Introduction to the Bear Put Spread

Introduction to the Bear Put Spread

Getting into a college of your choice with the subject you want is tough unless you are part of the ‘98%-plus club’. Thus most students strategize like options traders - going long or short on their colleges of choice - and hope for the best.

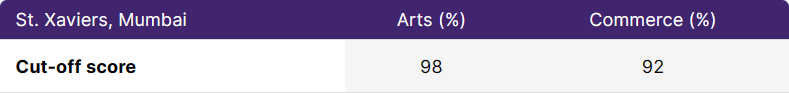

Say St. Xavier’s Mumbai is your dream college and you wish to study Economics here (for the uninitiated, St. Xavier’s is a top-tier college in India and it is known for English Literature, not Economics). Typically, the college posts a higher cut-off for the Arts stream versus the other streams. The college also offers a Commerce program with Economics. You want to try your luck for both. Listed below are the cut-off marks.

Illustration 1

Source: Upstox

Source: UpstoxMeanwhile, you have scored 90%. You get accepted to the Commerce course and you take admission. A month later, you see that the third merit list for Arts has dropped to a significantly lower cut-off - 89%. You are a shoo-in. Since you have already paid for the Commerce seat, you also don’t forfeit the fees. The college transfers you to the Arts department and refunds the balance amount.

You get the college of your choice, the subject of your choice, and you save the fees you would have to forfeit (had you taken admission in another college) and you get a refund. A Bear Put Spread Strategy is somewhat similar.

How do you construct a long bear put spread?

A Bear Put Spread consists of purchasing a put option at one strike price and selling another put option at a lower strike price. Both the bought and sold put options will have the same expiration date.

When you sell a put option, you will receive the premium associated with the option, unlike the premium that you pay when you buy a put option. Due to this combination of buying and selling a put option, the net cost of entering this strategy will be cheaper than simply entering into a long put trade.

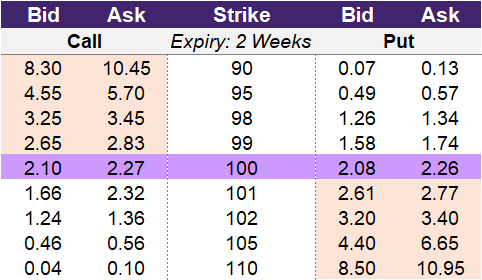

The table below is an example of an option chain with bid and offer prices for 9 strikes associated with calls and puts of the same expiry.

The current price of the underlying is 100, so the 100-strike is the ‘at-the-money’ strike price. If you were ready to place a trade for a long bear put spread strategy, you would look to the right side of the option chain for the put option section.

Illustration 2

Source: Upstox

Source: UpstoxLet’s look at two quick examples: perhaps you decide to enter into a 95-100 spread or a 90-100 spread.

The 95-100 spread involves buying the 100-strike put option and selling the 95-strike put option. The cost to buy the 100-strike is 2.26. When you sell the 95-strike, you will receive the amount of the bid price which is 0.49. The net cost to enter the 95-100 bear put spread is 1.77 (2.26 – 0.49).

For the 90-100 spread, it will cost 2.27 to buy the 100-strike and you will receive 0.07 in premium by selling the 90-strike. The net cost to enter the 90-100 bear put spread is 2.20 (2.27 – 0.07).

Why would a trader use a bear put spread?

A trader will enter into a Bear Put Spread Strategy if they believe two things:

-

The underlying stock or index will move downward but not drastically downward AND

-

You expect this downward move to occur prior to the selected expiration date of the option.

What is the max profit of a long bear put spread?

Key Formula:

- Long Bear Put Spread Max Profit = Lower Strike Price – Higher Strike Price – Net Premium Paid

- Net Premium Paid = Debit from Long Put – Credit from Short Put

The maximum payoff from a Bear Put Spread is the difference between the two strikes. The maximum profit from this strategy is the difference between the two strikes minus the net cost to enter the trade. In the two examples above, there were two spreads: 95-100 and 90-100.

