Introduction to the Short Strangle

Introduction to the Short Strangle

What if you believe that a stock or index like the Nifty won’t move much in the coming weeks? However, maybe you aren’t completely confident that the underlying will be at the exact price on expiry and you want to give yourself a little “wiggle room”. The strategy that could help you in this situation is the short strangle.

How do you construct a short strangle?

To enter into a short strangle, you sell both a call and a put with different strike prices. The call and put will typically both be out-of-the-money. This means that the short call will have a higher strike price than the current underlying price, and the short put will have a lower strike price than the current underlying price.

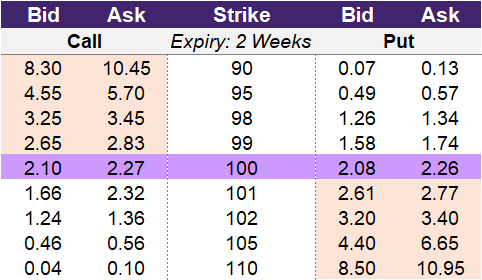

Let’s walk through an example using the data in illustration 1 below. You can choose any strike price, but we will examine the 95 and 105 strike prices. By shorting the 95-strike put option, you will collect 0.49 in premium. Shorting the 105-strike call option, you will collect 0.46 in premium. Our example short strangle will provide a total premium of 0.95.

Illustration 1

Source: Upstox

Source: UpstoxWhy would a trader use a short strangle?

You would enter into a short strangle if you believe that the price of the underlying stock or index will stay relatively flat. This strategy is similar to a short straddle, but there are a few differences. With the short straddle, you short the same strike, and that strike is usually the at-the-money strike price. Because of this, you will collect more premium by executing a short straddle versus a short strangle. You would choose a short strangle over a short straddle because the short strangle offers more flexibility to keep the full premium. With a short straddle, the underlying price has to equal the short strike price to keep the full premium. For the short strangle, the underlying just needs to fall within the two short strike prices to retain the premium collected.

What is the max profit of a short strangle?

Key Formula:

- Short Strangle Max Profit = Total Premium Received

A short strangle has a max profit potential of the total premium initially collected when entering into the strategy. Looking back to our example strategy, we collected 0.95 in premium by entering into this hypothetical short strangle. This 0.95 is the max profit for this example strategy.

How much can you lose trading a short strangle?

Key Formula:

- Short Strangle Max Loss (if the stock rises) = Unlimited – Total Premium Received

or - Short Strangle Max Loss (if the stock falls) = Strike Price – Total Premium Received

By trading a short strangle, you can possibly lose more than the premiums you collected when entering into the trade. You can theoretically lose an unlimited amount if the underlying price rises to infinity. Alternatively, if the underlying price falls to zero, you can lose the amount of the strike price less the premium collected. In our example, the lower strike price selected was 95, and the total premium received was 0.95. Therefore, your max gain is 0.95, but the max potential loss if the underlying falls to zero is 94.95. While the scenarios of the underlying price rising to infinity or falling to zero aren’t likely, there is still a significant risk of substantial loss when you trade short strangles.

What is the breakeven point when entering a short strangle?

Key Formula:

- Short Strangle Upper Breakeven Point = Short Call Strike Price + Total Premium Received

- Short Strangle Lower Breakeven Point = Short Put Strike Price – Total Premium Received

The short strangle has two breakeven points: an upper and lower one. The upper breakeven is based on the short call strike price, and the lower breakeven is based on the short put strike price. Looking at our example, the short call strike price was 105, and the total premium received is 0.95, leading to an upper breakeven point of 105.95. Once the underlying rises above 105.95, you will no longer be in a profitable situation. As the underlying price rises higher, you will lose more and more. On the other side, the lower strike in our example was the 95-strike, and when you reduce it by the total premium received, this leads to a lower breakeven point of 94.05. If the underlying falls below this price, you will be at a loss.

What is the profit formula for a short strangle?

Key Formula:

- Short Strangle Profit = Total Premium Received – Max(0 Underlying Price – Strike Price) – Max(0 Strike Price – Underlying Price)

To calculate the profit for a short strangle, you start with the premium collected by shorting the call and put options. You then reduce this premium by the payoff formulas for the short call and short put options.

