Introduction to the Reverse Iron Condor

Introduction to the Reverse Iron Condor

Assume that you believe that a company soon to announce earnings will move dramatically following the release of this information. You consider a non-directional strategy like a straddle or strangle but quickly realize that the premiums are extremely high because of this upcoming event. You are fairly certain about this move but don’t want to commit so much capital to this trade. The strangle is cheaper than the straddle, but how can you make the strangle even more cost-effective? You can hedge the long calls and puts of the strangle with short calls and puts to further reduce the premium paid. This is the reverse iron condor.

How do you construct a reverse iron condor?

You construct a reverse iron condor by starting with a long strangle. As a reminder, a long strangle is a long call and long put option that are both out-of-the-money. Typically, the long call and put are equidistant from the at-the-money strike price. This means that if you buy a call that is 2 strikes or 100 points above the at-the-money value, you should buy the put that is 2 strikes or 100 points below the at-the-money value.

In addition, you sell a call option that has a higher strike price than the long call. You also sell a put option that has a lower strike than the long put option. When you sell these options, you want to ensure that they are equidistant from their corresponding long contracts. So if you sell a call option that is 1 strike or 50 points above the long call, you should sell the put option that is 1 strike or 50 points below the long put. However, the long call and put options don’t have to be the same distance as the short options. For example, the long call and put could be 4 strikes away from the at-the-money price, while the short call and put could be 1 strike away from the long call and put.

The rule of thumb is:

- The further away that the long call and put strike prices are from the at-the-money price, the lower the premium paid.

- The closer that the short call and put strikes are from the long call and put strikes, the higher the premium collected.

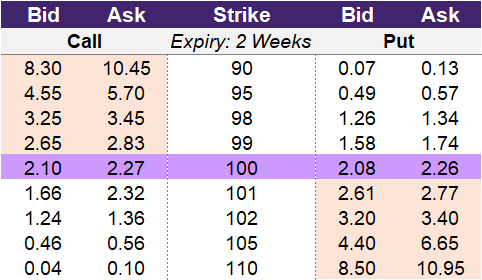

We can use illustration 1 to build an example strategy. Assume that you want to enter into a reverse iron condor. Let’s start with the “long strangle portion” of the strategy. Perhaps we purchase the 98-102 strikes. The 98-strike put option costs 1.34, while the 102-strike price costs 1.36. This portion of the strategy requires a premium of 2.70. We decide to sell the 95 and 105 strike prices. The 95-strike short put option will provide a premium of 0.49, while the 105-strike short call option will give us 0.46. The net credit from these two short legs is 0.95. Therefore, the net cost to enter into this reverse iron condor is 1.75 (0.95 – 2.70).

Illustration 1

Source: Upstox

Source: UpstoxWhy would a trader use a reverse iron condor?

You would consider using a reverse iron condor if the following things are true:

- Your trade hypothesis is that the underlying’s price will move significantly up or down.

- You are interested in paying a lower premium to enter into a non-directional strategy.

- You are comfortable with limiting your gains instead of having unlimited potential upside.

These are the same reasons as for a reverse iron butterfly. The difference is that you are interested in paying an even lower premium than with a reverse iron butterfly.

What is the max profit of a reverse iron condor?

Key Formula:

- Reverse Iron Condor Maximum Gain = Short Call Strike Price – Long Call Strike Price – Net Premium Paid

or - Reverse Condor Maximum Gain = Long Put Strike Price – Short Put Strike Price – Net Premium Paid

To calculate the max profit for a reverse iron condor, you need to subtract the difference between the long and short strike prices and further reduce it by the net cost to enter into the strategy. You can calculate this by either using the short call and long call strikes or the long put and short put strikes. The outcome will be the same either way. Let’s look at our example where we entered into a 95-98-102-105 reverse iron condor. The difference between the long and short contract strike prices is 3: either 98 – 95 or 105 – 102. The cost to enter into this example reverse iron condor was 1.75. This results in a potential max gain of 1.25 for this example strategy.

