Introduction to the Covered Call

Introduction to the Covered Call

Assume you just purchased a new car. You realize that you travel alone daily in a car that can seat five people. To make the most of this available space, you decide to use your car as an Uber driver. You only accept fares that are on your route home, so there is a negligible difference in your daily commute. The benefit is that you earn additional money just by owning the car, taking the time to accept a fare, and driving your normal route.

In this example, you own an asset (your car) and are able to use that with minimal effort to earn cash (yield). Carrying on with this example, if your daily commute is very short, then the amount you can earn as an Uber driver is limited. However, if you have a longer commute, then your earning potential increases.

If you own stocks, which are assets, you can do something similar to our Uber example by using options. Specifically, you can sell call options against the stock you own. By doing this, you will own the stock and collect a premium by selling the call, just as you would collect earnings from being an Uber driver.

This strategy is known as a covered call.

How do you construct a covered call (buy-write)?

A covered call requires you to either own or purchase (if you don’t already own) the underlying stock and then sell a call option. If you already own the stock and you sell the call, this is a covered call. However, if you buy the stock at the same time as selling the call option, this is technically known as a “buy-write.” Despite these two different names, the strategy is the same: long stock and short call.

A note about covered calls is that you need to execute the trade in the appropriate ‘ratio.’ What this means is that if the option lot size for the particular underlying is 250, you need to own 250 shares of that stock to execute a covered call. Likewise, if the option lot size is 40, you need to own 40 shares of the stock.

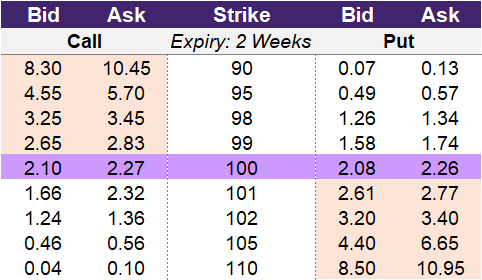

Illustration 1

Source: Upstox

Source: UpstoxLet’s look at an example covered call using the data in illustration 1. Assume you own this stock that is trading at 100 and you decide to sell the 102-strike price call option. By doing this, you receive a credit of 1.24. No matter what happens, you get to keep this 1.24. However, if the underlying rises above 102 on expiry, you will have the obligation to sell the stock at 102. If you think that the underlying will stay flat or slightly increase, a covered call could be a great strategy to execute. If the underlying is still at 100 on expiration, you will have made 1.24% (1.24 / 100) with the covered call. If you only held the stock, you would have made 0%.

Why would a trader use a covered call?

You would enter into a covered call if:

- You are moderately bullish on a stock. In particular, you believe that the stock price will stay below a certain price point on expiry.

- You currently own the stock (and the stock is optionable).

- You are interested in collecting a small premium on the stock you own.

- You are comfortable with potentially having to sell the stock if it rises higher than the price you think it will reach.

- You understand that managing a covered call position, including potentially re-entering new covered call positions as contracts expire, will require more effort than just holding a stock.

What is the max profit of a covered call?

Key Formula:

- Covered Call Max Profit = Short Call Strike Price – Underlying Price of Trade Entry + Short Call Premium Received

If you own a stock, your max profit is theoretically unlimited. If you sell a call and the underlying price moves higher than the strike price, your losses are 1-for-1 as the underlying moves up. By selling a call while owning a stock, any gains in the stock that are made once it moves higher than the short call strike price are offset by losses from the short call. What this means is that the max profit occurs at the strike call strike price. Therefore, the max gain is the difference in the strike price and the underlying price at the time of entering into the covered call plus the premium received from the short call.

Using the example from illustration 1, we shorted the 102-strike price and collect 1.24 in premium. This means that the max profit is calculated at 102 (short call strike price) – 100 (underlying price at stock purchase) + 1.24 (short call premium). Our example max profit is 3.24.

How much can you lose trading a covered call?

