Upstox Originals

Understanding Infrastructure Investment Trusts (InvITs) – A simple guide

.png)

5 min read | Updated on February 13, 2025, 09:55 IST

SUMMARY

Looking to get exposure to India’s rapid infrastructure development, but are not sure of which stock or sector to buy. Consider InvITs. This article breaks down Infrastructure Investment Trusts (InvITs) in a simple way, explaining how they work, how investors make money, and why they’re gaining popularity in India. We also compare their performance with the Nifty50—analysing both price trends and dividend yields—to give you a clearer picture of their historical returns.

Stock list

InvITs are like mutual funds, but instead of investing in stocks, they invest in infrastructure projects

Imagine you and your friends want to invest in big projects like highways, bridges, or power plants but don’t have enough money individually. Instead of each of you trying to buy a tiny piece of a highway, you all pool your money together and invest in a trust that owns these projects. This is exactly how an Infrastructure Investment Trust (InvIT) works!

InvITs are like mutual funds, but instead of investing in stocks, they invest in infrastructure projects. When these projects start making money (like tolls from highways or fees from power supply), the profits are shared with investors.

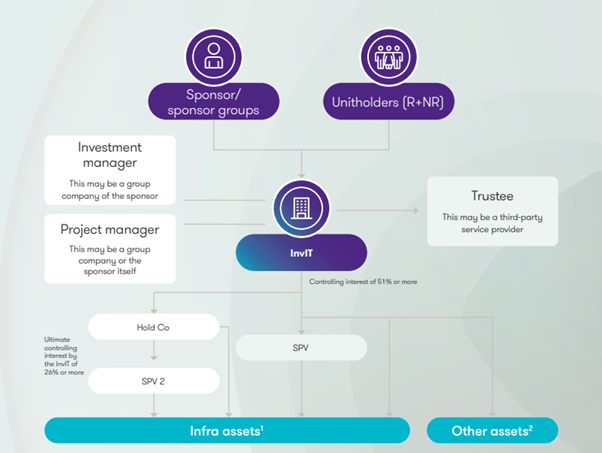

How are InvITs set up?

InvITs are registered with SEBI (Securities and Exchange Board of India) the below is how they are setup:

Source: grantthornton.in

- They work as trusts – A company or group called a Sponsor sets up the InvIT. This Sponsor must have a net worth of at least ₹100 crore and must hold at least 15% of the InvIT’s units for three years.

- They invest in infrastructure projects – Either directly or through Special Purpose Vehicles (SPVs).

- A Trustee manages investor interests – They ensure that at least 80% of the funds go into income-generating infrastructure assets.

- An Investment Manager handles day-to-day operations – This could be a company or LLP with experience in managing investments or infrastructure projects.

- A Project manager supervises construction and maintenance – Especially in Public-Private Partnership (PPP) projects.

How do investors make money?

When you invest in an InvIT, you can earn in three ways:

- Regular payouts – InvITs must distribute at least 90% of their net cash flow to investors. If the InvIT has extra cash, it can give investors additional income.

- Capital appreciation – If the value of the infrastructure project increases over time, your investment may become more valuable.