What is the payoff diagram for a short strangle?

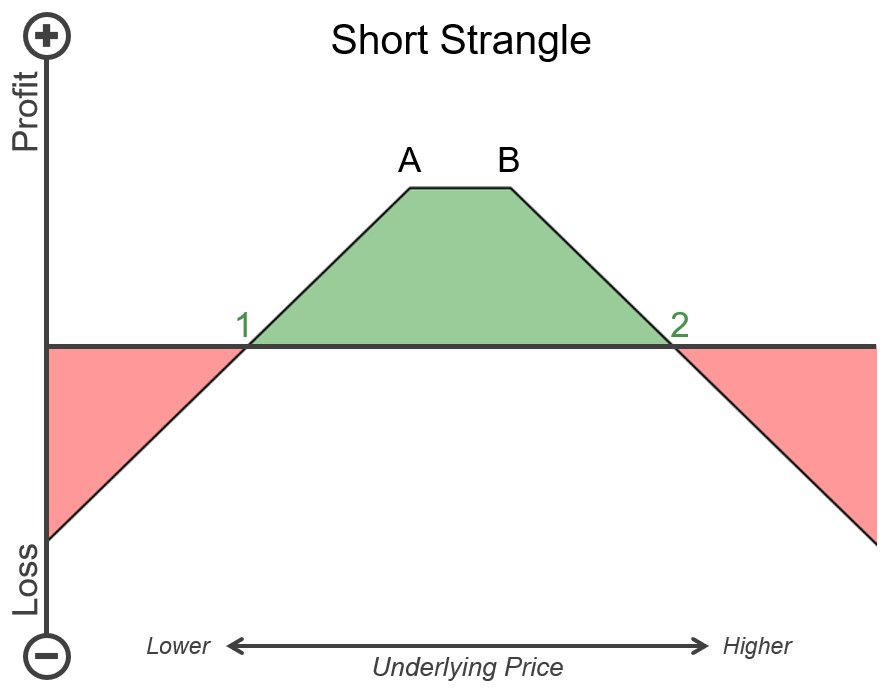

Illustration 2 shows the payoff or P&L diagram for a short strangle. Point A is the strike price for the short put, and point B is the strike price for the short call. The area shaded in green represents profit, while the areas shaded in red represent losses. Points 1 and 2 are the breakeven points. If the underlying price represented by the x-axis rises above point 2 or falls below point 1, then the short strangle will be a losing trade.

The vertical axis is the profit and loss, where higher values represent a higher profit, and lower values represent a loss. As you can see, the area between points A and B is where the profit is the highest. Between these two strike prices is where you will reach the max profit for the short strangle.

Illustration 2

Source: Upstox

Source: UpstoxWhat is the point of max profit for a short strangle?

Key Formula:

- Price of Underlying between the two Strike Prices

When you trade a short strangle, you want the short call and short put option to expire worthless or out-of-the-money. For the short call, the underlying price needs to be below the shorted strike price. For the short put, the underlying price needs to be above the shorted strike price. This means that if the underlying is between the two strike prices on expiry, you will keep the entire initial premium collected.

What is the point of max loss for a short strangle?

Key Formula:

- Price of Underlying = ∞

or - Price of Underlying = 0

A short strangle has a max loss that is theoretically unlimited. This is because a stock or index has no limit to how high its price can go. If you are shorting a call option, this means that you can lose more and more as the price of the underlying continues to rise. If the price of the underlying falls, the point of max loss is if the stock or index falls to zero.

Summary

- Short strangles are used if you think that the underlying’s price will move very little prior to expiry.

- Short strangles consist of shorting a put option and a call option. Both options are out-of-the-money.

- A short strangle is a credit strategy that involves collecting an upfront premium.

- The max gain for a short strangle is the initial premium collected.

- A short strangle has two breakeven points. If the underlying price is between the breakeven points on expiry, the trade will be profitable.

- The max loss of a short strangle is theoretically unlimited.

Is this chapter helpful?

- Home/

- Introduction to the Short Strangle