Introduction to the Bull Put Spread

Introduction to the Bull Put Spread

As we have discussed, options provide significant flexibility. If you are bullish on a particular index or stock, you could purchase a call option, or if you want to reduce the cost of entry, you could enter into a bull call spread. What if you want to construct a strategy that doesn’t involve an initial capital outlay? You can do that as well! The bull put spread lets you enter into a trade that is comparable to a bull call spread, but the key difference is that you will receive an initial credit instead of paying an initial debit. Let’s walk through how this strategy works.

How do you construct a long bull put spread?

A bull put spread is a bullish option strategy that involves selling a put option and purchasing a corresponding put option at a lower strike price. With this strategy, both options will have the same expiration date. This particular strategy results in a net credit. This is because the long put option with the lower strike price will be either out-of-the-money or more out-of-the-money compared to the short put option. This means that the premium received from the short put will more than offset the cost to purchase the long put.

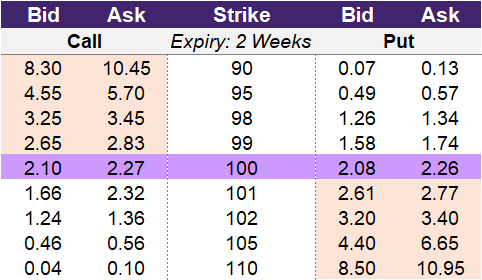

Using the data in illustration 1 below, we can review an example trade. Assume that this particular stock is trading at 100, and you believe that it will rise in price to around 102. You decide to enter into a bull put spread by shorting a put at the 102-strike price and then hedging that with a long put at the 98-strike price. You will receive a credit of 3.20 by shorting the put and will pay 1.34 to go long the put. The net credit received for this example bull put spread is 1.86.

Illustration 1

Source: Upstox

Source: UpstoxWhy would a trader use a bull put spread?

You would execute a bull put spread if you believe that:

- The underlying stock or index will move upward but not significantly. If you believe that the underlying will move up significantly, a long call would be the preferred strategy.

- The upward move will occur prior to the expiration date of the option contracts selected.

What is the max profit of a long bull put spread?

Key Formula:

- Long Bull Put Spread Max Profit = Initial Net Credit (Premium) Received

The maximum profit for the long bull put spread is the net premium that you initially receive when you enter into the trade. From our example where we shorted the 102-strike put option and hedged with the purchase of the 98-strike put option, we received a credit of 1.86. This 1.86 is the max profit for our example strategy.

How much can you lose trading a long bull put spread?

Key Formula:

- Long Bull Put Spread Max Loss = Upper Strike (short put) – Lower Strike (long put) – Net Premium Received

- Net Premium Received = Credit from Short Put – Debit from Long Put

A bull put spread has a limited loss that is known upfront. The loss is calculated as the difference between the two strike prices and then reduced by the credit received when you initially entered the trade. Using our example from before, we shorted the 102-strike put option and purchased the 98-strike put option. The premium we received from this trade was 1.86. Thus, the max loss is 2.14 or 102 – 98 – 1.86.

What is the breakeven point when entering a long bull put spread?

Key Formula:

- Long Bull Put Spread Breakeven Point = Higher Strike Price (Short Put Strike Price) - Net Premium Received

- Net Premium Received = Credit from Short Put – Debit from Long Put

To calculate the breakeven point of a long bull put spread, you subtract the net premium received from entering into the strategy from the higher strike price. If the underlying falls below this price on expiry, your trade won’t be profitable. If the underlying is above this price on expiry, you will be profitable.

Let’s go back to our example. We received a credit of 3.20 from the short put and paid 1.34 for the long put. This resulted in a net premium or credit of 1.86. The higher strike price, which is the strike price of the short put, is 102. If we take 102 and subtract 1.86, this will provide us with the breakeven point of 100.14.

What is the profit formula for a long bull put spread?

Key Formula:

- Long Bull Put Spread Profit = Net Premium Received + Max(0 Lower Strike Price – Underlying Price) – Max(0 Upper Strike Price – Underlying Price)

- Net Premium Received = Credit from Short Put – Debit from Long Put

To calculate the profit of a bull put spread, you should use the individual payoff formulas of a long put and a short put. A long put has a payoff on expiry that is the maximum of 0 or the strike price minus the underlying price. The short put has the same payoff, except that this value is negative. Once you calculate the payoff of these two options, you add the net premium received to enter into the strategy.

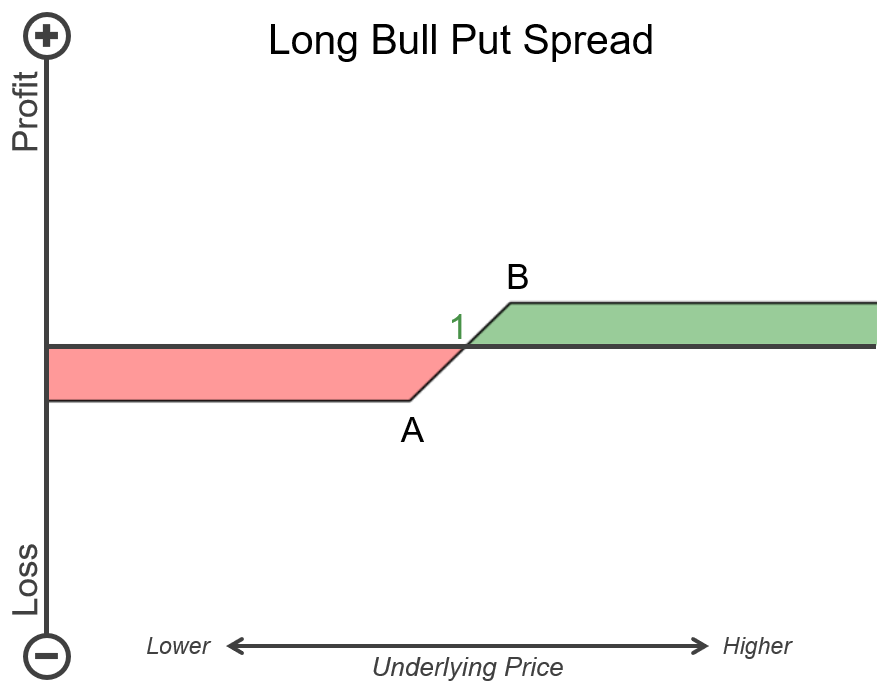

What is the payoff diagram for a long bull put spread?

