Introduction to the Short Combo

Introduction to the Short Combo

The most common trade is to “buy low and sell high.” The hope is that the stock or index rises in order to profit. However, this doesn’t always happen. You can use futures to short sell an asset to profit from falling prices. However, this requires a significant amount of capital. Instead of this, you can purchase a put option. While the capital required to buy a put option is far lower than shorting a futures contract, you could possibly further reduce the amount you spend to enter into this trade. Let’s discuss how the short combo strategy can be a potential answer to this.

How do you construct a short combo (or short synthetic stock)?

You construct a short combo or short synthetic stock by selling a call option and purchasing a put option. The short call option will provide you with a credit that helps offset the cost of the long put option. Just like a long combo, a short combo can be designed as either a net debit strategy or a net credit strategy depending on the strike prices selected for the long put and short call option.

Illustration 1

Source: Upstox

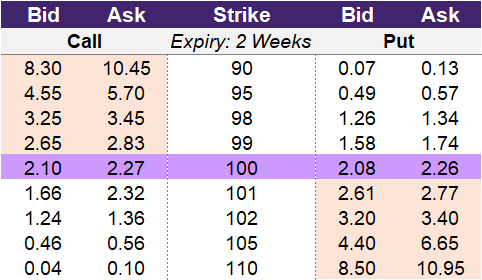

Source: UpstoxLet’s look at two quick examples of establishing a short combo position. In both instances, you are bearish on this underlying stock that is currently priced at 100.

-

Example 1: You short the 102-strike call option and purchase the 100-strike put option. The put option will cost 2.26, and you will receive a credit of 1.24 from shorting the call option. This results in a debit or cash outlay of 1.02 to enter into the 100-102 short combo.

-

Example 2: Alternatively, you decide to short the 100-strike call option, which provides a credit of 2.10. You also purchase the 98-strike put option at a price of 1.34. This is a net credit strategy, providing you an initial cash inflow of 0.76 to enter into this 98-100 short combo.

Why would a trader use a short combo (or short synthetic stock)?

A trader would execute a short combo if they are extremely bearish. Depending on the particular strikes selected, the short combo can be a synthetic version of a short stock position. A trader may also be interested in a short combo because the breakeven point for this strategy is more favorable than that of a long call. In addition, a trader would want to benefit from the leverage effect of options versus shorting a futures contract on the underlying stock or index.

What is the difference between a short combo and short synthetic stock?

A short combo and short synthetic stock are constructed using a short call option and long put option. The difference is that a short synthetic stock strategy is a special case of a short combo. Specifically, a short synthetic stock strategy is when the short call and long put are at the same strike price. When this occurs, the payoff of the short synthetic stock strategy is the same as a short stock.

What is the max profit of a short combo (or short synthetic stock)?

Key Formula:

- Short Combo Max Profit = Strike Price of Long Put – Net Premium Paid (or + Net Premium Received)

The max profit of a short combo will occur if the underlying asset falls to zero. If this happens, then the gain for the trader is equal to the strike price of the long put. Since you may have paid a premium to enter into this trade, you would have to reduce this gain by the net premium. If you received a credit to enter into this trade, you would add this premium to the value of the short call strike price. We explored two examples where we entered into short combos. Let’s look at the max profit for these example trades:

-

Example 1: In this example, you purchase the put option with a 100-strike price, and the net premium paid is 1.02. This means that the max profit for this strategy is 98.98 (100 – 1.02) and would occur only if the underlying stock fell to zero on expiry.

-

Example 2: In our second example, you instead purchase the 98-strike put option and receive a credit of 0.76 to enter into the strategy. The max profit is 98.76 (98 + 0.76).

How much can you lose trading a short combo (or short synthetic stock)?

Key Formula:

- Short Combo Maximum Loss = Unlimited

The max loss for a short combo, as well as for a short synthetic stock, is unlimited. This is because a stock or index can rise infinitely, and when you are short a call option, you have exposure to potential unlimited losses.

What is the breakeven point when entering a short combo (or short synthetic stock)?

