Long Put

Introduction to Long Puts

Amit has a farm on which he grows potatoes. His neighbors, all farmers, also grow potatoes. Now one year, with about a month to harvest, Amit realizes that he is looking at a bumper crop. That’s the good news. The bad news - every farmer around him would also have a bumper crop, meaning a supply glut of potatoes in the market. That could cause prices to fall.

Amit enters into a contract with a potato chip manufacturer to supply potatoes at last season’s prices - ₹2,000 per quintal. As expected, he has a bumper harvest, there is a glut in the market and prices fall to ₹1,800 per quintal. But that doesn’t bother Amit. He is still able to sell his crop at ₹2,000 per quintal - the contracted price with the chip company- and earn a tidy profit.

A long put option strategy works in a similar fashion. Like Amit the farmer, you believe the value of the underlying will fall and prepare to profit from it.

Why would a trader use a long put?

You buy or ‘go long’ on a Put Option if you believe two things:

- The underlying stock or index will move downward AND

- You expect this downward move to occur prior to the selected expiration date of the option.

While put options allow traders to benefit from bearish movements in stocks or indices, put options aren’t assets. This means that upon expiration, the put option will no longer exist, and if the underlying price didn’t move favorably, the trader could end up losing 100% of what they paid for the put option. By comparison, if you were to buy a stock, the only way you could lose 100% of your capital is if the price of the stock went to zero.

How do you construct a long put?

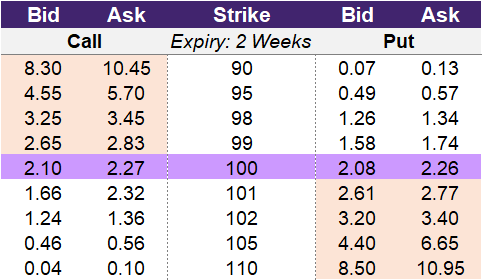

The table below is an example of an option chain with bid and offer prices for 9 strikes associated with calls and puts on one expiration date.

If you were ready to place a trade for a long put option, you would look to the right side of the option chain for the put option section. You could select from any of the strikes listed. For example, if you wanted to buy the put option with the strike price of 98, this would cost you 1.34, which is the asking price for this option contract.

Illustration 1

Source: Upstox

Source: UpstoxWhat is the max profit of a long put?

Key Formula:

- Long Put Max Profit = Strike Price – Premium Paid

The maximum gain you can have with a long put option is the price of the underlying. When you buy a put option, you are anticipating a price decrease in the underlying stock or index. The lowest price that a stock or index can go to is 0. If the price of a stock is 250, the most you can gain with a put option is 250 which is the current price of 250 minus 0 (less the cost to purchase the put option).

This is different from a call option that has a theoretically unlimited upside. Because of the disparity in maximum gain, put options could seem less attractive.

But a concept to remember here is that stocks tend to fall faster than they rise. The fear that drives irrational selling is greater than the ‘fear of missing out’ that drives irrational buying. The table in illustration 2 shows the Nifty 50 rolling 1-week returns for the last 10 years, ranked by largest gain and largest loss. As you can see, the top 10 losses are always bigger than the top 10 gains.

Illustration 2: Nifty 1-Week Historical (10-yr) Returns

| Rank | 1-Week Gain | 1-Week Loss |

|---|---|---|

| #1 | 10.5% | -19.0% |

| #2 | 10.4% | -17.3% |

| #3 | 10.2% | -16.3% |

| #4 | 9.5% | -14.8% |

| #5 | 9.0% | -14.2% |

| #6 | 8.8% | -13.8% |

| #7 | 8.7% | -13.0% |

| #8 | 8.1% | -12.2% |

| #9 | 8.0% | -11.7% |

| #10 | 7.8% | -8.3% |

How much can you lose trading a long put?

Key Formula:

Long Put Max Loss = Premium paid

The maximum loss is capped at the price at which you purchased the option. In the option chain above, if you selected the at-the-money strike of 100, the premium or cost that you paid to buy the call option is 2.26. This cost is the maximum you can lose in this trade.

What is the breakeven point when entering a long put?

Key Formula:

- Long Put Break-even Point = Strike Price – Cost of Put Option

The breakeven point is the strike price minus the cost to buy the put option. Using the example data from illustration 1, if you bought the 100-strike, this would cost you 2.26 (the ask price). Since the underlying is currently trading at 100, this option is at-the-money. The breakeven price is 97.74 = 100 – 2.26. To achieve breakeven, the underlying would need to fall by 2.26% from its current price of 100.

Alternatively, you could choose to purchase an out-of-the-money put option. If you purchased the 95-strike, this would only cost 0.57, but the breakeven would be 94.43 due to the lower strike price. This would require a drop of 5.57% in the underlying to break even.

What is the profit formula for a long put?

