What is a Put Option?

Introduction to Put Options

A put option is analogous to insurance. Say, your car is insured for the price you paid for it, ₹10 lakh, and the annual premium is ₹5,000. Now, suppose your car gets damaged in the sixth month and the repairs cost ₹50,000. The insurance company pays for the repairs. So, the net savings or gains for you would be ₹50,000 minus the ₹5,000 premium, or ₹45,000.

With insurance, you have flexibility through a deductible. The deductible is when the insurance "kicks in". If you wanted to pay a lower premium, say 1,000, you would accept a deductible. If you don't have an accident, you only pay 1K instead of 5K. However, if you do have an accident, you could have to pay a deductible of 10K before the insurance pays the remaining 40K. It is a trade-off.

Just as you have prepared for the possibility of damage to your car and paid a premium to insure it, with a put option, you anticipate a fall in the value of a security and prepare to profit from it.

What is a Put Option?

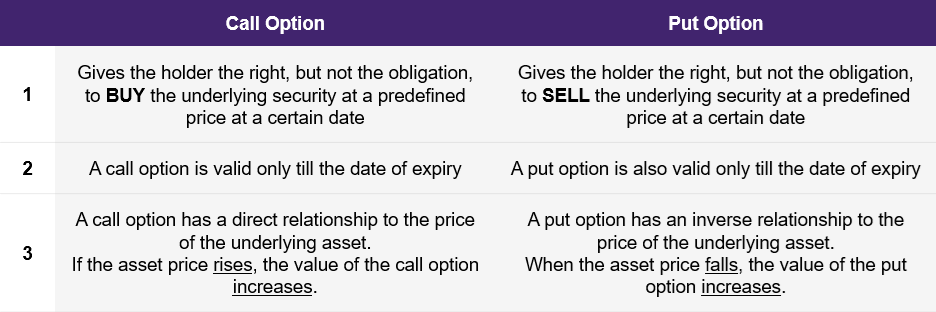

A Put Option is a contract that gives the holder the right, but not the obligation, to sell the underlying security at a predefined price at a certain date. As discussed in the last chapter on call options, there are a few key components associated with Put Options: the underlying, the option premium or cost, the expiration date, and the strike price. We will get into more detail on each of these individual concepts but here is a quick overview and how they relate to the car insurance example above.

- Underlying and underlying price: The underlying is the security that the option is based on. This could be an index like the Nifty or Bank Nifty or one of the approximately 200 individual scrips that are optionable. The underlying price is the current value of the security that the option is based on.

Relationship to the example: The underlying is comparable to your new car. So, the put option is based on the underlying stock or index while the insurance policy is based on the car. The underlying price is comparable to the price you paid, or the value of your new car.

- Expiration date: Put options have limited lifespans. Traders can use the Option Chain to select from a range of expiration dates when buying them.

Relationship to the example: The car insurance policy also has an expiration date after which it ceases to be in force.

- Strike Price: This is the set price at which the option can be exercised. There is a trade-off between the strike price and the option premium, or cost. If you choose a strike price that is lower, the premium to buy the option will be lower. So, the stock will have to fall quite a bit before the put option 'protection' kicks in. If the strike price is higher, the premium will be higher.

Relationship to the example: With car insurance, if you set your deductible high, you will pay a low premium. However, you will have to pay the higher deductible if your car is damaged.

- Options premium or cost: To buy a put option, you pay a premium, or cost, upfront. The amount of this premium will vary based on the strike price, or deductible. It will also increase with the duration until its expiration date.

Relationship to the example: This is similar to our car insurance example, in which your premium will vary based on the value at which your car is insured. In addition, if you want your policy in-force for longer, you will pay a higher premium.

Illustration 1

Source: Upstox

Source: UpstoxNow that you know the difference between Call and Put options, let’s understand what it means to go long or go short. We will cover that in the next chapter.

Is this chapter helpful?

- Home/

- What is a Put Option?