Introduction to the Protective Put

Introduction to the Protective Put

One big concern for anyone investing in stocks is timing; no one wants to buy something that goes down in value shortly after purchase. Since you cannot predict the market, there is always a risk that losses could occur. If this risk is what prevents you from investing, there is an ‘option’: the protective put option strategy.

How do you construct a protective put?

The Protective Put option strategy is a combination of being long on a stock and a put option. Usually, the trader already holds the stock but is concerned about near-term volatility that could drive prices downward. As a reminder, a put option gives the holder the right, but not the obligation, to sell the stock at a specified price at a predefined date in the future. Purchasing a put option by itself is an inherently bearish option strategy, meaning you profit if the underlying security moves down. Combining a stock and a put option allows you to preset a maximum loss on your stock position.

Illustration 1

Source: Upstox

Source: UpstoxThe protective put strategy works best whenever there is a large downward movement in the underlying stock. However, there is a trade-off in the performance of this strategy. The more protection for your stock that you want, the higher the cost.

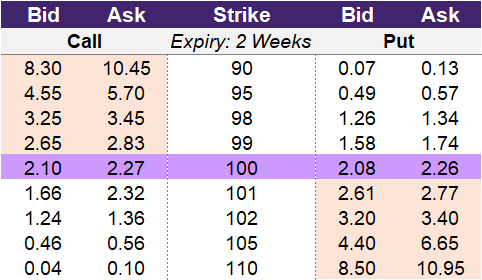

Let’s look at an example. You own a stock that is trading at 100. Using the data in illustration 1, you consider two possible options to hedge against a downward price movement. You consider either the 98-strike price or the 95-strike price. The 95-strike price costs 0.57 to buy the put option, while the 98-strike price costs a substantially higher 1.34 to purchase. The difference is that the more expensive option, the 98-strike price, offers you more protection. Let’s assume that the underlying falls to 96 on expiry. The 98-strike put option will “kick in” at 98, and you won’t lose any more. You will only lose from 100 to 98. The further downward movement from 98 to 96 is protected by the 98-strike put option.

However, if you decide to purchase the 95-strike option for a lower price, your protection will be worthless if the underlying stock only falls to 96. The put option will only help you if the stock falls below 95.

Why would a trader use a protective put?

You would enter into a protective put if you own a stock, want to keep owning it, but are near-term bearish. You are also comfortable with giving up a little upside if the stock moves up in price in the near-term. This is because purchasing a put option requires a capital outlay.

What is the max profit of a protective put?

Key Formula:

- Protective Put Max Profit = Unlimited – Premium Paid for Long Put

The profit potential is unlimited because, with the protective put strategy, you are still long the underlying stock. However, by executing the protective put strategy, the trader will always underperform compared to only holding the stock due to the cost of purchasing the put option.

In illustration 1, the 95-strike price put option traded at 0.57. By purchasing this, we would have downside protection if the underlying stock fell below 95. However, if the underlying price rises, we will underperform. For instance, if the stock rises to 110 on expiry, the put option will be worthless. If we didn’t purchase the put option, we would have a gain of 10 from the stock’s price appreciation (110 – 100). The put option lowers this gain from 10 to 9.43 because we had to pay the put option premium of 0.57. No matter how far the stock rises, the protective put strategy will always underperform the strategy of only owning the stock. The benefit you get from the protective put strategy is risk reduction from a sharp drop in prices.

How much can you lose trading a protective put?

Key Formula:

- Protective Put Maximum Loss = Long Put Strike Price – Underlying Price at Trade Entry – Long Put Premium

As a reminder, the max loss of a put option by itself is the cost of the put option. Therefore, the maximum loss for the protective put strategy is a combination of the loss associated with the underlying stock and the cost of the put option.

Using the data from illustration 1, assume that you entered into the 95-strike protective put strategy while the underlying stock was trading at 100. The cost of the 95-strike put option was 0.57. This means that the max loss in our example is 5.57, which is a combination of the put option cost (0.57) and the loss of the stock moving from 100 to the strike price of 95 (95-100 = 5).

What is the breakeven point when entering a protective put?

Key Formula:

- Protective Put Breakeven Point = Underlying Price + Premium Paid

The protective put strategy has one breakeven point. Since you are purchasing a put option, you are spending capital to gain downside protection. To offset this purchase, the underlying stock needs to rise a certain amount. This amount is the premium paid for the call option. Therefore, the breakeven point for a protective put is the underlying price (at the time of strategy entry) plus the premium paid for the put option.

Looking at illustration 1, if we entered into a protective put with a strike price of 98, this would cost us 1.34. Since the underlying stock is currently trading at 100, this means that the stock would need to rise to 101.34 (100 + 1.34) in order to breakeven.

What is the profit formula for a protective put?