Key Formula:

- Short Combo (Net Debit Trades) Breakeven point: Long Put Strike Price – Net Premium Paid

- Short Combo (Net Credit Trades) Breakeven point: Short Call Strike Price + Net Premium Received

The short combo has one breakeven point, but the formula and specific point will depend on whether the trade was entered as an initial net debit or net credit. If your short combo is entered as a net debit, you take the long put strike price and reduce it by the premium paid. This means that the breakeven point for a debit short combo is below the long put strike. Alternatively, if you executed the short combo as a net credit, then you start with the short call strike price and add the premium received. This results in a breakeven point that is above the short call strike price.

Let’s look at our two examples. One of them was entered as a net debit and the other a net credit.

-

Example 1: The first example trade was a short combo that was entered as a net debit or cash outlay. The long put option strike price was 100, and the premium paid was 1.02. The breakeven point for this strategy is 98.98.

-

Example 2: In the second example, the short combo was a cash inflow or net credit. The short call strike price was 100, and the credit received was 0.76. Therefore, the breakeven point for this strategy is 100.76.

What is the profit formula for a short combo (or short synthetic stock)?

Key Formula:

- Short Combo Profit = Max(0 Strike Price – Underlying Price) – Max(0 Underlying Price – Strike Price) + Short Call Credit Received – Long Put Debit Paid

The short combo strategy is comprised of a long put and a short call. To determine the profit for the short combo or short synthetic stock, you would sum the individual profit calculations for the long put and short call.

What is the payoff diagram for a short combo (or short synthetic stock)?

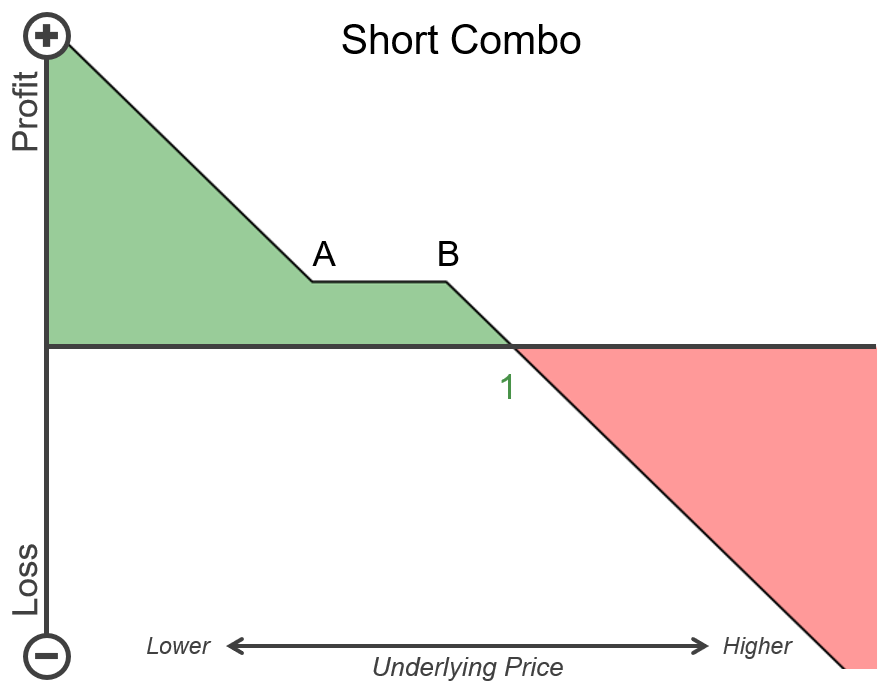

The payoff diagram for a short combo is displayed in illustration 2. The horizontal axis is the underlying stock or index price. If on expiry the underlying price is higher or to the right, the short combo will be a losing trade. The loss is represented by the section shaded in red. Conversely, if the underlying price is lower on expiry or to the left side of the chart, then the short combo will be a profitable trade. The profit is represented by the section shaded in green. The breakeven point for this strategy is highlighted as Point 1. Point A is the strike price of the long put option. Point B is the strike price of the short call.

