Introduction to the Iron Butterfly

Introduction to the Iron Butterfly

We’ve discussed a few strategies that allow you to profit if the underlying’s price stays relatively flat prior to expiry. These option strategies are the short straddle and short strangle. A short straddle involves shorting a call and a put on the same strike price; typically the at-the-money strike. The risk of a short straddle is that it has the potential for catastrophic losses because it is an unhedged strategy. The way to mitigate this risk is to hedge each of the short options with a corresponding purchase of a call and a put. While this will reduce the maximum you can profit, you will significantly reduce the most you can lose. In fact, both your potential max gain and max loss will be capped.

Let’s explore more about this non-directional trading strategy.

How do you construct an iron butterfly?

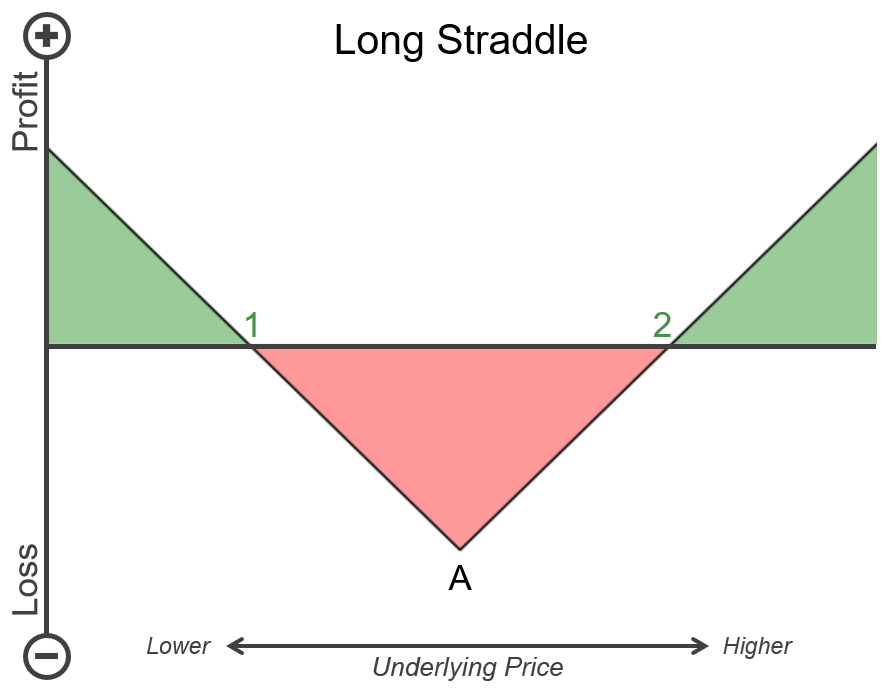

An iron butterfly is essentially a hedged short straddle. As a reminder, a long straddle is the simultaneous purchase of a call and put option on the same strike price. This strike is typically the at-the-money strike price. On the left in illustration 1 below, we display the payoff diagram for a long straddle. As you can see, if the underlying moves significantly up or down, the long straddle is profitable (in green).

On the right side of illustration 1, you will see the payoff diagram for a short straddle. It is the inverse, where large movements up or down result in losses (in red). The profitable section for a short straddle (in green) occurs when the underlying moves very little. To reduce the risk of large losses, you start with a short straddle, but you also purchase a call and a put. The call and put are out-of-the-money, so the credit received from the short straddle will more than offset the cost of these two option purchases.

