Introduction to the Long Combo

Introduction to the Long Combo

Options are incredibly flexible, and we’ve seen how you can use call options to profit from price increases in the underlying and put options to profit from price decreases in the underlying. We have also seen how combinations of call and put options can be used to profit from either large price movements or lack of price movements.

When you buy a stock and the price goes up, you profit. When the price goes down, you have a loss. Beyond flexibility, options are also capital efficient, and taking a position requires a less upfront cost than if you were to purchase a stock. What if you wanted to have a similar payoff of a stock but with far lower upfront costs? You can use options to structure this same payoff. This is the long combo or synthetic stock strategy.

How do you construct a long combo (or synthetic stock)?

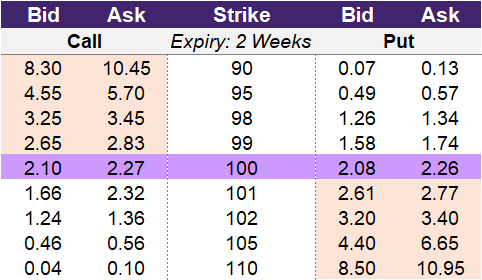

A long combo is comprised of purchasing a call option and selling a put option. By selling the put option, you will collect a premium that offsets the purchase of the call option. Depending on the strikes chosen, you can enter into a long combo for either a debit or a credit. Using the table in illustration 1 below, we can look at two different examples of constructing this option strategy.

Illustration 1

Source: Upstox

Source: UpstoxHere is one example: You could purchase the 100-strike call option at a price of 2.27 and sell the 98-strike put option for a credit of 1.26. The net cost for this long combo is 1.01.

This is a second example: You decide to buy the 100-strike call option for a cost of 2.27 and sell the 100-strike put option for a credit of 2.08. The net cost of this long combo is 0.19. Because this long combo used the same strike prices for the call and put options, this specific case is known as a ‘synthetic stock.’ This is because the payoff diagrams for this particular strategy at expiry are identical to that of the underlying stock. For every Rs 1 increase or decrease in the price of the stock, the option strategy will be up or down by the same amount on expiration. This is where leverage comes in. The price to enter into the stock was 100. The price to enter into the synthetic stock strategy was 0.19 – a 99.9% lower amount.

In our first example, we paid 1.01 to enter into the long combo. Why would we choose this when we can pay far less by selecting a different strike price? The reason is the breakeven point. The long combo with the 100-98 strike prices provides more “safety” for downward movement in the underlying. We will discuss that further momentarily.

Why would a trader use a long combo (or synthetic stock)?

A trader would use a long combo or synthetic stock strategy if:

- They are extremely bullish.

- They want to lower the breakeven point by reducing the cost to enter the trade but don’t want to use a call spread because of their extreme bullish hypothesis.

- They want the low cost and high leverage of options compared to purchasing a stock.

What is the difference between a long combo and synthetic stock?

Both a long combo and synthetic stock involve purchasing a call option and selling a corresponding put option. With a synthetic stock strategy, the long call and short put are for the same strike price. So a synthetic stock strategy is a specific case of a long combo.

What is the max profit of a long combo (or synthetic stock)?

Key Formula:

- Long Combo Max Profit = Unlimited – Premium Paid

A stock can theoretically rise an infinite amount, and as we’ve seen with call options, the max profit is theoretically unlimited. Because the long combo involves the purchase of a call option and there is no corresponding short call option like with a bull call spread, the max profit for the long combo is theoretically unlimited. In reality, the potential gain won’t be unlimited but could be substantial. Any gains on the strategy need to be reduced by the net premium paid if the long combo was an initial debit to calculate the profit.

How much can you lose trading a long combo (or synthetic stock)?

Key Formula:

- Long Combo Maximum Loss = Strike Price of Short Put + Net Premium Paid (or – Net Premium Received)

The max loss depends on the specific strike chosen for the short put contract as well as the net premium paid (or net premium received). Let’s look at our two examples.

- Example 1: We had a short strike price of 98 and paid a net premium of 1.01. If the underlying falls from 98 to 0, you will lose the entire 98. Since you entered into this trade for a net cost, you will also lose this amount as well. Thus, the max loss for this long combo is 99.01.

