Upstox Originals

Why a falling rupee is not bad news

.png)

5 min read | Updated on November 12, 2024, 22:48 IST

SUMMARY

The Indian Rupee has weakened against the US Dollar in 2024, hitting an all-time low of ₹84.38 as of November 11, 2024. What are some of the major factors contributing to this decline? Should you be excessively worried about this? Read on to find out.

YTD the INR has depreciated ~1.3% versus the dollar, lower than its historical annual average

The rupee has recently reached an ‘all-time’ low at ₹84.38 to a dollar as of November 11th, 2024. This has led to a lot of noise with experts questioning the future and the impact of this fall.

While there certainly will be some impact of a depreciating currency (imports becoming expensive for one), is this fall something we need to be excessively worried about?

Relative deprecation

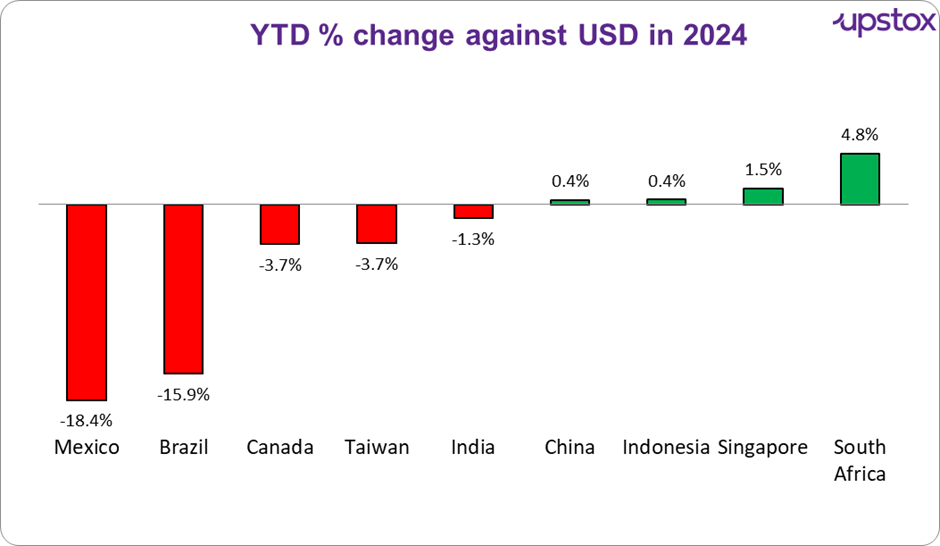

The depreciation of a currency should always be seen relative to other currencies. Why? In this globablised world, if peer currencies are weakening, while the INR remains firm, the economy could become less competitive against its peers.

As a very simple example, assume that the Chinese Yuan depreciates while the Indian Rupee remains stable. Simply put, it now takes fewer dollars to buy goods and services from China as compared to India.

This can make it more expensive to trade with India. In the chart below, we look at the trend in the currencies of some other countries.

As can be seen, the INR’s deprecation in 2024 is much lower compared to some peers, suggesting a better performance on the part of INR.

In fact, seen another way, the INR may still be overvalued against the dollar when compared to peers. If one were to refer to the RBI’s Real Effective Exchange Tate (REER), as of September 30, 2024 (latest available data) the INR was still ~5.5% overvalued against the dollar

Source: Investing.com

What are some of the key factors contributing to this decline?