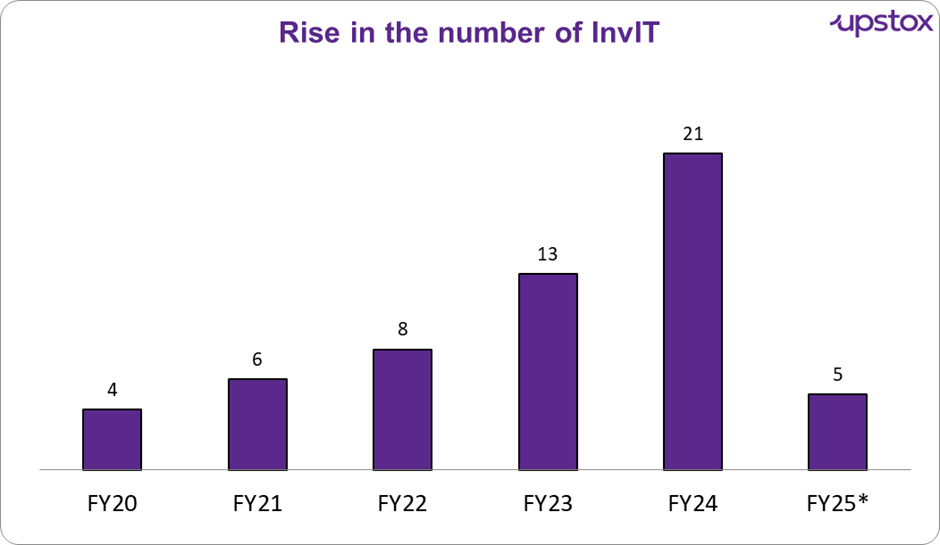

The number of InvITs has been steadily increasing each year…

Source: crisilrating.com,SEBI, Note: FY25 date is from April-Nov

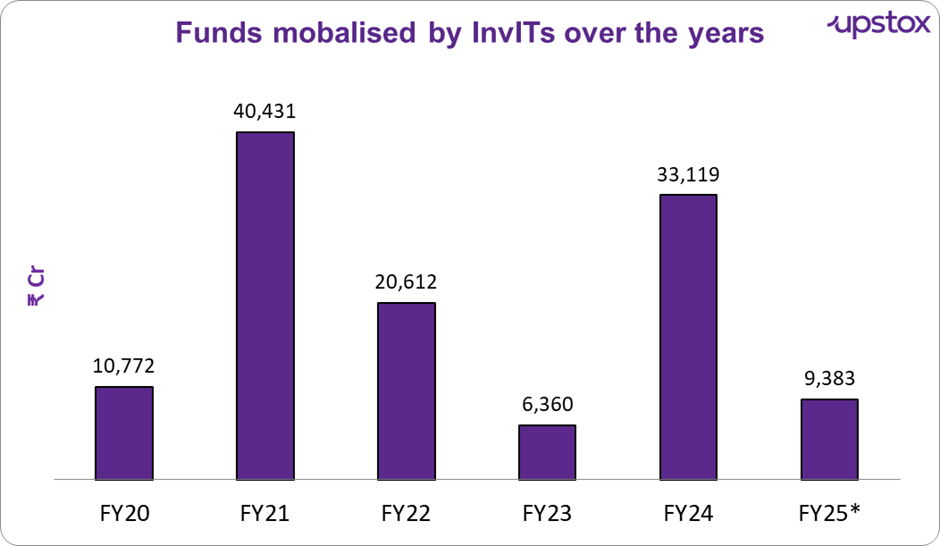

… which has helped in increased fund mobilisation for projects like toll roads, power transmission lines, and pipelines. That said, overall funds raised have slowed down in FY25, which can be attributed to slower awarding of certain critical projects

Source: SEBI, *Note: FY25 date is from April-Nov

Now that we have seen how it has grown and the amount of interest in this asset, let's look at how it fairs against Nifty 50.

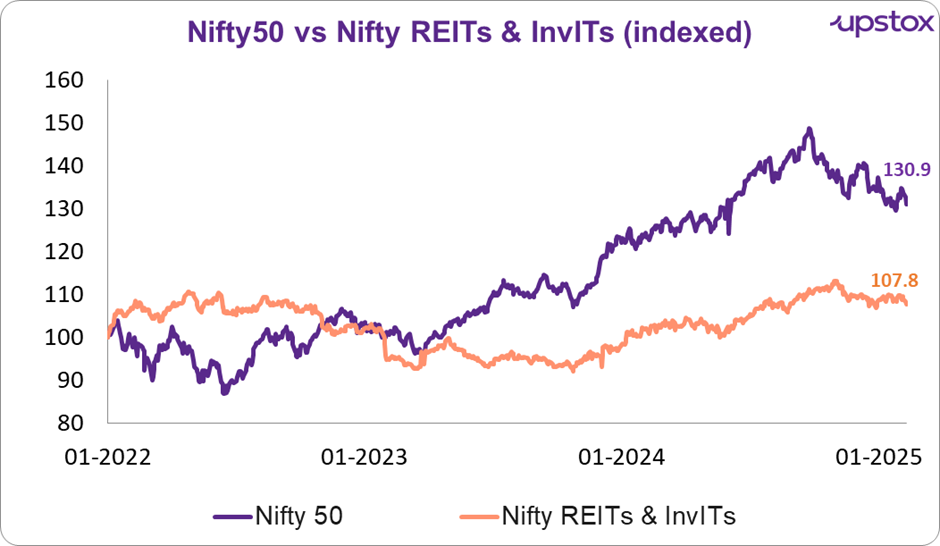

Nifty REITS & INVITS Index (Nifty R&I) vs Nifty 50

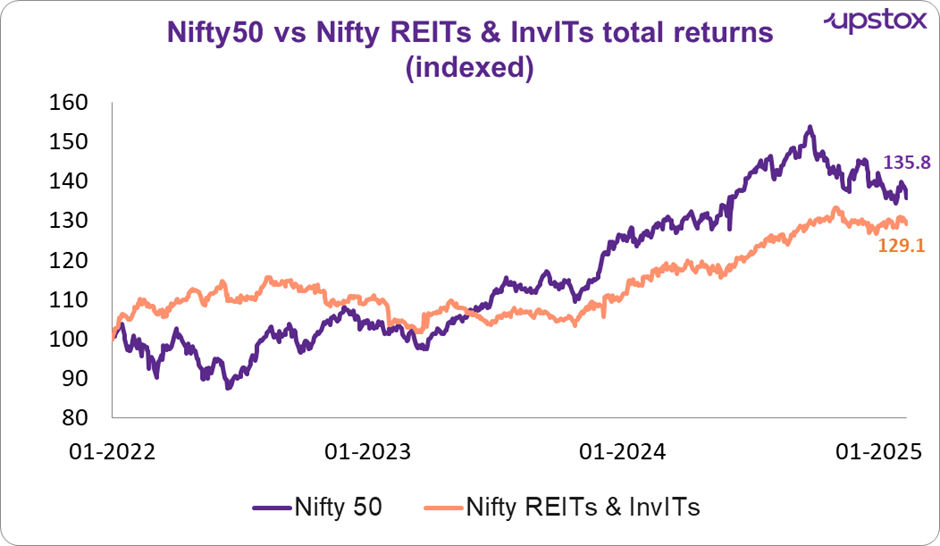

Comparing price-to-price Nifty 50 outperformed the Nifty R&I index by almost 22% in the last 3 years.