For the 95-100 Bear Put Spread:

- The maximum payoff is 5 or 95-100.

- The maximum profit is 3.23, which is 5 minus 1.77 (the spread of 5 minus the net cost to enter the position).

With the 90-100 Bear Put Spread:

- The maximum payoff is 10 as that is the difference between 90 and 100.

- The net cost for this trade was 2.20, so the maximum profit is 7.80 (the spread of 10 minus the net cost).

How much can you lose trading a long bear put spread?

Key Formula:

- Long Bear Put Spread Maximum Loss = Net Premium Paid

- Net Premium Paid = Debit from Long Put – Credit from Short Put

The maximum loss is capped at the price you paid to enter the strategy. In the 95-100 spread example above, your max loss is 1.77. By comparison, your max profit is 3.23.

What is the breakeven point when entering a long bear put spread?

Key Formula:

- Long Bear Put Spread Break-even Point = Higher Strike – Net Premium Paid

- Net Premium Paid = Debit from Long Put – Credit from Short Put

The break-even point is the upper strike price minus the net cost to buy the spread. This is the opposite of the bull call spread, which has a break-even point of the lower strike price plus the net cost to buy the spread.

In the 95-100 spread example, the net cost to enter the trade is 1.77. The break-even point for this trade is 98.23 = the upper strike of 100 minus 1.77.

Since the underlying is trading at 100, the underlying needs to move down by 1.77% in order to be profitable. The maximum profit occurs when the underlying is at the lower strike of 95. For this trade to reach its maximum profit, the underlying would need to move down at least 5.0% as of the expiration date.

What is the profit formula for a long bear put spread?

Key Formula:

- Long Bear Put Spread Payoff = Max(0 Higher Strike Price – Underlying Price) – Max(0 Lower Strike Price – Underlying Price) – Net Premium Paid

- Net Premium Paid = Debit from Long Put – Credit from Short Put

The profit formula for a bear put spread is similar to the bull call spread in that it is a combination of the profit formulas of the bought (long) and sold (short) option contracts. The payoff formula for a long put on expiration is the maximum of 0 or the strike price minus the underlying price. The payoff for a short put is the same as a long put with the exception that the value is negative. To calculate the profit for a bear put spread, the payoffs of the long put and short put options are reduced by the net premium paid to enter into the bear put spread.

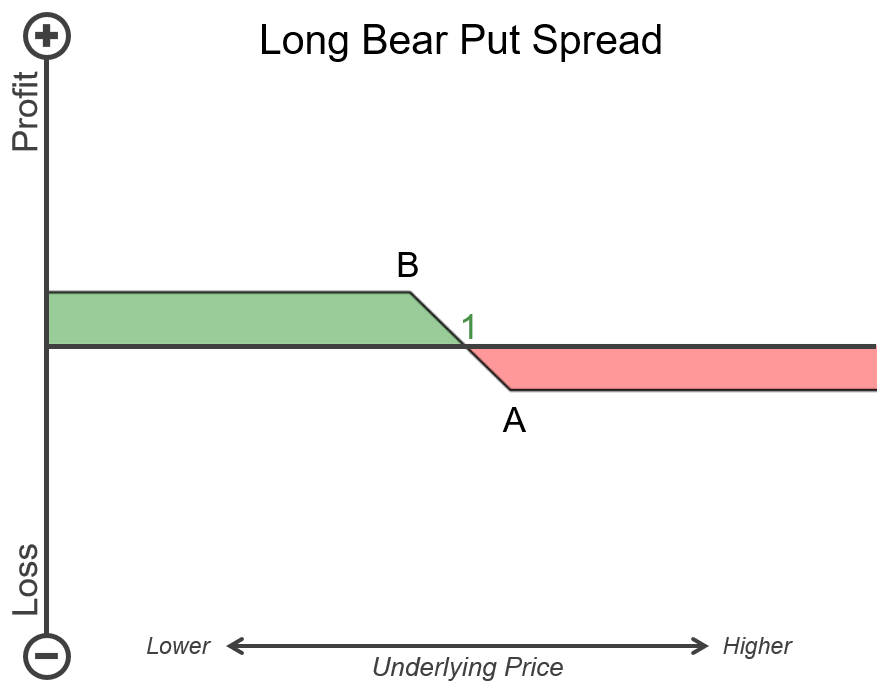

What is the payoff diagram for a long bear put spread?