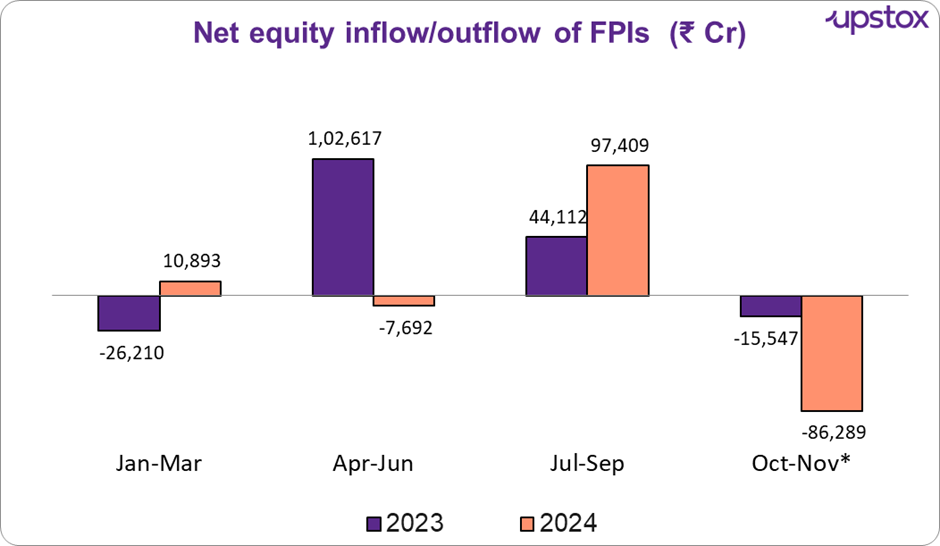

Foreign investors

Recently markets have seen some record FPI selling in the equity markets. As can be seen from the chart below, the outflow across just October and the first half of November is almost equal to the inflows that our markets saw in the entire previous quarter. On an aggregate basis, Indian equity markets have still seen net positive flows, but the spike in volatility and volume of flows is enough to cause changes in the INR.

Source: NSDL,*Upto 11th Nov

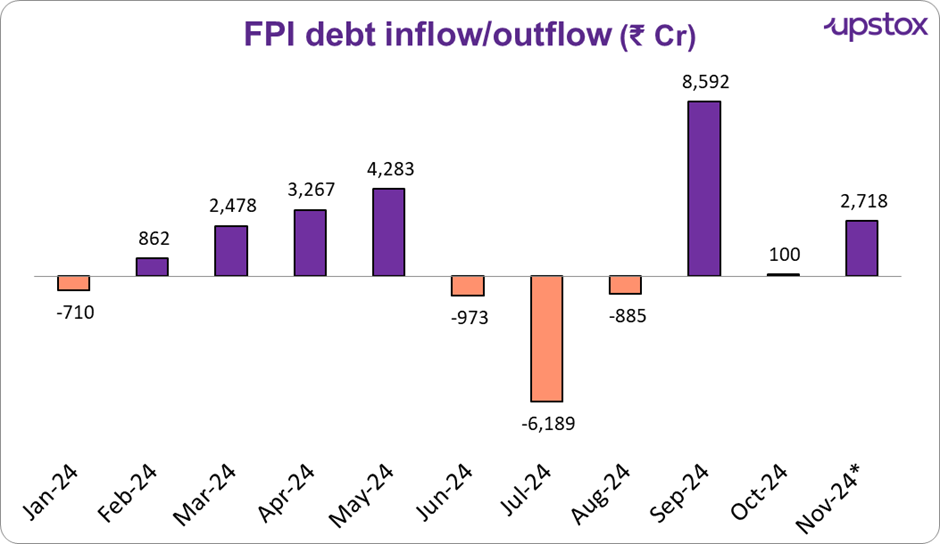

Indian debt markets present a more optimistic story, with positive flows across this year.

