Introduction to the Reverse Iron Butterfly

Introduction to the Reverse Iron Butterfly

We previously introduced a few ‘volatility’ strategies that allow you to profit from significant upward or downward movements in an underlying asset. One of these strategies was the long straddle, and it involved the simultaneous purchase of a call option and put option at the same strike price. The huge benefit of a straddle is that it is non-directional in nature. You didn’t need to have a specific trade hypothesis on whether the stock or index would rise or fall. All you needed to know was that the stock or index would rise or fall by a lot.

The trade-off to a straddle is that it can be costly to deploy. Because you are buying two options, you are paying two premiums, leading to an even larger movement required in order to breakeven.

What if you didn’t need to pay as much to enter into a strategy that takes advantage of the volatility of a stock or index? Allow us to introduce you to the reverse iron butterfly.

How do you construct a reverse iron butterfly?

You would construct a reverse iron butterfly by purchasing an at-the-money call and an at-the-money put. Simultaneously, you would sell an out-of-the-money call and an out-of-the-money put option. The out-of-the-money call and put options should have strike prices that are equidistant apart. This means if you sell a call option that is 100 points above the at-the-money strike, you would sell a put option that is 100 points below the at-the-money strike. You can also think of a reverse iron butterfly as a hedged long straddle. This is because a long at-the-money call and put are a long straddle.

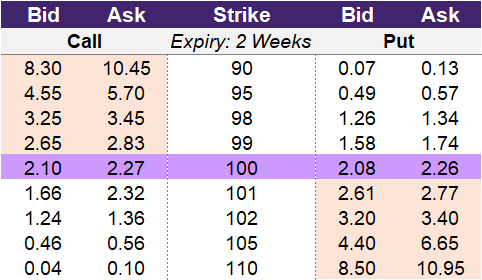

Using the table in illustration 1, we can construct an example reverse iron butterfly. We will start by purchasing a straddle at the 100-strike price. This will cost us 2.27 to buy the call option and 2.26 to buy the put option. To reduce the cost of the call option, we will sell a call at the 105-strike price. We will do the same for the put option and sell a put option at the 95-strike price. The 105-strike call will provide us with a premium of 0.46, and the 95-strike put will provide us with a premium of 0.57. By selling options at 5% above and below the straddle, this caps the gains of the straddle at the 95 and 105 strikes. The cost to buy the straddle is 4.53, and we receive a total credit of 1.03 to sell the call and put options that complete the construction of the reverse iron butterfly. The total net cost of our example iron butterfly is 3.50.

Illustration 1

Source: Upstox

Source: UpstoxWhy would a trader use a reverse iron butterfly?

As a trader, you would use a reverse iron butterfly if you:

- Believe the underlying will move significantly up or down.

- Want to pay a lower premium to enter into this non-directional strategy.

- Are comfortable with capping your gains instead of having the unlimited gain potential of a straddle.

What is the max profit of a reverse iron butterfly?

Key Formula:

- Reverse Iron Butterfly Maximum Gain = Short Call Strike Price – Long Call Strike Price – Net Premium Paid

or - Reverse Butterfly Maximum Gain = Long Put Strike Price – Short Put Strike Price – Net Premium Paid

A reverse iron butterfly has capped gains, and the max profit can be calculated two ways. However, since this strategy requires you to use the same strike differential for the short call and put options, the calculations will still result in the same answer. For example, if we enter into a 95-100-105 reverse iron butterfly at a net cost of 3.50, these will be the two ways to calculate the max profit:

- Max Gain (using call side): 105 (short call) – 100 (long call) – 3.50 (net cost) = 1.50

- Max Gain (using put side): 100 (long put) – 95 (short put) – 3.50 (net cost) = 1.50

As you can see, both formulas yield the same max potential profit. The generalized max profit formula is the difference between the long and short strikes, less the net cost to enter into the trade.

How much can you lose trading a reverse iron butterfly?

Key Formula:

- Reverse Iron Butterfly Max Loss = Initial Net Premium Paid

A reverse iron butterfly has a fixed max loss that is capped at the amount paid to enter into the strategy. In our example, we entered into a reverse iron butterfly by purchasing a straddle at the 100-strike price and selling a put option at the 95-strike price and selling a call option at the 105-strike price. The net debit or cash outlay for this strategy was 3.50. Therefore, 3.50 is the max loss for the example reverse iron butterfly.

What is the breakeven point when entering a reverse iron butterfly?

Key Formula:

- Reverse Iron Butterfly Upper Breakeven Point = Long Strike Price + Net Premium Paid

- Reverse Iron Butterfly Lower Breakeven Point = Long Strike Price – Net Premium Paid

The reverse iron butterfly has two breakeven points. If the underlying price rises enough to cover the cost to enter into the strategy on expiration, you will be profitable. Likewise, if the underlying price falls enough by expiry to offset the strategy’s cost, you will also be profitable. Let’s return to our example strategy. We purchased the 100-strike call and put option and hedged this with a 105-strike short call and 95-strike short put. The net cost for this example reverse iron butterfly is 3.50. This means that the underlying stock needs to rise to 103.50 (100 + 3.50) or fall to 96.50 (100 – 3.50) in order to breakeven.

What is the profit formula for a reverse iron butterfly?