How much can you lose trading a reverse iron condor?

Key Formula:

- Reverse Iron Condor Max Loss = Initial Net Premium Paid

A benefit to trading a reverse iron condor is that the max loss is capped. Specifically, the reverse iron condor has a max loss of the initial net premium paid to enter into the trade. In our example reverse iron condor, we purchased the 98-strike put option and 102-strike call option. This cost a total of 2.70. We also shorted the 95-strike put option and 105-strike call option, which provided us a credit of 0.95. The net cost and max loss for this example strategy is 1.75 (0.95 – 2.70).

What is the breakeven point when entering a reverse iron condor?

Key Formula:

- Reverse Iron Condor Upper Breakeven Point = Long Call Strike Price + Net Premium Paid

- Reverse Iron Condor Lower Breakeven Point = Long Put Strike Price – Net Premium Paid

There are two breakeven points for a reverse iron condor. There is an upper breakeven point that is found by adding the net cost of the strategy to the long call strike price. There is also a lower breakeven point that is determined by subtracting the net cost of the strategy from the long put strike price. If the price of the underlying stock or index is above the upper breakeven point on expiry, then the trade will be profitable. Likewise, if the price of the underlying falls below the lower breakeven point on expiry, then you will also be profitable.

In our example 95-98-102-105 reverse iron condor, it cost you 1.75 to enter into the strategy. Adding this to the long call strike price of 102 results in an upper breakeven price of 103.75. When you subtract 1.75 from 98, you will get the lower breakeven price of 96.25.

What is the profit formula for a reverse iron condor?

Key Formula:

- Reverse Iron Condor Profit = Long Call Profit + Long Put Profit + Short Call Profit + Short Put Profit

- Long Call Profit = Max(0 Underlying Price – Strike Price) – Premium Cost

- Long Put Profit = Max(0 Strike Price – Underlying Price) – Premium Cost

- Short Call Profit = Premium Received – Max(0 Underlying Price – Strike Price)

- Short Put Profit = Premium Received – Max(0 Strike Price – Underlying Price)

A reverse iron condor strategy is a four-legged option strategy. To calculate the profit of the whole strategy, you simply need to calculate the profit of the individual option contracts entered. When you do this, you need to incorporate the premium paid or received for the individual contract. For example, the long call will require a debit or premium to be paid, while the short call will provide a credit. You need to sum the profit formulas for the long call, short call, long put, and short put to determine the profit of the reverse iron condor.

What is the payoff diagram for a reverse iron condor?

