Short Put

Introduction to Short Puts

In a previous lesson, we introduced put options and used insurance as an analogy. We discussed an example where you had recently purchased a health insurance policy. You had done so that you were covered for any unplanned expenses that could arise from a medical emergency.

Put options are similar to insurance because if you own a particular stock, you can purchase a put option on that stock to protect you from downward movements in the stock, should they occur. Since buying puts is like buying insurance, then selling puts is like selling insurance.

Warren Buffett is arguably one of the most notable and greatest investors of the last century. He is known for the conglomerate that he runs, Berkshire Hathaway, as well as notable investments in Coca-Cola, NetJets, and railroads. He is also well known for not investing during the tech boom of the late 1990s. What he isn’t well known for is GEICO - the Government Employees Insurance Company. In the US, GEICO is a property & casualty insurance company that is known for its extremely low premiums. GEICO keeps their profit margins low in order to keep their customers’ premiums low. By keeping premiums low, they can have a larger customer base with which to collect premiums from. These premiums are then invested in the markets and the company is able to earn an attractive return.

Warren Buffett, through Berkshire Hathaway, owns GEICO and by being in the business of selling insurance, Buffett is essentially selling puts; albeit in a very sophisticated way.

Why would a trader use a short put?

A trader would sell a put option when they believe that the price of the underlying asset will stay flat or increase in price. This is a similar outlook to a long call option where you profit when the underlying goes up in value. The difference is that time is less important when you execute a short put. When you execute a long call, the underlying needs to move up a certain amount prior to expiry in order to make a profit. With a short put, the trader will be profitable if the underlying stays flat, moves up a little, or moves up a lot. The magnitude of the movement doesn’t matter with a short put; the trader will be successful as long as it doesn’t move down substantially to cross the breakeven point.

How do you construct a short put?

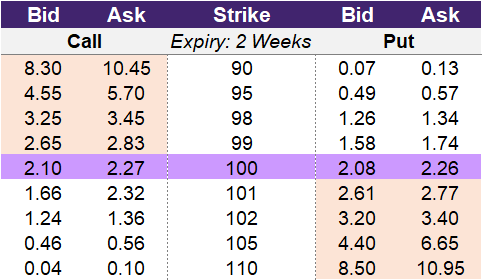

The table below is an example of an option chain with bid and offer prices for 9 strikes associated with calls and puts on one expiration date.

If you were ready to place a trade for a short put option, you would look to the right side of the option chain for the put option section. You could select from any of the strikes listed. Let’s look at two different examples: one where you sell the 99-strike price and one where you sell the 95-strike price. In our example, the underlying price is currently 100.

For the 99-strike price: You will sell the put and collect the bid price of 1.58 as a credit. The effective yield on this particular trade is 1.6% (1.58 / 99). The effective yield assumes that the trade is successful and you are able to keep the entire premium. This option expires in 2 weeks and you can extrapolate what the annualized yield of this trade is. Assuming 26 2-week periods in a year, the annualized yield of this trade is 50.9%. What this means is that if you executed a comparable trade every other week for a year, and were successful in every attempt, your compounded return for the year would be over 50%.

For the 95-strike price: You will sell the put for a premium of 0.49. The effective yield of this premium collected is 0.52% and the annualized yield is 14.3%. While deploying a short put on this strike results in a smaller premium and effective yield than the 99-strike price, the 95-strike price has a lower risk profile due to a lower breakeven point. Keep reading to learn more!

Illustration 1

Source: Upstox

Source: UpstoxWhat is the max profit of a short put?

Key Formula

- Short Put Max Profit = Premium Received

The maximum profit from trading a short put is the premium collected from the sale of the option. The amount of premium collected will vary based on the time to expiry when the options were shorted and the implied volatility of the underlying asset. If there is more time until expiry, you will collect more premium than if there was less time until expiry assuming all other factors are comparable. Higher implied volatility will also result in a higher premium potential.

How much can you lose trading a short put?

Key Formulae

- Short Put Max Loss = Strike Price – Premium Received

The maximum loss would occur if the price of the underlying goes to zero. In this rare occurrence, the loss would be the amount of the strike price offset by the premium received.

What is the breakeven point when entering a short put?

Key Formulae

- Short Put Break-even Point = Strike Price – Premium Received

For short put options, also known as sold or written put options, the break-even point is the strike price of the put option minus the premium received. If the underlying stays at or above the strike price, you will retain all of your premium collected and thus earn the maximum profit.

The break-even is a slightly different concept for writing or selling options compared to buying options. When you buy options, you have an outlay of cash that leaves you in the negative. Once the underlying moves favourably to the break-even price, your trade is now ‘in the green’ and is profitable on paper. When you sell an option, you receive the premium as a credit. This credit is the most profit you can make from this trade. If the price of the underlying moves towards the break-even point, this reduces your profit. Once the break-even point is crossed, you are now losing money on the trade.