Key Formula:

- Covered Call Maximum Loss = Short Call Premium Received – Underlying Price of Stock at Trade Entry

By trading a covered call, you are long a stock. The risk of owning a stock is that the price could fall, where the worst scenario involves the price dropping to zero. When you enter into a covered call, you sell a call option and receive a premium upfront. This premium that you collect would offset the complete loss in the value of the stock. In our example, you collected 1.24 by selling the 102-strike call option. If the underlying stock falls from 100 to 0, you would lose 100 but still get to keep the 1.24 in option premium. This means that the max loss in our scenario is -98.76.

What is the breakeven point when entering a covered call?

Key Formula:

- Covered Call Breakeven Point = Underlying Price – Premium Received

There is one breakeven point for covered calls. The premium received from the short call option partially offsets a downward move in the stock that is also held. The breakeven point is the underlying price less the premium collected from the short call. Looking at our example using the data in illustration 1, the underlying was trading at 100 and we collected 1.24 in premium. If the underlying falls to 98.76 (100 – 1.24), the premium collected offsets the loss in the stock. If the stock falls further in price, then you will be at a loss.

What is the profit formula for a covered call?

Key Formula:

- Covered Call Profit = Underlying Stock Profit + Short Call Profit

- Underlying Stock Profit = Current Stock Price – Stock Price when call shorted

- Short Call Profit = Short Call Credit Received – Max(0 Underlying Price – Strike Price)

The profit formula for a covered call combines the individual P&L of the long stock position, the credit received by shorting the call option, and the payoff of the short call option on expiry.

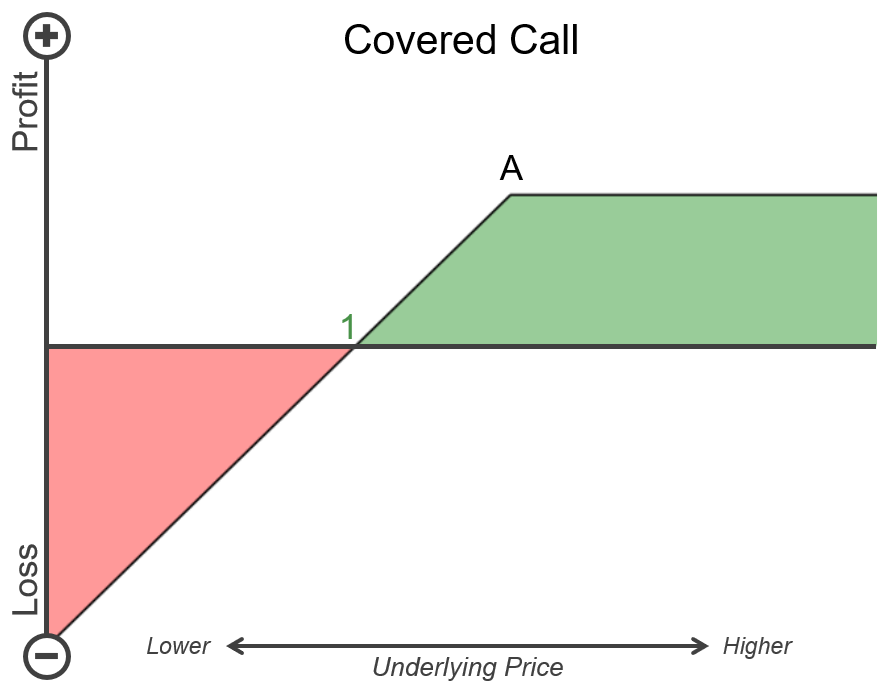

What is the payoff diagram for a covered call?

An example payoff diagram for a covered call is in illustration 2 below. The areas of green and red represent potential profit and loss at expiry, respectively. Point A is the strike price of the short call, and point 1 is the breakeven point of this strategy. The horizontal axis is a range of possible underlying prices where higher prices are to the right and lower prices are to the left. On the vertical axis is profit and loss, where profit is higher up on the axis and losses are further down.