Key Formula:

- Reverse Iron Butterfly Profit = Long Call Profit + Long Put Profit + Short Call Profit + Short Put Profit

- Long Call Profit = Max(0 Underlying Price – Strike Price) – Premium Cost

- Long Put Profit = Max(0 Strike Price – Underlying Price) – Premium Cost

- Short Call Profit = Premium Received – Max(0 Underlying Price – Strike Price)

- Short Put Profit = Premium Received – Max(0 Strike Price – Underlying Price)

Since a reverse iron butterfly is an option strategy that combines four individual option trades – a long call, long put, short call, and short put – we should sum the individual P&Ls to determine the net P&L. You should include any premium paid or premium received as part of the individual option profit formulas.

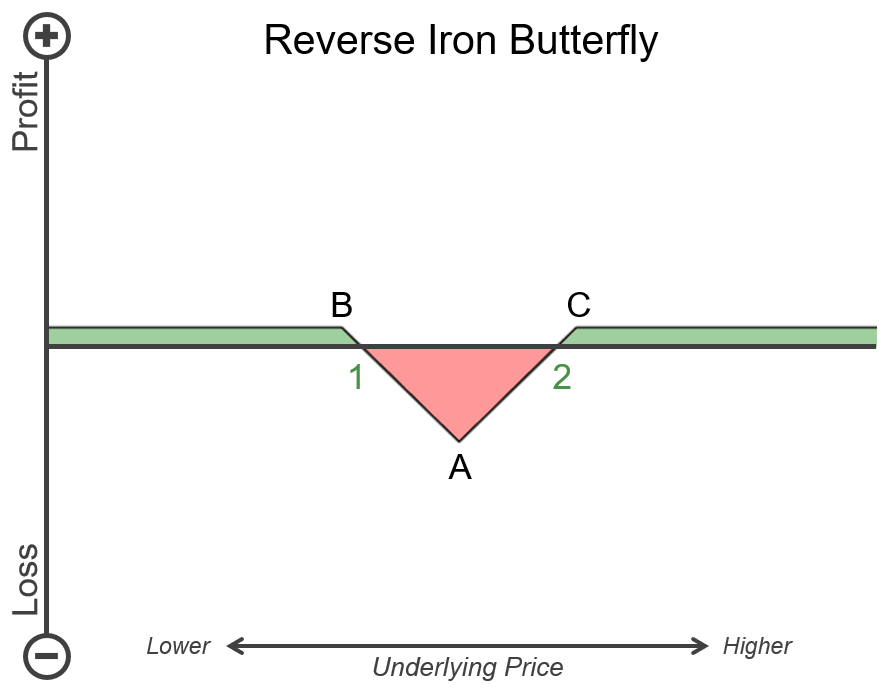

What is the payoff diagram for a reverse iron butterfly?

The payoff diagram for a reverse iron butterfly is shown in illustration 2. Point A is the strike price of the long call and long put. Points 1 and 2 are the two breakeven points – one above the Point A strike price and one below this strike price. Any values that are shown in red between points 1 and 2 are losses for this strategy. If the underlying price, which is shown on the x-axis, doesn’t move far enough above or below the strike price at Point A, then this strategy won’t be profitable.

There are two points of max profit: Points B and C. Point B is the strike price of the short put option. Point C is the strike price of the short call option. The areas shaded in green represent profit. If the underlying price moves significantly higher or lower, then this trade will be profitable. However, the reverse iron butterfly has capped gains. You can see this visually as the profits don’t continue to rise as the underlying price rises and falls.

Illustration 2

Source: Upstox

Source: UpstoxWhat is the point of max profit for a reverse iron butterfly?

Key Formula:

- Price of Underlying >= Short Call (Upper) Strike Price

or - Price of Underlying <= Short Put (Lower) Strike Price

There are two points of max profit for a reverse iron butterfly. One point of max profit is on the upper side, and the other point is on the lower side. The short call strike price is the upper point of max profit, while the short put strike price is the lower point of max profit. If the underlying moves higher or lower than these two points, you will no longer make additional profit.

What is the point of max loss for a reverse iron butterfly?

Key Formula:

- Price of Underlying = Long Strike Price

A reverse iron butterfly will have the max loss if the underlying price is at the strike price of the long call and put option on expiry. As long as the underlying is higher or lower than this strike price on expiry, then you won’t be at the max loss. The reverse iron butterfly has the same max loss point as a long straddle. In our example, we went long the call and put option at the 100-strike price. This means that 100 is the point of max loss for our example strategy.

Summary

- A reverse iron butterfly strategy is a four-legged option strategy that can be used if you believe that the underlying will have price volatility prior to expiry.

- You construct a reverse iron butterfly by going long an at-the-money call option and an at-the-money put option, as well as going short an out-of-the-money call option and out-of-the-money put option. The out-of-the-money option contract strike prices are equidistant from the at-the-money strike price.

- The reverse iron butterfly is similar to a long straddle because you believe the underlying will move up or down significantly, but you don’t have a specific opinion on the direction of movement.

- The reverse iron butterfly will have a more favorable breakeven point than a comparable long straddle.

- Because of the associated short option contracts, the max gain of a reverse iron butterfly is capped.

- The max loss of the reverse iron butterfly is capped at the net premium paid to enter into the strategy.

Is this chapter helpful?

- Home/

- Introduction to the Reverse Iron Butterfly