Let’s look at an example where you sell a put with either a strike price of 99 and strike price of 95. In this example, we are using data from illustration 1 where the underlying is trading at 100.

What is the profit formula for a short put?

Key Formulae

- Short Put Profit = Premium Received – Max(0, Strike Price – Underlying Price)

The profit formula of a short put is the premium received less the payoff of a put option. The payoff of a put option is the maximum of zero or the strike price less the price of the underlying on expiry. If the underlying price is at or above the strike price on expiry, then the put will be worthless. When you trade a short put option, you want the option to expire worthless so that you make the max profit.

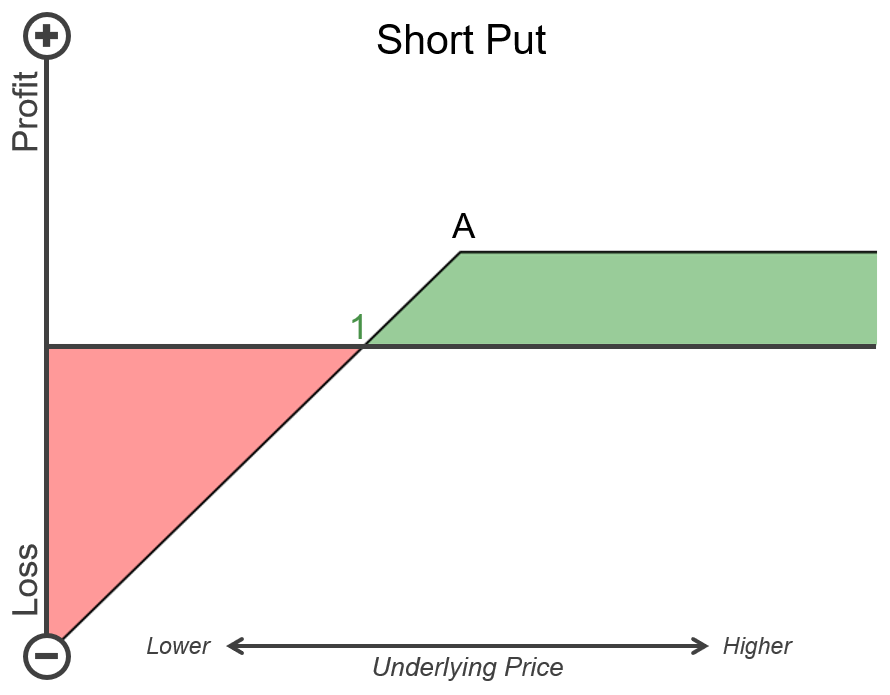

What is the payoff diagram for a short put?

Below is an example P&L diagram for a short put option. On this chart, Point A is the strike price of the short put. Point 1 represents the breakeven point. The vertical axis is the profit and loss where the higher up represents more profit and further down is a higher loss. The underlying price is on the horizontal axis of the chart. Higher underlying prices are towards the right side of the horizontal axis while lower underlying prices are towards the left. Sections that are shaded green are when the short put will have a positive payoff and sections that are shaded red are when the short put will have a negative payoff.

If the price of the underlying stays at or above (to the right) of the strike price at point A, then the max profit will be achieved. If the price of the underlying is between the strike price (A) and the breakeven point (1) on expiry, then the trader will have a profit but it will be less than the max profit. If the underlying price expires below (to the left) of the breakeven point (1), then the trader will have a loss.

Illustration 2

Source: Upstox

Source: UpstoxWhat is the point of max profit for a short put?

Key Formula:

- Price of Underlying ≥ Strike Price

The point of maximum profit for a short put occurs if the underlying price stays flat or rises. In this situation, the short put will expire worthless, and the trader will keep the entire premium collected.

What is the point of max loss for a short put?

Key Formula:

- Price of Underlying = 0

If the underlying keeps going down, the trader will also lose more and more due to the falling value of the short put option. Technically, the max loss of a short put occurs if the underlying falls to zero. For an underlying asset to fall to zero, the company would have to go bankrupt, which is an unlikely situation. However, the risk of significant loss is always possible.

Summary

- Think of Put options like insurance. They protect you from downward movements in the stock.

- Maximum profit is the premium received by selling the put option.

- The trader will profit if the underlying moves upward.

- Maximum loss occurs if the price of the underlying goes to zero.

- When selling options, the profit reduces as the price of the underlying moves towards the break-even point.

- Trader makes a loss when the price of the underlying crosses the break-even point.

- The trader profits when underlying stays at or above the strike price and they are able to retain all their premium.

- When you sell puts, your return is known as ‘yield-to-strike’ or YTS.

- The yield-to-strike is often annualized.

Is this chapter helpful?

- Home/

- Short Put