Illustration 1

|  |

|---|

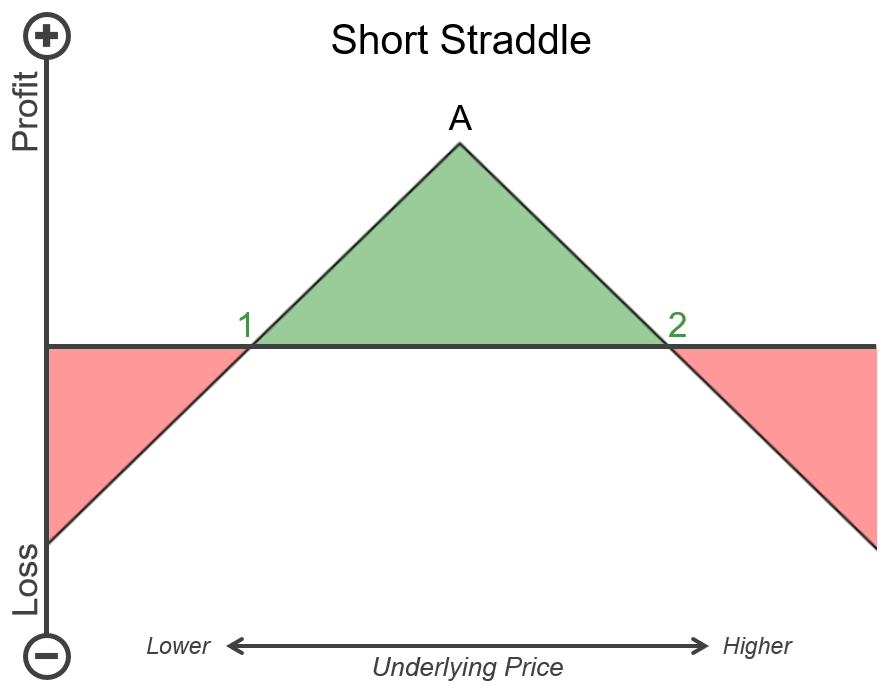

Here is an example of how to enter into an iron butterfly. Using the data in illustration 2, we could execute a short straddle at the 100-strike price. The credit we would receive for the call is 2.10, and the credit for the put is 2.08. If we did nothing else, we would receive a credit of 4.18, but we would be exposed to substantial risks if the underlying moved significantly. Instead, we will continue by purchasing an out-of-the-money call option at the 102-strike price. This will cost us 1.36. We will also purchase an out-of-the-money put option at the 98-strike price at a cost of 1.34. The combination of these four strategies is the iron butterfly. The net premium received is 1.48.

While we selected the 98-100-102 strike prices for this example iron butterfly, you can select any range of strike prices. For example, you could use 95-100-105, 99-100-101, 90-100-110, etc. The only requirements are: the short options are the same strike price, the long strike prices are equidistant, and the expiry dates are all the same.

Illustration 2

Source: Upstox

Source: UpstoxWhy would a trader use an iron butterfly?

An iron butterfly strategy is a multi-leg option strategy that will be successful if the underlying moves very little between the time you enter the trade and expiration. This strategy is a counterpart to a short straddle. As a reminder, the short straddle is a short call and short put that both have the same strike price and expiration date. A trader would use an iron butterfly instead of a short straddle if they want to lower their risk of loss because a short straddle has an extremely large max loss potential. Conversely, an iron butterfly has a fixed known max loss.

Another similar strategy to the iron butterfly is the iron condor. You would use the iron butterfly instead of the iron condor if you are extremely confident in the underlying remaining flat or if you want to collect more premium. If you compare an iron butterfly to an iron condor, the iron butterfly will always have the higher upfront premium collected. The trade-off is that the iron butterfly requires the underlying to move far less to achieve max profit compared to an iron condor.

What is the max profit of an iron butterfly?

Key Formula:

- Iron Butterfly Max Profit = Initial Net Premium

An iron butterfly has a max profit of the initial net premium collected. No matter the movement of the underlying, this initial credit is the most that you can make for that particular trade. In our example, we shorted the 100-strike call and put and purchased the 98-strike put and 102-strike call options. This gave us a net credit or premium of 1.48. This is the max profit of this example trade.

How much can you lose trading an iron butterfly?

Key Formula:

- Iron Butterfly Maximum Loss = Net Premium Received – Long Call Strike Price + Short Call Strike Price

or - Iron Butterfly Maximum Loss = Net Premium Received – Short Put Strike Price + Long Put Strike Price

A benefit of trading iron butterflies is that the maximum loss is capped and known ahead of time. The maximum loss is the difference between a long strike price and a short strike price, less the credit received for entering into the trade. In our example, we received an initial credit of 1.48 to enter into an iron butterfly. The short strike price for both the call and put option is 100. The long call strike price, which acts as a hedge for the short call, is 102. If the underlying moves up to 102 or higher on expiry, in our example, then this is the point of maximum loss. In our example, this is calculated as 102 – 100 + 1.48, or a loss of 0.52.

What is the breakeven point when entering an iron butterfly?

