Short Call

Introduction to Short Calls

Let’s imagine that you own a vacation house—perhaps it is on the beach. Since this is a second house, you don’t use it all the time, and in fact, you decide that you will travel abroad this summer, so you won’t be using this vacation home. Instead of it sitting empty, you decide to rent it out. This rental income could be lucrative, and the premium you collect for simply letting people use your house could help pay down the mortgage, or you could invest that money. The risk is that the tenants may not treat your house as well as you do; they could damage or neglect it, and the costs of repair could exceed the rental income you collected.

This is analogous to a short call option. As a trader, you can collect a steady premium by selling call options, but there could be substantial risks where you could potentially lose more than you gain.

Why would a trader use a short call?

Short call options are a type of options trading strategy that involves selling call options in order to profit. This strategy is used when the trader believes that the price of the underlying asset will stay at current prices or decrease. The trader will collect a premium when they sell the call option, and if the underlying asset does go down in price, they will be able to keep the entire premium.

If you are trading short call options, you have a similar investment thesis as those that purchase – or go long – put options. With both short call options and long put options, you will profit if the underlying falls in value. The difference is that with short call options, traders don’t need to have an idea of the magnitude of the movement and the timing of that movement. With long put options, traders need to have an idea of how far the underlying will fall to ensure that their trade could be profitable. In addition, traders need to be confident that this price decrease will occur prior to expiration. If this price decrease happens after the long put expires, then the trade will not be successful. This information about magnitude and timing isn’t necessary for short calls. Traders only need to be confident that the underlying won’t have a higher price on expiry. If the underlying is flat, slightly down, or significantly down, the trader will be profitable.

How do you construct a short call?

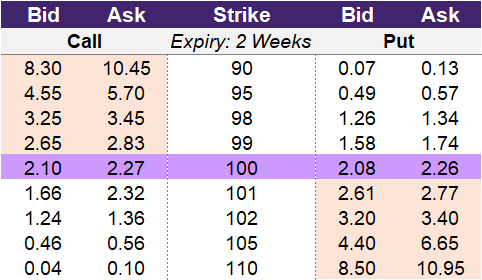

In illustration 1 below, we provide an example of an option chain with bid and offer prices for 9 strikes associated with calls and puts on one expiration date. Let’s walk through two example trades with a short call option. While you could select any strike listed, we will focus on two out-of-the-money strikes: the 102-strike and 105-strike price.

For the 102-strike price: When you sell the call, you will collect 1.24 as a credit. This 1.24 is the bid price for the 102-strike call option. The effective yield on this particular trade is 1.2% (1.24 / 102). The effective yield assumes that the trade is successful and you are able to keep the entire premium. You can convert this to an annualized yield by assuming 26 2-week periods in a year. The annualized yield for this example trade is 36.9%. So, what does this mean? If you were somehow able to execute a comparable trade – 2-weeks until expiry with similar yield – 26 times in the next year, you would have a compounded return of nearly 37%.

For the 105-strike price: You will sell the call option and receive the bid price of 0.46 as a premium. The effective yield of this premium collected is 0.44% and the annualized yield is 12.0%. If you can earn a 3x annualized yield with the 102-strike price compared to the 105-strike price, why would anyone trade the strike that is further out-of-the-money? The answer is risk vs. reward. This will make more sense as we discuss max gain, max loss, and the breakeven points of this strategy.

Illustration 1

Source: Upstox

Source: UpstoxWhat is the max profit of a short call?

Key Formula:

- Short Call Max Profit = Premium Received

The maximum profit from a short call option is the credit (or premium) received from selling the call option. The amount of the premium you can receive from selling a call option will vary depending on the time until expiry and the implied volatility of the underlying asset. If there is more time until expiry, you will collect more premium than if there was less time until expiry assuming all other factors are comparable. Higher implied volatility will also result in a higher premium potential.

How much can you lose trading a short call?

Key Formula:

- Short Call Max Loss (if the stock rises) = Unlimited – Total Premium Received

The maximum loss for a short call is technically unlimited. If the underlying price keeps rising, well above the strike price, the trader will have a loss. Since the underlying price can technically go up infinitely, the max loss for a short call is unbounded. This is the flip-side of a long call that can technically have infinite upside. Placing stop losses, understanding the volatility of the underlying, and knowing about upcoming events that could impact prices are all considerations to mitigate the risks associated with short calls.

What is the breakeven point when entering a short call?

Key Formula:

- Short Call Break-even Point = Strike Price + Premium Received

Breakeven points for short strategies are different than those for long strategies. When you short an option, you will collect a premium and this premium is the max profit that can be made for the trade. If the price of the underlying security moves beyond the breakeven point, the trader will suffer a loss. The breakeven point for a short call is the strike price of the option plus the total premium received for the short call.

One thing to note is that the concept of breakeven points is different between buying options and selling options. When you buy, or go long, an option, you have an outflow of cash to purchase the contract. This means that you are “in the red” at the start of the trade. If the underlying security moves favorably and crosses the breakeven point, then your trade will be profitable. When you sell options, like shorting a call, you are receiving an initial cash inflow. This cash inflow puts you “in the green”. This cash inflow is the most you can make on the trade. If the underlying security moves against you and crosses the breakeven point, your trade will be “in the red”. To summarize, for long option strategies, you want to move past the breakeven point. With short option strategies, you want to stay away from the breakeven point.

Let’s return to an example where you are trying to decide between selling a call with a strike price of 102 versus one with a strike price of 105. Again, we will be using the data from illustration 1 where the underlying is trading at 100. Both of these strike prices are out-of-the-money but the 105-strike price is further out-of-the-money.

