Long Call Ladder Options Strategy

Written by Upstox Desk

Published on July 31, 2025 | 6 min read

A Long Call Ladder is a three-legged options strategy, which is deployed when markets are expected to rise very slightly and with substantial reduction in volatility. Since it's a three-legged options strategy, Option Greeks influence the payoff very actively. The strategy is also known as “Bull Call Ladder spread”, it is an improvement over Bull Call spread options strategy. A Bull Call spread involves buying a call with At-the-money strike and selling a higher strike which is Out-of-the-money to fund the purchase of the lower strike.

A Long Call Ladder follows the same aspect and improves upon the Bull Call spread by adding a third leg, which is to sell one more out-of-the-money strike at an even higher strike. Thus, making it look like a ladder. The three strikes traded may or may not be equidistant from one another. But, all three should have the same underlying and same expiration.

The strategy belongs to the ladder spread family and requires a lesser capital outlay than a conventional vertical spread strategy. The improvements over the vertical call spread comes at a cost. In Bull Call spread, both profit and loss are capped but in Long Call Ladder options strategy, the profits are severely curtailed below a particular point and potential for losses are unlimited, if the price rises significantly. Therefore, as mentioned before, the strategy is conducive when traders expect price to rise slowly and volatility to reduce substantially.

The strategy is deployed by buying an ITM or ATM call option, selling an ATM or OTM call option and selling a call option which is further OTM above the previously sold call option strike.

Illustration:

The Nifty50 is currently trading at 18,000.

| Strategy | Index | Action | Strike | Premium |

Long Call Ladder | Nifty50 | Buy Call | 17,900 (strike 1) | -160 |

Sell Call | 18,000 (strike 2) | 90 | ||

| Sell Call | 18,100 (strike 2) | 50 | ||

| Net Premium | -20 |

The deployment of strategy results in net outflow of premium, which makes this a debit spread, the net premium can also be positive depending on the moneyness of the strike chosen.

There are 2 breakeven points here because of the premium debit, in case the credit or net premium was positive, there would only be an upper breakeven point.

Lower breakeven point = (strike 1 + net premium paid) = (17,900 + 20) = 17,920 Upper breakeven point = (strike 3 + strike 2 – strike 1 – net premium paid) = (18,100 + 18,000 – 17,900 – 20) = 18,180

Max potential profit = (strike 2 - strike 1 – net premium) * lot size = (18,000 – 17,900 – 20) * 50 = ₹ 4,000

Maximum loss on upside = Unlimited Maximum loss on downside = (Net premium paid * lot size) = -₹20 * 50 = -₹1,000

The point between the two sold option strikes is where the strategy earns the maximum profit. Beyond both the breakeven points the strategy becomes unprofitable. On the lower side, the loss is limited to the extent of net premium paid. On the higher side the risk is unlimited due to a pair of sold call options, among which there is only one hedged by long call option position.

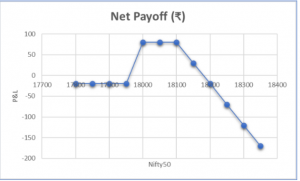

Payoff Schedule

| Nifty50 @ Expiry | Net Payoff (₹) |

17800 | -20 |

17850 | -20 |

| 17900 | -20 |

| 17950 | 30 |

18000 | 80 |

18050 | 80 |

| 18100 | 80 |

18150 | 30 |

| 18200 | -20 |

18250 | -70 |

| 18300 | -120 |

18350 | -170 |

Payoff chart

Impact of Greeks:

- The strategy is exposed to the impact of option Greeks due to one unhedged open short call position. Since the strategy is centered around reduction in volatility, the impact of Vega is negative. Increase in Vega leads to loss and decrease in Vega leads to profit.

- The time value erosion is faster in the short OTM call option than in the long call option. Therefore, the impact of Theta is positive.

The Gamma is at the highest at long call strike, when the price begins to rise, the gamma starts to shrink and reaches its lowest point at the 3rd strike. Thus, the spread is Gamma negative.

Conclusion:

- The Long Call Ladder is an improvement over bull call spread, which is a vertical spread. While the profit potential is higher than Bull Call spread, the potential loss is unlimited as against limited loss in the latter strategy.

- The strategy gains when the price movement within the sold call option strikes, therefore, it is recommended to deploy the spread only when the outlook on underlying asset is slightly bullish, with expectation of significant reduction in market volatility.

- Volatility spikes usually occur near to corporate announcements, earnings date and when there is significant time left for expiration. These events or scenarios are best avoided when initiating this spread.

- Since the potential loss can be unlimited, it is essential to place a stop loss to avoid wipeout of capital. A stop loss at or near the highest strike price is advisable.

- The default ratio of option position remains 1:1:1, where we are buying ITM call option and selling two call options, at higher strikes. But experienced traders usually prefer to side with market direction and change the combination to 2:1:1 or 1:1:2 to earn a disproportionately high amount of profit but this can also increase the potential risk.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.