In illustration 2, we show an example payoff diagram for a long bull put spread. Point B represents the strike price of the short put option, and point A is the strike price of the long put option. The sections in green are areas of profit, while the red sections are areas of loss. Point 1 is the breakeven point or breakeven price for this strategy. The horizontal axis is the price of the underlying asset. Values on the right are higher prices, while values towards the left are lower prices. As you can see, the max gain and max loss for the long put spread are limited. Specifically, the max gain occurs once the underlying reaches point B, or the upper strike price of the short put option on expiration. On the other side, the max loss occurs if the underlying reaches point A, or the lower strike price of the long put option on expiration.

Illustration 2

Source: Upstox

Source: UpstoxWhat is the point of max profit for a long bull put spread?

Key Formula:

- Price of Underlying >= Upper Strike Price (short put strike)

The long bull put spread is a bullish option strategy, so as a trader, you will profit the most when the underlying goes up in price by expiry. Specifically, if the underlying reaches the upper strike price or higher, then you will attain the max profit. If the underlying moves higher than the upper strike price, you will still only collect the initial premium—you cannot make any more. In our example, we shorted the 102-strike put option. This means that if the underlying is at or above 102 on expiry, you will keep the entire premium initially collected.

What is the point of max loss for a long bull put spread?

Key Formula:

- Price of Underlying <= lower strike price (long put strike)

When you enter into a bull put spread, you want the underlying to increase in price. You will lose the most if the underlying falls to the lower strike price or lower. The lower strike price is the strike of the long put option. Since the long put acts as the hedge for the short put option in this strategy, your losses are capped if the underlying falls to this price—or lower—on expiry. Going back to our example, we purchased the 98-strike put option. The max loss will occur if the underlying falls from 100 to 98 or lower on expiration.

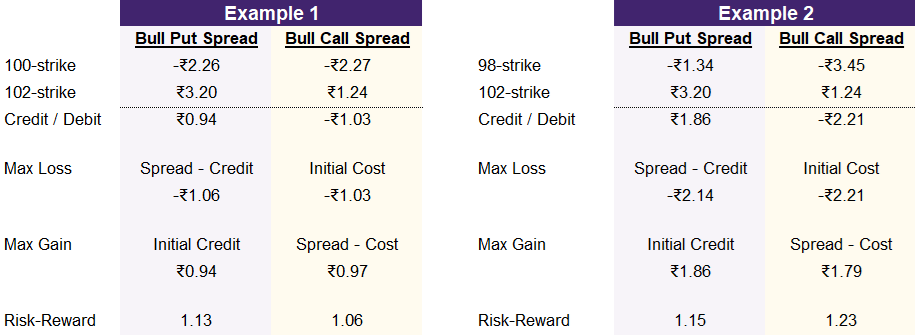

What is the difference between buying a bull put spread and bull call spread?

You would choose to enter a bull put spread instead of a bull call spread if you prefer to receive a credit upfront instead of paying a debit upfront. These strategies effectively have the same payoff diagram with comparable max loss, max gain, and risk-reward metrics. Beyond the preference for a credit versus a debit, you may have a slight advantage with one of them depending on the liquidity of the individual option contracts selected. When you purchase a security, you will pay the ‘ask’; when you sell a security, you will receive the ‘bid’. Option contracts that are in-the-money tend to be less liquid than those that are at-the-money or out-of-the-money.

Let’s look at two examples. In example 1, we use the 100-strike for the long contracts and 102-strike price for the short contracts. Because the short put option is in-the-money while the short call option is out-of-the-money, you receive more credit from the short put option. This is where the net credit for the bull put spread comes from. If you look at the max loss and max gain between the bull put spread and bull call spread in example 1, there is a slight difference based simply on the width of the bid-ask spread of the individual contracts. This leads to a situation where the bull call spread is slightly better from a risk-reward perspective: the max gain is slightly higher and the max loss is slightly lower for the call spread.

In example 2, we looked at a wider spread with strikes at 98 and 102. The max gain for the put spread is 1.86, while the max gain for the call spread is 1.79. In addition to the put spread having a higher max gain, the put spread has a lower max loss compared to the call spread. This leads to a superior risk-reward ratio for the bull put spread. The strategies are synthetically the same, but differences in market liquidity can lead to one being slightly preferred.

Illustration 3

Source: Upstox

Source: UpstoxSummary

- You would enter into a Bull Put Spread strategy if you think the underlying asset will rise but not drastically.

- The bull put spread involves the simultaneous shorting of a put option and purchasing of a put option at a lower strike price. This strategy requires that you use the same expiration date for both option contracts.

- Unlike the bull call spread, the bull put spread is a strategy where you receive an initial credit when you enter into the trade.

- The max gain and max loss are limited.

- The max gain is the initial credit received.

Is this chapter helpful?

- Home/

- Introduction to the Bull Put Spread