Illustration 2

Source: Upstox

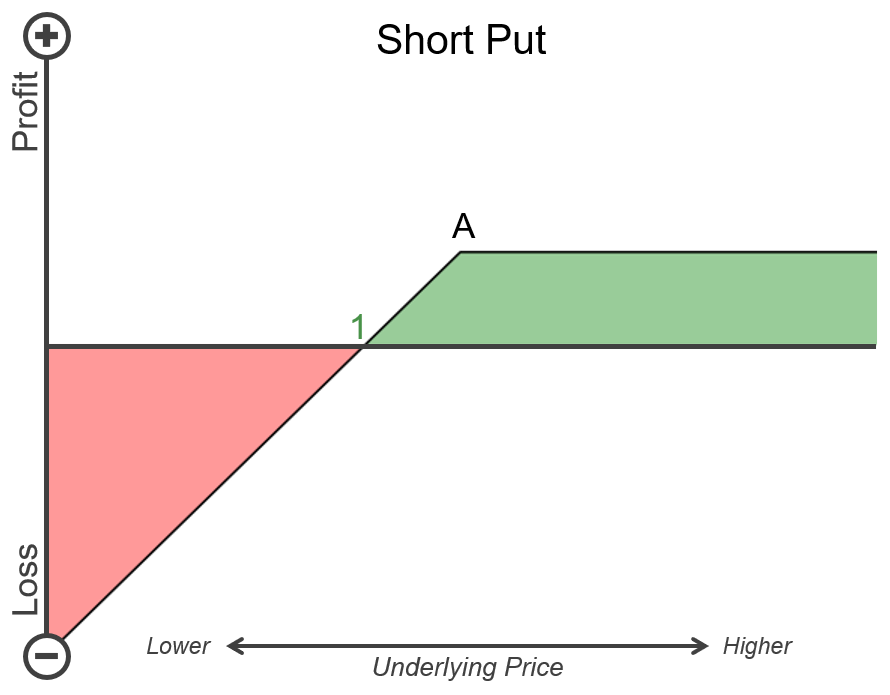

Source: UpstoxAn interesting point is that this payoff diagram is the same as a short put. You can see this in illustration 3 below and compare it to illustration 2. Why is this? If you refer to the lesson on long combos, you will see that the synthetic stock strategy, which replicates the payoff of holding a stock, is comprised of a long call and short put. Assume that instead of owning stock and selling a call option to create a covered call, you decide to use a synthetic stock strategy in place of owning the stock and then selling the call option to create a covered call.

In this situation, you would have a long call, short call, and short put. The long call and short call ‘cancel’ each other out. This leaves you with a short put. This is why a covered call has the same payoff as a short put.

Illustration 3

Source: Upstox

Source: UpstoxWhat is the point of max profit for a covered call?

Key Formula:

- Price of Underlying >= Short Call Strike Price

The max profit point for a covered call is the short call strike price. When you enter into a short call, you begin to have a negative payoff if the underlying rises above the strike price. Because you are long the underlying stock when you trade covered calls, this underlying will increase in value as its price rises. Once the underlying price rises above the short call strike price, the loss in the short call position is equally offset by the gain in the long stock position.

As a reminder, if you short a call option, you have the obligation to sell the underlying asset at the strike price on expiry. If the underlying is above the strike price on expiry, you have the obligation to sell the underlying at the price. This means that if the underlying rises significantly higher than the strike price, you still have to sell it at the strike price. Therefore, your max profit occurs when the underlying is at the strike price or higher.

What is the point of max loss for a covered call?

Key Formula:

- Price of Underlying = 0

With a covered call, you own stock, which means that you are exposed to potential losses with that stock. The worst-case scenario is that this stock falls to zero. While unlikely, this is still a possibility. The benefit of covered calls is that if this were to happen, you would be slightly better off because with a covered call, you collect a premium. If you only hold the stock, you will have a greater loss in this situation because you don’t collect this premium.

Summary

- A trader enters into a covered call strategy when they are slightly bullish on the underlying stock.

- A covered call is a strategy that involves owning the underlying stock and selling a corresponding call option.

- A buy-write is technically a covered call, but this strategy is when you purchase the stock and sell the corresponding call option at the same time.

- This strategy provides a credit by selling a call option.

- A covered call is a slightly bullish strategy with a fixed max gain.

- A covered call caps the gains of a stock and reduces the downside of the stock.

Is this chapter helpful?

- Home/

- Introduction to the Covered Call