Illustration 2

Source: Upstox

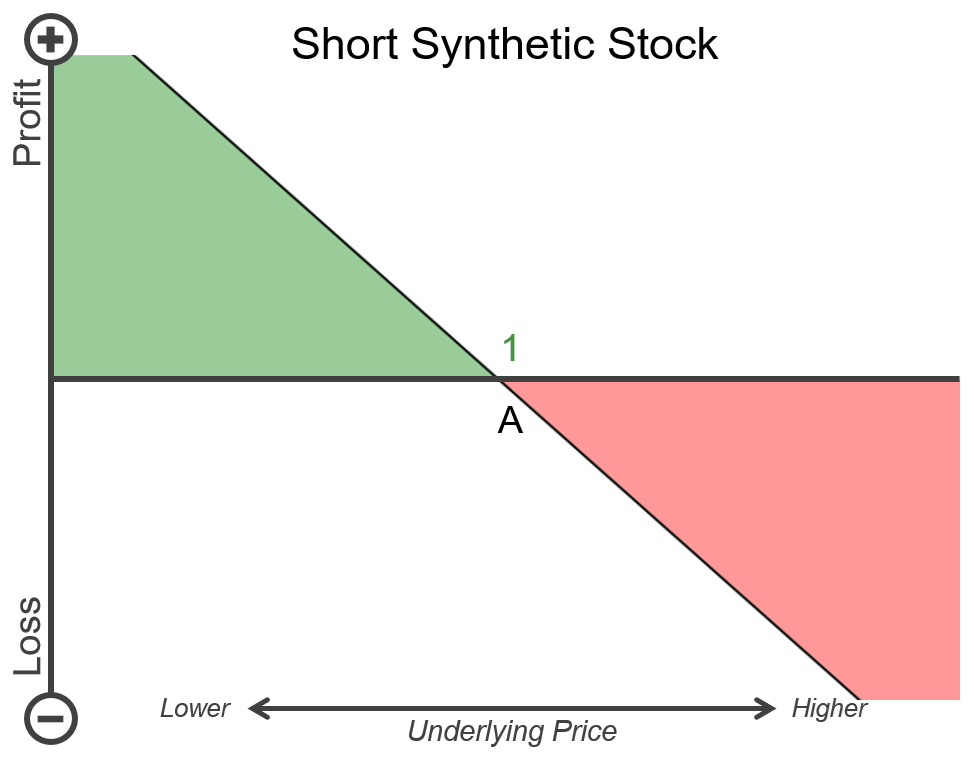

Source: UpstoxIf you use the same strike price as the long put and short call options, then this would be a short synthetic stock strategy. Then, points A and B would be the same on the chart. The payoff diagram for the short synthetic stock, which has the same strike price for the short call and long put, is shown in illustration 3.

Illustration 3

Source: Upstox

Source: UpstoxWhat is the point of max profit for a short combo (or short synthetic stock)?

Key Formula:

- Price of Underlying = 0

The short combo or synthetic stock reaches the point of max profit if the underlying stock or index falls to zero.

What is the point of max loss for a short combo (or short synthetic stock)?

Key Formula:

- Price of Underlying = ∞

The short combo strategy, as well as the synthetic stock strategy, doesn’t have a max loss point. This is because a stock or index can theoretically rise infinitely. As the stock or index rises, the value of the short combo or synthetic stock trade will fall.

Summary

- A short combo strategy is used when you think that the underlying stock or index will fall significantly prior to expiry, and you want to benefit from the leverage effect of options.

- You execute a short combo by purchasing a put option and shorting a call option at the same or higher strike price as the long put option.

- If the long put option and short call option use the same strike price, this is a special case of a short combo. This special case is known as a short synthetic stock.

- The max gain of a short combo is significant and would happen if the underlying asset’s price falls to zero.

- The max loss potential is theoretically unlimited.

- A short combo strategy can be structured as a net debit (cash outlay) or net credit (cash inflow) trade. This depends on the strike prices selected for the strategy.

Is this chapter helpful?

- Home/

- Introduction to the Short Combo