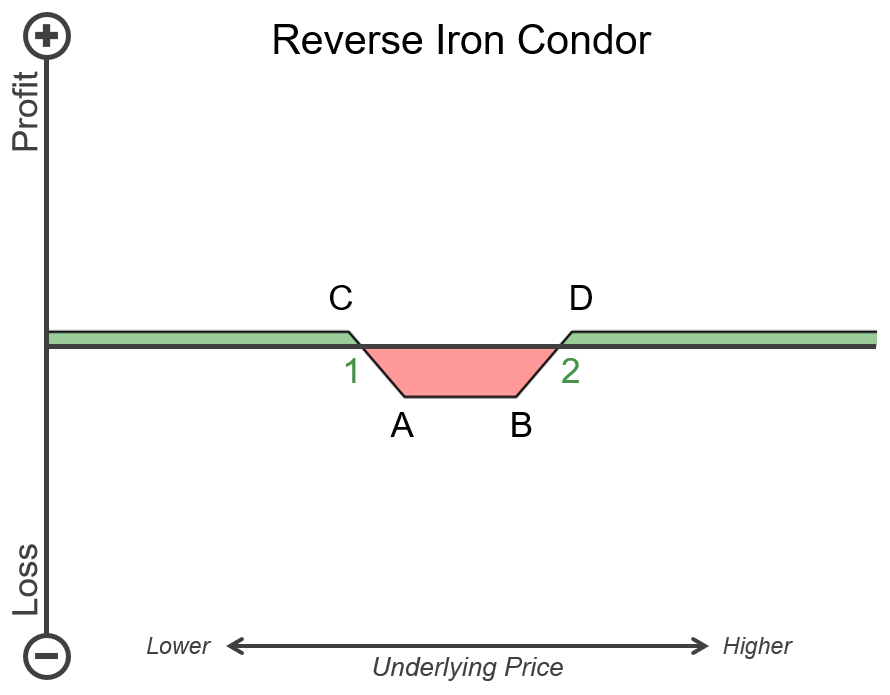

Illustration 2 displays the payoff diagram for the reverse iron condor. Points A and B are the strike prices of the long put and long call, respectively. Point C is the strike price of the short put option. Point D is the strike price of the short call option. There are also two breakeven points for this strategy. Point 1 is the lower breakeven point, and point 2 is the upper breakeven point.

The horizontal axis represents the price range of the underlying asset on expiry. Higher asset prices are to the right side of the chart, while lower prices are to the left. The middle represents situations where the price of the asset didn’t move much between the time the strategy was entered and expiry. If the underlying price moves very little and stays between points 1 and 2, then the trade will be at a loss. This is the area shaded in red. If the underlying stays between points A and B, then the trade will be at the max loss.

If the underlying price is lower (to the left) of point C, then the trade will be at the max gain. Alternatively, if the underlying price is above (to the right) of point D, then the trade will also be at the max gain.

Illustration 2

Source: Upstox

Source: UpstoxWhat is the point of max profit for a reverse iron condor?

Key Formula:

- Price of Underlying >= Short Call (Upper) Strike Price

or - Price of Underlying <= Short Put (Lower) Strike Price

Also, if the underlying price falls to or below the short put strike price – the lowest strike price of the trade – on expiry, then this strategy will be profitable. In our example reverse iron condor, the short call and short put strike prices were 105 and 95, respectively. So if the underlying stock or index price is at or above 105 on expiry or at or below 95 on expiry, then this trade will be at the max profit point.

What is the point of max loss for a reverse iron condor?

Key Formula:

- Price of Underlying between the two Long Put Strike Price and Long Call Strike Price

The max loss for a reverse iron condor occurs when the price of the underlying is between the long put and long call strike prices on expiry. These strike prices are the “inner” strike prices of the trade. This is similar to a long strangle, where you purchase a long call and put option that have strike prices that are out-of-the-money. With a long strangle, if the underlying is between these two strikes, then the trade will have its max loss. This is the exact same as with a reverse iron condor. The difference is that the max loss for a reverse iron condor will be lower than that of a comparable long strangle.

In our example 95-98-102-105 reverse iron condor, the long call and long put strikes were the 98-strike and 102-strike, respectively. If the underlying price is between 98 and 102 on expiry, then this reverse iron condor will be at the max loss point.

Summary

- The reverse iron condor is a four-legged option strategy that is non-directional in nature.

- You enter into a reverse iron condor if you believe that the underlying price will move significantly prior to expiry.

- A reverse iron condor consists of a long strangle with a corresponding short call that is out-of-the-money and a short put that is also out-of-the-money. The short contracts are both equidistant from their respective long contracts. This means that if the short call is 2 strikes away from the long call, the short put should also be 2 strikes away from the long put.

- You would select this strategy instead of a long straddle, long strangle, or reverse iron butterfly if you prefer to pay a low premium to enter this non-directional trade.

- A reverse iron condor has capped upside potential, unlike a long straddle or strangle that have potentially unlimited max gains.

- A benefit to the reverse iron condor is that it has a fixed max loss.

Is this chapter helpful?

- Home/

- Introduction to the Reverse Iron Condor