Source: NSE

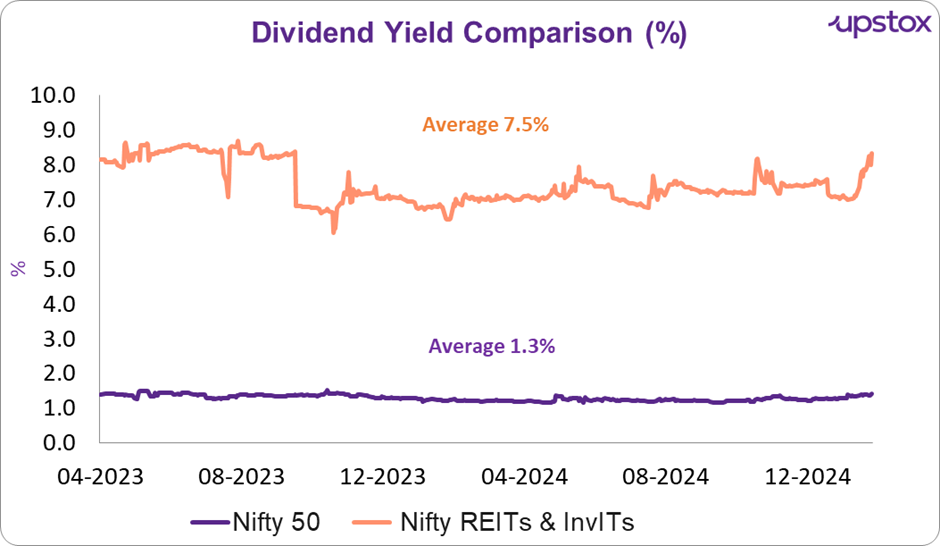

While Nifty R&I underperformed Nifty50 in terms of price returns, it does provide a considerably higher dividend yield to its investors.

Source: NSE

Basically on a total return basis (price appreciation + dividends) the Nifty R&I Index has delivered a respectable performance compared to the broader market.

Source: NSE

The table below provides a snapshot of 5 of the largest stocks in this sector. As can be seen, the ROEs are at a lower end, but given that most of these companies invest in assets with a long gestation period, that is only to be expected.

Some of these companies are not even three years old and as their projects keep getting executed and they start to see returns materlise, ROEs could hopefully receive an uplift.

Top 5 InvIT stocks as per market capitalisation

| Name | Market Cap ₹ Cr. | Asset type | EV / EBITDA | ROE % | Dividend Yield % | 3Y price perf (%) |

|---|---|---|---|---|---|---|

| Altius Telecom | 45,711 | Telecom | 13.4 | 5.5 | 16.40 | NA |

| National High | 17,334 | Highways | 22.1 | 2.7 | 5.27 | 7.3 |

| Cube Highways | 16,280 | Highways | 10.6 | -12.5 | 3.56 | NA |

| IndiGrid Trust | 11,912 | Power | 10.3 | 4.6 | 7.87 | -0.8 |

| Powergrid Infra. | 7,392 | Power | 8.5 | 13.1 | 3.17 | -14.3 |

| Energy InfrTrust | 5,909 | Power | 5.0 | 31.4 | 11.96 | -3.2 |

| Indus Inf. Trust | 4,119 | Highways | 11.6 | - | 9.63 | - |

Source: screener.in, indmoney, data as on 12-02-25

Finally, let us look at risks associated with investing in InvITs

What are the risks of InvITs?

The following highlights the significant drawbacks of this investment tool.

- Regulatory risk: Any changes in the regulatory framework like taxation or policies concerning the infrastructure sector would have a ripple effect on InvITs.

- Gestation risk: Typically, investment in infrastructure has a long gestation period, and hence the process of generating returns is often delayed. Such a delay not only takes a toll on the cash flow but further hampers profit projections.

Why this matters for investors

We talked about InvITs because they offer a unique way to invest in large infrastructure projects while enjoying regular payouts. For investors, they have provided a mix of stable returns and exposure to critical sectors like power and highways.

That said, as highlighted in the risks section, InvITs invest in asset classes with a long gestation period. Besides that, their investments are in sectors that are typically cyclical in nature. Both these factors have a significant impact on the returns expectation of an investor. As such, an investor should carefully consider their choices, and only take any decisions not only after thorough research but also be prepared for sudden unexpected developments along the way.

_Disclaimer: This article is for informational purposes only and must not be considered investment advice. Investors should consult with experts before making any investment decisions. _

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story