For the 102-strike price: The call option bid price for the 102-strike price is 1.24. The breakeven point for this trade is 103.24 (102 + 1.24). If the underlying rises in price by 3.2% or more on expiration, then this trade will be unprofitable.

For the 105-strike price: The put option bid price for the 105-strike price is 0.46. The breakeven point for this trade is 105.46 (105 + 0.46). If the underlying rises in price by 5.5% or more on expiration, then this trade will be unprofitable.

Comparing these two trades, the max gain for the 102-strike compared to the 105-strike is clearly higher at 1.24 vs. 0.46. The max gain for a short call is the premium initially received. However, the 105-strike price provides more of a “cushion” because the likelihood of the underlying rising by more than 5.5% and turning the trade unprofitable is less likely than the underlying rising by more than 3.2%. So, this is about balancing the size of the reward versus the likelihood of keeping that reward.

What is the profit formula for a short call?

Key Formula:

- Short Call Profit = Premium Received – Max(0, Price of Underlying – Strike Price)

The profit formula for a short call is the premium received from selling the call option less the payoff of the call option on expiry. The payoff of a call option is the maximum of zero or the underlying price on expiry less the strike price. If the underlying price is at or below the strike price when the option expires then the call will be worthless. A trader of a short call option should want the call to expire worthless in order to make the max profit.

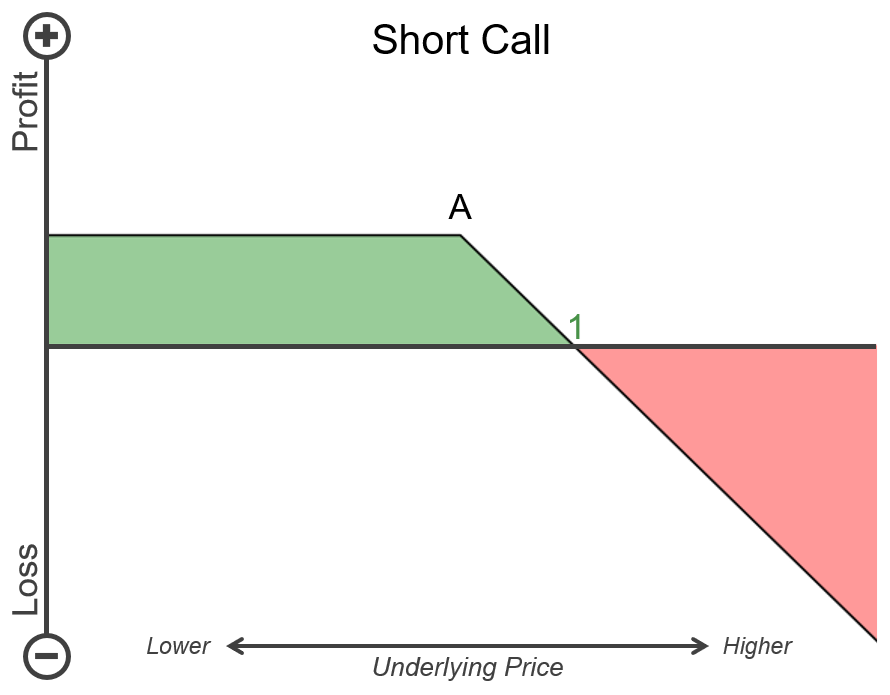

What is the payoff diagram for a short call?

Below is an example P&L diagram for a short call option. Point A on the chart is the short call strike price. Point 1 is the breakeven point. The vertical axis is the profit and loss where higher up values represent more profit and lower values represent a higher loss. The underlying price is on the horizontal axis of the chart. Higher underlying prices are on the right side of the horizontal axis while lower underlying prices are on the left. Sections that are shaded green are when the short call will have a positive payoff and sections that are shaded red are when the short call will have a negative payoff.

If the price of the underlying stays at or below (to the left) of the strike price at point A, then the max profit will be achieved. If the price of the underlying is between the strike price (A) and the breakeven point (1) on expiry, then the trader will have a profit but it will be less than the max profit. If the underlying price expires above (to the right) of the breakeven point (1), then the trader will have a loss.

Illustration 2

Source: Upstox

Source: UpstoxWhat is the point of max profit for a short call?

Key Formula:

- Price of Underlying ≤ Strike Price

A short call will reach the point of max profit if the underlying price expires at or below the strike price of the call option. When the price of the underlying expires at or below the strike price, the short call will be worthless resulting in the trader being able to keep the entire premium received.

What is the point of max loss for a short call?

Key Formula:

- Price of Underlying = ∞

The short call option doesn’t have a specific point of maximum loss because the max loss isn’t capped. If the underlying keeps going up, the trader will lose more and more due to a falling value of the shorted call option. While the underlying technically can’t rise infinitely, the losses associated with a short call option can be substantial.

Summary

- Short Call options are similar to renting property. You can collect “rent” but what you collect may not offset potential “damages”.

- Maximum profit is the premium received by selling the call option.

- The trader will profit if the underlying moves downward or stays flat.

- Maximum loss occurs if the price of the underlying goes to infinity.

- When selling options, the profit reduces as the price of the underlying moves towards the break-even point.

- Trader makes a loss when the price of the underlying crosses the break-even point.

- The trader profits when underlying stays at or below the strike price and they are able to retain all their premium.

Is this chapter helpful?

- Home/

- Short Call