Four Sides

What are the Four Sides of Options?

Let’s go back to the time when you had just finished your Class 10 Board Exams. At that point, you have to make a decision - choose one stream of study between Arts, Science and Commerce. Two years down, after your Class 12 Board exams, you get to make a choice again. This time you have multiple options to choose from - these include professional courses and pure-play Arts, Science and Commerce degrees, or a combination of these. What you choose will help you chart your career path.

Similarly, in equity or futures trading, you can take only two basic positions - buy or sell. This is also called going long or short.

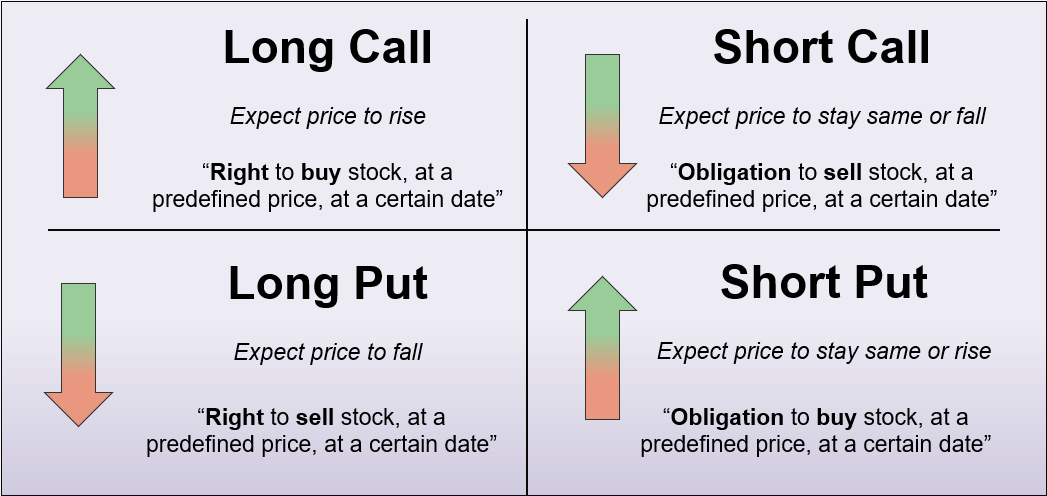

In options trading, however, the choices are much more. Based on your prediction about the price of the underlying, you have a choice of taking four basic positions. They are long call, long put, short call, and short put.

Illustration 1: Four sides of options

Source: Upstox

Source: UpstoxThe four sides (or legs) make options trading slightly complicated. However, they also open up immense possibilities for trading, hedging and income generation. We will learn various options strategies in the coming chapters which will use a single leg or multiple legs in one strategy.

With this basic theory in mind, let's move on to learning options strategies.

Summary

- A trader would use a long call if they believe the underlying price will increase in value.

- A trader would use a long put if they believe the underlying price will decrease in value.

- A trader would use a short call if they believe the underlying price will stay the same or fall.

- A trader would use a short put if they believe the underlying price will stay the same or rise.

Is this chapter helpful?

- Home/

- Four Sides