Key Formula:

- Iron Butterfly Upper Breakeven Point = Short Strike Price + Net Premium Received

- Iron Butterfly Lower Breakeven Point = Short Strike Price – Net Premium Received

The iron butterfly has two breakeven points because the strategy involves both calls and puts. If the underlying moves upward and is at or above the upper breakeven point on expiration, the trader will suffer a loss. On the other hand, if the underlying falls in price and is at or below the lower breakeven point on expiration, the trader won’t be profitable. Profitability occurs for an iron butterfly when the underlying price is between the two breakeven points on expiration. As with other option strategies, the formula for the breakeven point is for expiration. The breakeven point will be more favorable to the trader prior to expiry because the options will still have time value associated with them.

What is the profit formula for an iron butterfly?

Key Formula:

- Iron Butterfly Profit = Short Call Profit + Short Put Profit + Long Call Profit + Long Put Profit

- Short Call Profit = Premium Received – Max(0 Underlying Price – Strike Price)

- Short Put Profit = Premium Received – Max(0 Strike Price – Underlying Price)

- Long Call Profit = Max(0 Underlying Price – Strike Price) – Premium Cost

- Long Put Profit = Max(0 Strike Price – Underlying Price) – Premium Cost

An iron butterfly is a four-legged option strategy – a short call, long call, short put, and long put. To calculate the profit for this strategy, you need to determine the profit for each individual leg and then sum them up. The profit for each leg includes the payoff on expiry of the strategy as well as the premium cost for the long options and premium received for the short options.

What is the payoff diagram for an iron butterfly?

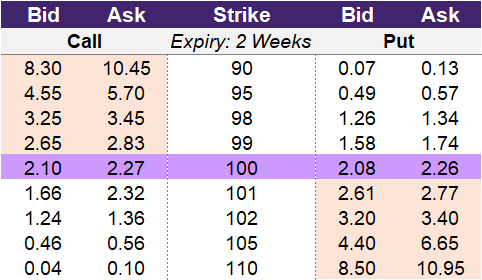

Illustration 3 displays the payoff diagram for an iron butterfly. Point A represents the strike price of the short call and put options. Point B is the strike price for the long put option that hedges the short put, while Point C is the strike price for the long call that hedges the short call option.

The section in green between points 1 and 2 is the area of profitability. The horizontal axis is the underlying price, with lower prices on the left and higher prices on the right. If the underlying price stays in the middle, then the trade will be profitable. You can also see that the max point of profit occurs at Point A – the strike price of the shorted options.

Point 1 is the lower breakeven, and Point 2 is the upper breakeven point. If the underlying price is lower than point 1, the iron butterfly is at a loss. If the underlying price is higher than point 2, then the strategy will also be at a loss.

Illustration 3

Source: Upstox

Source: UpstoxWhat is the point of max profit for an iron butterfly?

Key Formula:

- Price of Underlying = Short Strike Price

An iron butterfly will be the most successful for a trader if the underlying is exactly at the short strike price on expiration. By selling a call and a put, you will receive a credit upfront. You will keep all of this premium as long as the underlying is at that strike price on expiry. If the underlying expires slightly away from that strike but still within the breakeven points, you will still be profitable, but you won’t achieve the max profit.

What is the point of max loss for an iron butterfly?

Key Formula:

- Price of Underlying >= Long Call (Upper) Strike Price

or - Price of Underlying <= Long Put (Lower) Strike Price

There are two points of max loss for an iron butterfly. One max loss point occurs if the underlying is significantly higher on expiration, while the other max loss point is when the underlying is significantly lower on expiration. The specific points are the strike prices of the long call and long put. The long call strike price is the upper max loss point. The long put strike price is the lower max loss point.

Summary

- Use an iron butterfly if you think that the underlying will have very little price movement before expiry.

- An iron butterfly will have the max profit if the underlying price is at the short strike price on expiry.

- Iron butterfly is a four-leg option strategy that consists of a short straddle and a hedge. The hedge is an out-of-the-money call option and put option.

- An iron butterfly has an upper and lower breakeven point.

- If the underlying price is between the two breakeven points on expiry, then the iron butterfly will be profitable.

- An iron butterfly has a fixed max loss that occurs if the underlying price is above the long call strike price or below the long put strike price on expiration.

Is this chapter helpful?

- Home/

- Introduction to the Iron Butterfly