- Example 2: We had a short strike price of 100 and paid a net premium of 0.19. If the underlying falls from 100 to 0, you will lose the entire 100. This synthetic stock strategy cost 0.19 to enter, so you will also lose this. The max loss for this synthetic stock strategy is 100.19.

What is the breakeven point when entering a long combo (or synthetic stock)?

Key Formula:

- Long Combo (Net Debit Trades) Breakeven point: Long Call Strike Price + Net Premium Paid

- Long Combo (Net Credit Trades) Breakeven point: Short Put Strike Price – Net Premium Received

There is only one breakeven point for a long combo, but the position of it will vary depending on if the strategy was an initial debit or credit. If the long combo is entered as a debit, you use the long strike price and add the amount of the premium that you paid. This is the breakeven point, and it will be higher than the long call strike price.

On the other hand, if you enter into the long combo as a credit, you would take the put strike price and reduce it by the credit received. This means that the breakeven point will be below the put strike price. We have used two examples previously. Let’s calculate the breakeven point for each of these.

- Example 1: The long call strike price selected was 100, and the net premium paid was 1.01. The breakeven point for this long combo is 101.01 (100 + 1.01).

- Example 2: The long call strike price selected was also 100, but the net premium paid was lower at 0.19 due to the higher short put strike price. The breakeven point for this trade is 100.19 (100 + 0.19).

What is the profit formula for a long combo (or synthetic stock)?

Key Formula:

- Long Combo Profit = Max(0 Underlying Price – Strike Price) – Max(0 Strike Price – Underlying Price) + Short Put Credit Received – Long Call Debit Paid

A long combo is a two-leg option strategy that involves a long call and a short put. The profit formula is simply the profit formula for a long call and profit formula for a short put.

What is the payoff diagram for a long combo (or synthetic stock)?

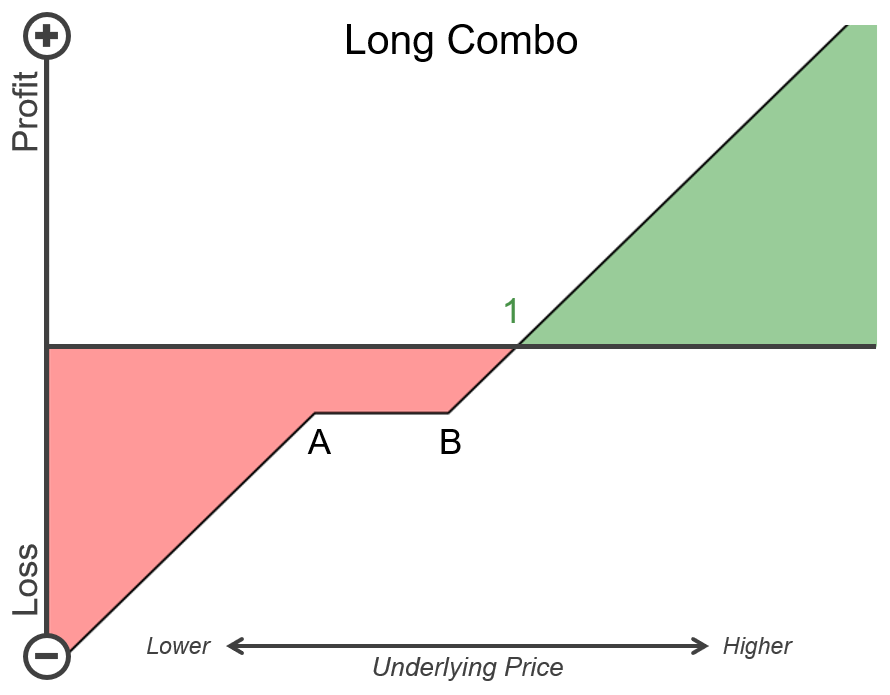

Illustration 2 has an example payoff diagram of the long combo. The vertical axis represents the potential profit and loss of the strategy, where the higher values are profit and lower values are loss. The horizontal axis represents potential prices of the underlying at expiration. The higher prices are to the right of the chart, and lower prices are to the left side. Areas shaded green are profitable, while those shaded in red are losses.