Below is an example P&L diagram for a long bear put spread. The vertical axis is the profit and loss, where the higher up represents more profit and further down is a higher loss. The horizontal is the underlying price. Further to the right is a higher underlying price, and further to the left is a lower underlying price. Point A on the chart is the strike price that we have referred to as the ‘higher strike price’. This is the strike price of the long put option. Point B is the strike price of the short put option – also referred to as the ‘lower strike price’.

Point 1 is the breakeven point for the strategy. As the underlying price decreases to Point 1 and then moves below this price point, the strategy will become profitable. Areas that are shaded green are when the bear put spread will have a positive payoff, and areas shaded red are when the long bear put spread will have a negative payoff. As you can see by the chart, there is a point where both the profit and loss don’t move any higher or lower. This is because the strategy has capped profit potential as well as capped loss potential. The point of max profit will occur when the underlying’s price is at or below the lower strike price (short put option). The point of max loss will occur when the underlying’s price is at or above the higher strike price (long put option).

Illustration 3

Source: Upstox

Source: UpstoxWhat is the point of max profit for a long bear put spread?

Key Formula:

- Price of Underlying <= Lower Strike Price (short put strike)

The point of maximum profit will occur once the underlying price falls to the lower strike price – the short put option strike. If the underlying keeps falling below the short put option strike price, you are no longer entitled to those gains as you sold rights to the buyer of the put option. When you shorted the put option, you received an upfront premium that helped offset the cost of the long put option.

What is the point of max loss for a long bear put spread?

Key Formula:

- Price of Underlying >= Higher strike price (long put strike)

The most you can lose with a long bear put spread is the net premium paid to enter into the strategy. The point of max loss occurs if the underlying expires at the long put strike price or higher. If this happens, then the strategy will be worthless on expiry and you will lose the cost to enter the trade, which is the most you can lose. If the underlying expires between the breakeven point and the long put strike price (higher strike), then you will suffer a loss, but it won’t be the max loss.

Why would you trade a long bear put spread instead of a long put?

A bear put spread is a more complex option strategy versus a long put because it involves the simultaneous purchase and selling of put options with different strike prices. The difference between the long put and long bear put spread is that with a bear put spread you are able to reduce your risk since you are offsetting the cost of the long put option you bought with the premium you received from the put option you sold. This reduced risk (or cost) also lowers your breakeven point since the underlying doesn’t need to move as much due to the lower cost compared to a simple long put. The trade-off is that your profit potential is capped with a long bear put spread, whereas the profit potential for a long put is substantial. So traders would generally use a long bear put spread instead of a long put when you expect the price of the security to go down, you are possibly uncertain as to the amount of downward movement, and you want to limit your risk.

Summary

- Execute a Bear put spread strategy when you believe that the price of the underlying will move down but not too much.

- Buy a put option at one strike price and sell another put option at a lower strike price to construct this strategy. Both options should have the same expiry date.

- The combination of buying and selling a put option reduces the net cost of entering this strategy as compared to a long put trade.

- The maximum payoff from a Bear Put Spread is the difference between the two strikes.

- The maximum profit from this strategy is the difference between the two strikes minus the net cost to enter the trade.

- The maximum loss is capped at the price you paid to enter the strategy.

- As compared to a spread, trading long puts is a simpler strategy but it requires larger downward movements in the underlying stock or index to be profitable.

Is this chapter helpful?

- Home/

- Introduction to the Bear Put Spread