How to Invest using Demat Account

Written by Upstox Desk

Published on February 04, 2026 | 5 min read

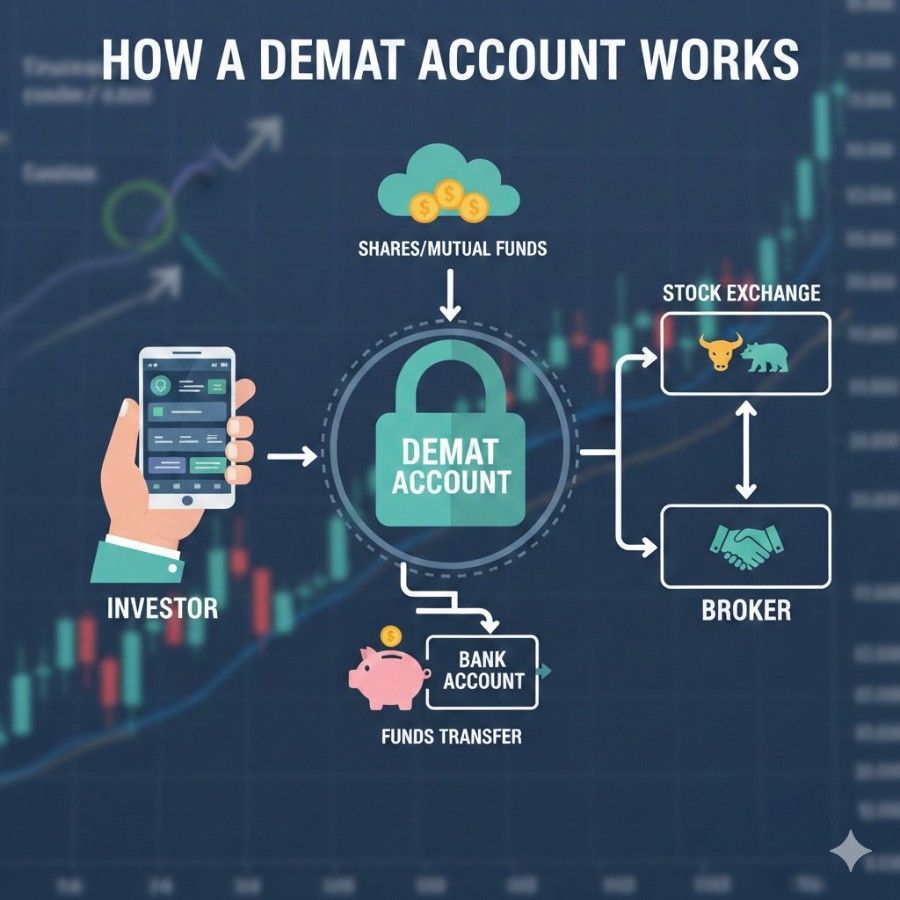

In this day and age of the internet and ceaseless electronic innovation, life continues to get easier and less troublesome - even when dealing with financial assets. Today, investors don't hold stacks of paperwork in their office to store securities. Introduced in 1996, they now use the demat account system.

We’re hoping you’re familiar with what is demat accounts by now and have grasped how to open a demat account. Next up, let’s learn how to invest using these demat accounts. Now, we will walk you through the steps required to invest in the stock markets.

Key Points

- E-KYC method is the one wherein the broker verifies your information utilizing your Aadhaar card, gets you to upload your documents online, and you’re done.

- It is important for you to know the trading terms like IPO, portfolio, yield, index, sector, P/E ratio etc.

- The settlement period is the duration it takes for all the trades on a particular day to be allotted/reconciled to demat accounts - usually T+2 days.

By the numbers

- There are plenty of active traders in the country. The total number of investor accounts in the country, as of July 2017 stood at 16.02 million with NSDL, while CDSL held 12.09 million accounts. With millions using these accounts to invest and trade wisely, getting started really shouldn’t be a dilemma.

- On CDSL alone, these traders together hold a staggering 25,709 crores of securities! The total value of these holdings exceeds 18 lakh crores!

- These collectively belong to over 10,080 companies

It’s a bustling ecosystem that continues to thrive and grow with every passing day. If you are looking to invest, this is a good time to join in.

Account Opening Requirements

Firstly, you need to choose the right broker to help you understand your account opening process. Your choice of brokerage would rely on a variety of factors, which would include: fees/charges, client benefit, additional offices and platform’s interface and experience (UI and UX).

A dematerialized account can be opened utilizing two techniques: the conventional format (paper form) or the e-KYC paperless registration i.e. opening a demat account online.

Traditional method

- The traditional method involves you filling out hard copies of an account opening form, and attaching a proof of identity and a proof of address. These proofs can be submitted using photocopies of suitable documents.

- When your documents and forms are processed, you'll be given a demat account number, similar to a bank account number. This number is known as the Beneficial Owner Identification Number (or BOID).

- You'll likewise get extra private information -for example, a login ID and a key for logging into online gateways.

Online method (e-KYC method)

In the present internet era, the conventional procedure of submitting paper forms is akin to booking trunk calls on landlines back in the 80s. It’s inconvenient, time-consuming and needs a lot of manual efforts. Now, investors can open demat accounts online without going through all the form filling, by consenting to an eKYC online. E-KYC method is the one wherein the broker verifies your information utilizing your Aadhaar card, gets you to upload your documents online, and you’re done. Here’s how you can get started:

- Visit the online account opening page and fill in your essential details - name, phone number, email etc.

- Upload copies of the required documents (Aadhaar, PAN, canceled cheque, and your most recent bank statement).

- Enter the 12-digit UIDAI number of your Aadhaar card for the verification of your identity, and enter the OTP sent to your linked mobile number.

- Follow the account opening process, upload your documents using a separate web page that opens up for you.

How can you get started?

For convenience’s sake, let’s say you’ve picked Upstox as your broker for a dematerialized account. Here’s how you can start investing.

- You should get used to the trading platform you will be using - in this case, you can use Upstox Pro Web if you’re logging in from your browser, or Upstox Pro Mobile if you’d prefer to trade on the move.

- It is important for you to know trading terms like IPO, portfolio, yield, index, sector, P/E ratio etc.

- Link your bank account to the trading account you are using. You will use this to move your funds. Start buying your desired stocks from the market using the money in the trading account. For a detailed guide on how to trade these stocks, check out this article.

- After you are done buying stocks; your trading account will be debited in real-time and the shares you bought will be credited to your dematerialized account within the ‘settlement’ period. The settlement period is the duration it takes for all the trades on a particular day to be allotted/reconciled to accounts - usually T+2 days.

If you want to sell your stocks to book your profit or ‘stop-loss’, place a ‘sell’ order via the same platform. Your shares will be bought by someone else. Once your stocks are bought by someone else; the money will be credited to your trading account while the shares will get debited from your account.

Holding stocks has become much simpler today in this era of digitization. With the advent of electronic storage, the account opening process has been simplified and it’s easier to enter the share markets. Once you’re done opening an account online, you can use the stock trading platforms to buy and sell shares. Your securities will be debited and credited to and from your account in the ‘settlement period’. This is usually within T+2 days i.e two days after a trade is placed.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.