Source: Trading economics *Upto 11th Nov

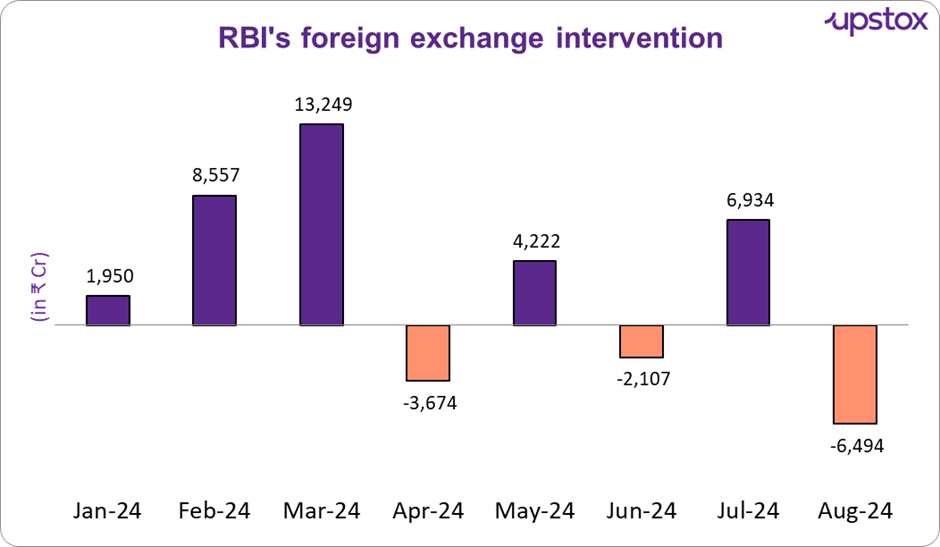

RBI's on a dollar-buying spree

The RBI has been on a dollar-buying spree this year. From January to August 2024 (latest available data), the RBI has purchased ~₹22,637 crore worth of dollars.

Why is the RBI doing this? The RBI aims to maintain a fine balance between keeping the INR competitive as well as making sure the rupee’s fall is not beyond its comfort range.

Source: News articles, RBI

Increasing oil prices

Since the low of $68.8 per barrel, oil prices spiked to as much as $80.9 per barrel, an almost 18% spike in early October 2024. Since then, prices have cooled to $73.7, which is still about ~8% higher than its September levels.

Geopolitical tensions

With geopolitical tensions spiking, it is natural for most global investors to find a haven. In line with gold, the dollar is also considered a potential safe haven, which has led to its overall strengthening.

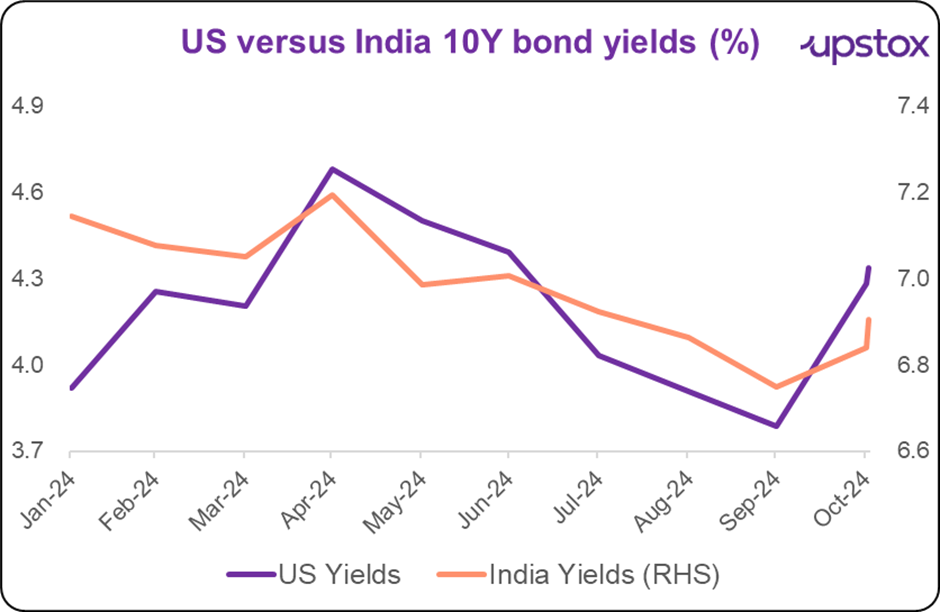

Resilient US economy

It would be an understatement to say that the performance of the USA economy has surprised market watchers. At the start of 2024, most discussions were centered around how a high and sticky inflation coupled with slowing growth would effectively see the US economy enter a recession in 2024.

That said, inflation in the US has become manageable, growth and employment remain robust, and as such, gradually investor confidence has increased in the US economy’s resilience.

