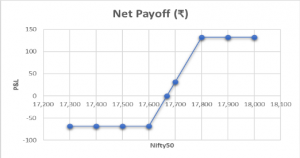

Payoff Schedule

| Nifty50 @ Expiry | Net Payoff (₹) |

17,300 | -68 |

17,400 | -68 |

17,500 | -68 |

| 17,600 | -68 |

17,668 | 0 |

17,700 | 32 |

| 17,800 | 132 |

| 17,900 | 132 |

| 18,000 | 132 |

Payoff chart

Scenario 1 - Nifty50 expires at 17,400

The long call at 17,600 expires worthless as there is no intrinsic value and we lose the premium paid. The short call at 17,800 also has no intrinsic value but, since it was sold, we retain the premium received, resulting in net loss limited to the extent of net premium paid i.e. ₹68.

Scenario 2 – Nifty50 expires at 17,600

Again both the long and short call options at 17,600 and 17,800 expire worthless resulting in loss and the trader loses the net premium paid of ₹68.

Scenario 3 – Nifty50 expires at 18,000

The long call has gained substantially in intrinsic value (18,000 – 17,600 = 400), which was acquired after paying a premium of ₹106. The short call option strike of 17,800 has also gained intrinsic value (18,000 – 17,800 = 200) which we sold at ₹38.

So, on long call option, we would make ₹400 – ₹106 = ₹294 and on the short call option we lose ₹200 – ₹38 = ₹162.

Therefore, overall, we stand to gain ₹200 – ₹162 = ₹132.

OR

If Nifty50 moves beyond 17,800, we could simply use the max profit formula.

Max Profit = (Strike 2 – strike 1 – net premium paid) = (17,800 – 17,600 – 68) = ₹132

Bear Put Spread

Bear Put Spread or long put vertical spread has a bearish outlook, meaning the strategy gains profit when the markets decline. Like the above strategy it is risk-defined with limited profit and loss. It is deployed by long and short put at different strikes, with the same expiration and underlying. The ITM put option is bought, which tends to have a higher premium and the OTM Put option strike is sold to collect the premium. This is also a debit strategy, resulting in net premium payment.

Illustration:

Nifty50 is currently trading at 17,550. A bear put spread can be initiated by purchasing the put option of ITM strike at 17,600 for a premium of ₹110 and selling a put option of an OTM strike at 17,400 for the price of ₹40. The transaction results in net outflow of ₹70.

Strategy | Index | Action | Strike | Premium (₹) |

| Bear Put Spread | Nifty50 | Sell Put | 17,400 (strike 1) | 40 |

Buy Put | 17,600 (strike 2) | -110 | ||

| Net Premium | -70 |

Break Even point = Strike 2- Net premium paid = 17,600 - 70 = 17,530

Max Profit = (Strike 2 – strike 1 – net premium paid) = (17,600 – 17,400 – 70) = ₹130

Max Loss = Net premium paid = ₹70

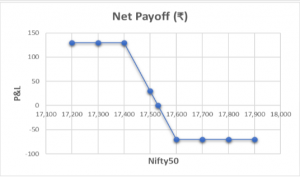

Payoff Schedule

Nifty50 @ Expiry | Net Payoff (₹) |

17,200 | 130 |

17,300 | 130 |

| 17,400 | 130 |

17,500 | 30 |

| 17,530 | 0 |

17,600 | -70 |

| 17,700 | -70 |

17,800 | -70 |

| 17,900 | -70 |

Payoff Chart -

Scenario 1 – Nifty50 expires at 17,800

The long put of strike price 17,600 would expire worthless and we lose the premium paid. The short put of strike price 17,400 is however able to retain the premium earned. Therefore, despite prices moving against the anticipated direction we are faced with limited loss. Max Loss = Net premium paid = - ₹70

Scenario 2 – Nifty expires at 17,600 Again, since the Nifty 50 expired at a higher level of 17,600, both options expire worthless and we lose the net premium paid i.e. ₹70.

Scenario 3 – Nifty50 expires at 17,400 While the long and short put option increase in value due to rise in intrinsic value, the net gains are again limited to the difference between spread and net premium paid. Max Profit = (Strike 2 – strike 1 – net premium paid) = (17,600 – 17,400 – 70) = ₹130

Conclusion:

The vertical spreads are easy to calculate and implement. A novice trader or an investor should have no problem in executing and managing these trades. There is always an option to choose whether one wants to create a structure by paying the premium or receiving the option premium.

The payoff of Bull Call spread and Bear Put spread are similar, and payoffs for Bull Put spread and Bear Call spread are similar. The vertical spreads are implemented when one’s outlook is moderately bullish or bearish, with low-risk taking ability. Moderate outlook would imply a 3-4% change in the underlying.

It is not at all necessary to hold long option positions in call option or put option at in-the-money strikes. Experienced traders mostly prefer to take a long position near At-the-money strikes. However, At-the-money strike should not be chosen closer to expiry.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.