Key Formula:

- Protective Put Profit = Underlying Stock Profit + Long Put Profit

- Underlying Stock Profit = Current Stock Price – Stock Price when Put Purchased

- Long Put Profit = Max(0 Strike Price – Underlying Price) – Premium Paid

The profit formula for the protective put is the combination of the profit or loss associated with the long stock position and the profit or loss of the long put position. To calculate the profit of the stock, you start with the current stock price and subtract the price of the stock when you entered into the protective put strategy. The long put P&L formula is the max of 0 or the strike price minus the underlying stock price and the price to purchase the put option.

What is the payoff diagram for a protective put?

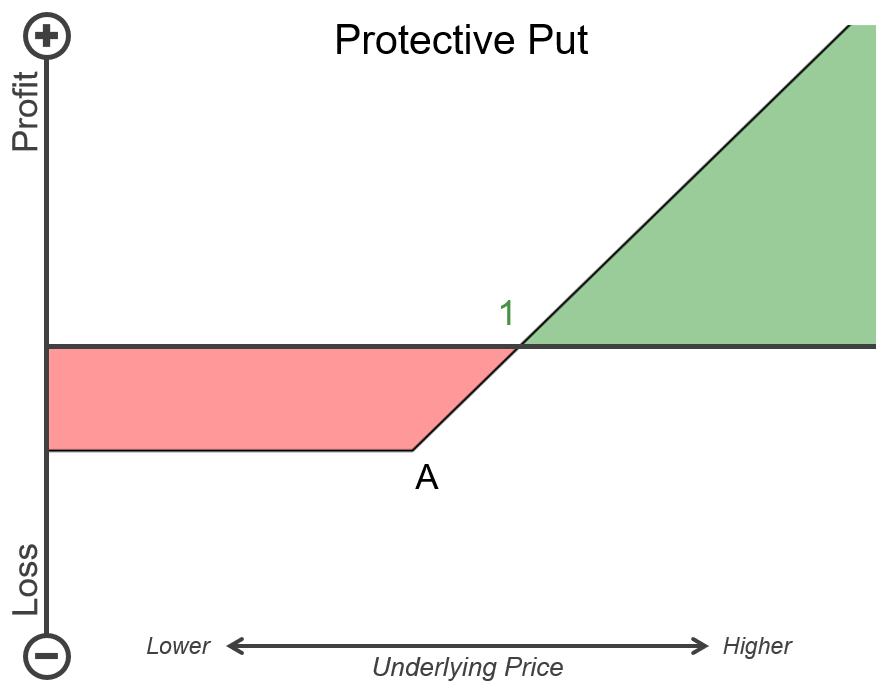

An example payoff diagram for a covered call is in illustration 2 below. The areas of green and red represent potential profit and loss at expiry, respectively. Point A is the strike price of the short call, and point 1 is the breakeven point of this strategy. The horizontal axis is a range of possible underlying prices where higher prices are to the right and lower prices are to the left. On the vertical axis is profit and loss, where profit is higher up on the axis and losses are further down.

In illustration 2, we display an example payoff diagram of a protective put strategy. Point A is the strike price of the long put option, and point 1 is the breakeven point of this strategy. Any area shaded in green represents where you would be in a profitable situation, while areas of red are when you would be at a loss. As you move to the right on the horizontal axis, this means that the underlying asset is at a higher price. You can also see that the green section or area of profit continues to rise as the underlying price rises. There is no limit to the profit of a protective put strategy. As you move to the left on the horizontal axis, this represents a lower price of the underlying asset.

Illustration 2

Source: Upstox

Source: UpstoxWhat is the point of max profit for a protective put?

Key Formula:

- Price of Underlying = ∞

The point of max profit for a stock is undefined as the price can theoretically rise to infinity. The higher the stock rises, the more profit this strategy will make. The protective put is a strategy that protects or hedges against potential downward price moves in the underlying stock. If the stock price is higher on the expiry of the long put option, then you will underperform compared to only holding the stock. This is because you pay a premium to purchase the long put.

What is the point of max loss for a protective put?

Key Formula:

- Price of Underlying = Long Put Strike Price

By purchasing a put option, you are capping the maximum amount that you can lose. This means that the point of max loss for the protective put strategy is the strike price of the put option. If the underlying stock keeps falling in price below the strike, you will not lose any more because the losses are limited to the strike price.

In our example using illustration 1, we considered the 98-strike price and 95-strike price put options to purchase to enter into a protective put strategy. If you purchased the 98-strike price, the point of max loss would be 98. If you instead purchased the 95-strike price, the point of max loss would be 95.

Summary

- The protective put strategy combines being long on an underlying stock and purchasing a put option to hedge against downward price movements.

- This strategy allows you to preset a maximum loss on your stock position.

- This strategy works best whenever there is a large downward movement in the underlying stock.

- The higher the protection you seek for your stock, the higher will be the cost you pay for the strategy.

- The maximum loss for the protective put strategy is the sum of the put option’s cost and the difference between the strike price and the current value of the stock at strategy entry.

- The strategy has unlimited profit because you are still long on the underlying stock.

Is this chapter helpful?

- Home/

- Introduction to the Protective Put