Source: Investing.com; *latest availabe data

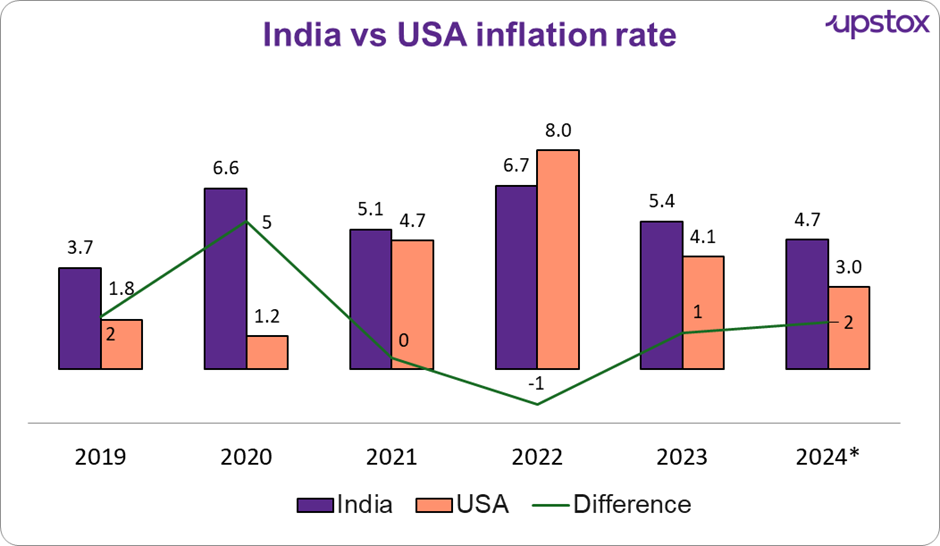

Interest rate differential

The interest rate differential between the US and Indian 10Y bond yields has been shrinking in 2024, making investing in US markets more rewarding.

Source: Investing.com

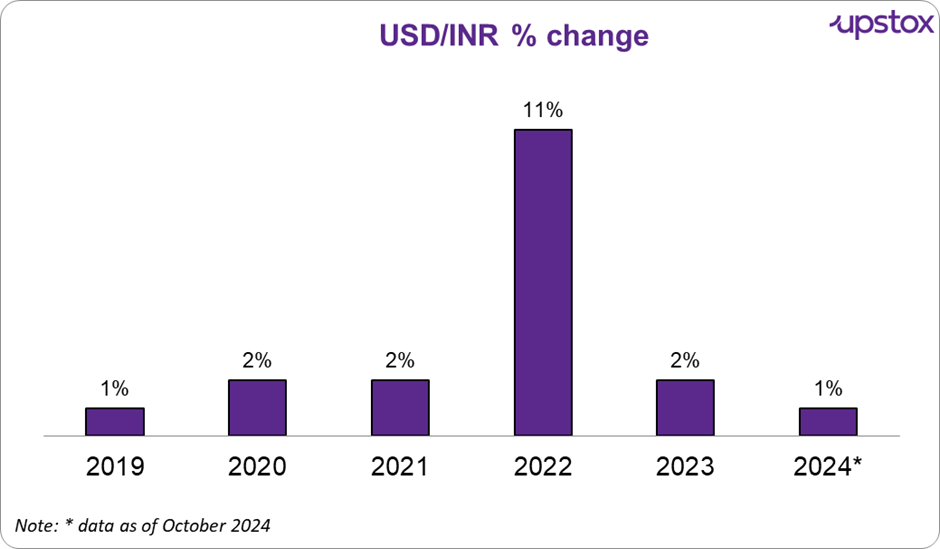

What does history tell us?

First, let's look at what the historical trend looks like. The chart shows that the Indian Rupee (INR) has been depreciating against the US Dollar (USD) at an average rate of ~1-2% per year from 2019 to 2024.

At that rate, so far, the currency has only depreciated ~1.3% since the start of the year.

Source: Investing.com

Conclusion

This brings us to - what does the future hold for the INR? Unfortunately, the answer is not very straightforward.

Analysts and market experts suggest that the RBI may need to allow further INR depreciation, particularly if China devalues the yuan in response to geopolitical pressures.

China might have to weaken the yuan if U.S. President-elect Donald Trump enforces his proposed tariffs of up to 60% on Chinese imports.

In such a scenario, the RBI might need to balance market dynamics by allowing controlled INR depreciation while leveraging its ample reserves to moderate volatility.

As India aims to attract foreign investments and bolster local manufacturing, maintaining a competitive exchange rate for the INR will remain critical. On a comforting note, as mentioned above, India has ample foreign reserves to make sure there are no shocks. On the other hand, India could potentially see higher FII flows now that:

-

The US elections are done and the uncertainty has ebbed - read - US election’s short-term impact on India

-

China’s recent stimulus has disappointed global investors (source), which could once again benefit India.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story