Key Formula:

- Long Put Payoff = Max(0, Strike Price – Underlying Price)

- Long Put Profit = Max(0, Strike Price – Underlying Price) – Option’s Cost

The formula for the payoff of a long put is the maximum of zero or the difference between the strike price and the underlying price. The reason we need to calculate the maximum between two values is that a long put cannot have a value less than zero when it comes to the payoff of the option. The profit formula for a long put is the long put’s payoff minus the cost to purchase the option.

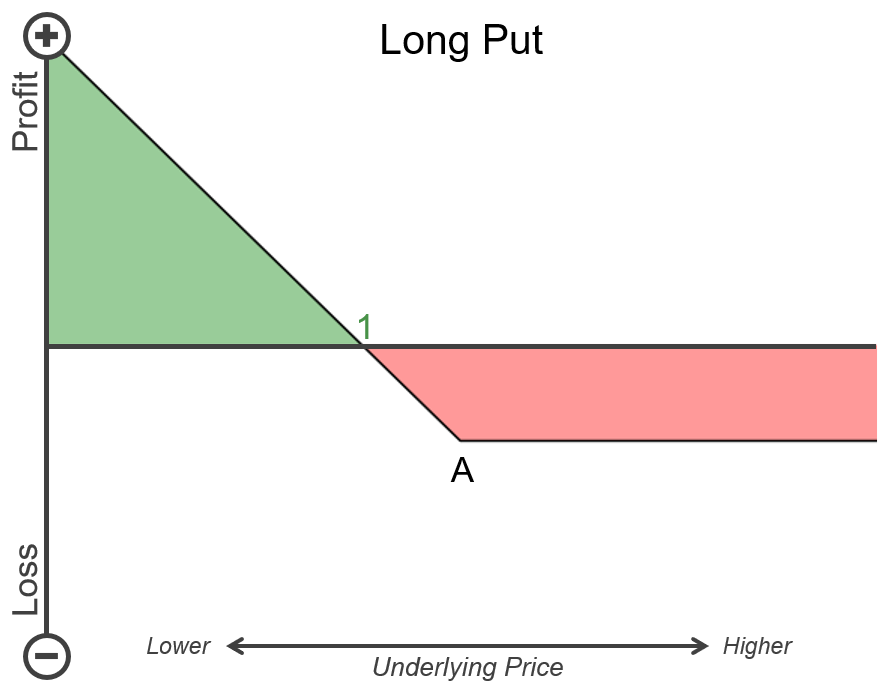

What is the payoff diagram for a long put?

Below is an example P&L diagram for a long put. Point A on the chart is the strike price selected for the long put. Point 1 is the breakeven point and is associated with the long put option. The vertical axis represents profit and loss, where higher values represent more profit and lower values represent a higher loss. The horizontal axis represents the underlying price. Further to the right is a higher underlying price, and further to the left is a lower underlying price. Areas that are shaded green represent when the long put will have a positive payoff, and areas shaded red represent when the long put will have a negative payoff.

If the price of the underlying stays at or below (to the left of) the breakeven point at point 1, then the trader will have a profitable trade. If the price of the underlying is between the breakeven point (1) and the strike price (A) on expiry, then the trade will result in a loss but not the max loss. The max loss will occur if the underlying price expires above (to the right of) the strike price (A).

Illustration 3

Source: Upstox

Source: UpstoxWhat is the point of max profit for a long put?

Key Formula:

- Price of Underlying = 0

The long put option will reach the point of maximum profit if the underlying falls to 0 on expiry. If the underlying keeps going down, the trader will earn more and more due to the rising value of the put option. The maximum the trader can earn on expiry is if the underlying expires at 0. While this is highly unlikely to occur, if a company were to enter into financial distress while a trader held a put option, a sharp decrease in the underlying price could lead to a rapid increase in implied volatility. Prior to expiry, the increase in implied volatility would provide additional extrinsic value to the option, making it significantly valuable, but likely still not as valuable as if the underlying expired at 0.

What is the point of max loss for a long put?

Key Formula:

- Price of Underlying ≥ Strike Price

The point of maximum loss for a long put occurs if the underlying doesn’t move at all or rises. In this case, the long put would expire with no intrinsic value, providing the trader with no payoff from the long put option. The trader will still have paid the premium to enter into the strategy, which is the max loss for a long put.

Summary

- You buy a Put Option if you believe the underlying stock or index will move downward before expiry.

- Traders could lose 100% of the cost of the put option if the underlying moves against them. • Put options are listed to the right of the Options chain.

- Maximum gain in a long put option is the price of the underlying.

- Maximum loss is capped at the price at which you purchased the put option.

- Put option loses Time value exponentially when closer to expiry.

- There is a positive relationship between implied volatility and the price of a put option.

Is this chapter helpful?

- Home/

- Long Put