Point A is the strike price of the short put option, while point B is the strike price of the long call. This specific illustration is a long combo. If points A and B were the same – meaning the call and puts used the same strike price – then this long combo would also be known as a synthetic stock strategy. Point 1 is the breakeven point for this strategy.

Illustration 2

Source: Upstox

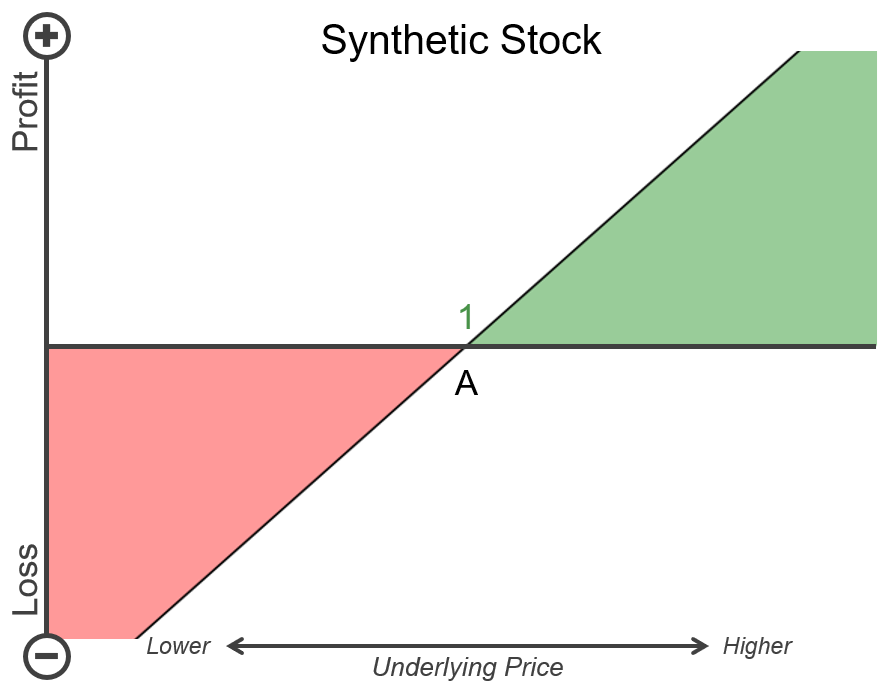

Source: UpstoxIn illustration 3, we display the payoff diagram for a synthetic stock. The primary difference is that instead of having two strikes at points A and B, the long call and short put are both at the same strike price of point A.

Illustration 3

Source: Upstox

Source: UpstoxWhat is the point of max profit for a long combo (or synthetic stock)?

Key Formula:

- Price of Underlying = ∞

The long combo or synthetic stock doesn’t have a point of max profit because the max profit isn’t capped. As long as the underlying stock keeps rising, the trader will earn more from the price appreciation of the long call option.

What is the point of max loss for a long combo (or synthetic stock)?

Key Formula:

- Price of Underlying = 0

If the price of the underlying falls to zero, then you will suffer the max loss associated with this strategy. This is unlikely to occur in general and is even less likely to occur during the lifespan of the option contracts. However, while the likelihood of max loss occurring is low, there is still a chance of substantial losses if the stock happens to fall dramatically while you are still entered into the long combo. The max loss of the long combo is due to the short put option contract.

Summary

- Use a long combo when you expect the underlying to rise dramatically and you want the leverage of options instead of the higher capital of buying the stock.

- A long combo involves the simultaneous purchase of a call and selling of a put option. The strike prices of the long call and short put don’t have to be the same, but the expiry must be the same.

- The max gain is unlimited, like a long call.

- The max loss is substantial, like a short put.

- When you select the same strike prices for the long call and short put, this strategy is known as a synthetic stock.

- A long combo is usually a net debit trade but can be structured as a net credit trade.

Is this chapter helpful?

- Home/

- Introduction to the Long Combo