Upstox Originals

Understanding free-float and its role in index calculation

.png)

4 min read | Updated on January 24, 2025, 22:11 IST

SUMMARY

Ever wondered what the terms ‘market capitalisation’ and ‘free-float market capitalisation’ mean? Don’t worry; we’ve got you covered! In this article, we will reveal the difference between market capitalisation and free-float market capitalisation, explaining why stocks with the largest market caps don't always dominate the Nifty50.

‘Free-float’ implies shares that are publicly available for investors to trade in

Market capitalisation, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders. To figure it out, you just multiply the company's current stock price by the total number of shares they have out there.

Now that we know what market cap is, let's dive into the different types of market cap.

Types of market cap

There are three main types of market capitalisation: large-cap (1st to 100th company by size), mid-cap (101-250), and small-cap (251 and onwards).

Now that we know what market cap is and its different types, let's dive into one of the most popular ones: the NIFTY50.

Top 10 Nifty 50 stocks by market capitalisation and weightage (%)

| Company Name | Industry | Market cap (₹ in cr) | Weightage (%) | Free float (₹ in cr) |

|---|---|---|---|---|

| Reliance Industries | Conglomerate | 17,62,388 | 7.7 | 8,70,449 |

| Tata Consultancy Services | IT | 14,92,714 | 3.9 | 4,13,917 |

| HDFC Bank | Financial Services | 12,51,800 | 12.7 | 12,44,337 |

| Bharti Airtel | Telecommunication | 9,74,447 | 4.0 | 436,907 |

| ICICI Bank | Financial Services | 8,65,495 | 8.6 | 8,53,556 |

| Infosys | IT | 7,53,679 | 6.4 | 6,50,261 |

| State Bank of India | Financial Services | 6,81,930 | 2.8 | 2,97,150 |

| Hindustan Unilever | FMCG | 5,53,153 | 1.9 | 2,10,559 |

| ITC | FMCG | 5,50,703 | 4.1 | 4,13,107 |

| Larsen & Toubro | Construction | 4,90,715 | 3.9 | 4,27,409 |

| HCL Technologies | IT | 4,85,624 | 1.8 | 1,91,874 |

Source: NSE, screener.in, weightage % data as of 03-01-25

An interesting question may arise after looking at the table: How does Reliance Industries have lower weightage in the index, when it has the highest market capitalisation of all Nifty 50 stocks?

The answer lies in a simple but often misunderstood concept known as free float market capitalisation.

Free-float market capitalisation

‘Free-float’ implies shares that are publicly available for investors to trade in. Nifty uses this metric to calculate the weightage. This metric excludes shares held privately by promoters or governments.

In a nutshell,

Total market capitalisation= free-float market capitalisation + privately-held shares

That’s the answer! Reliance Industries has a higher total market capitalisation but more of its shares are held privately leading to lower free-float market capitalisation, hence lower weightage in Nifty 50 Index.

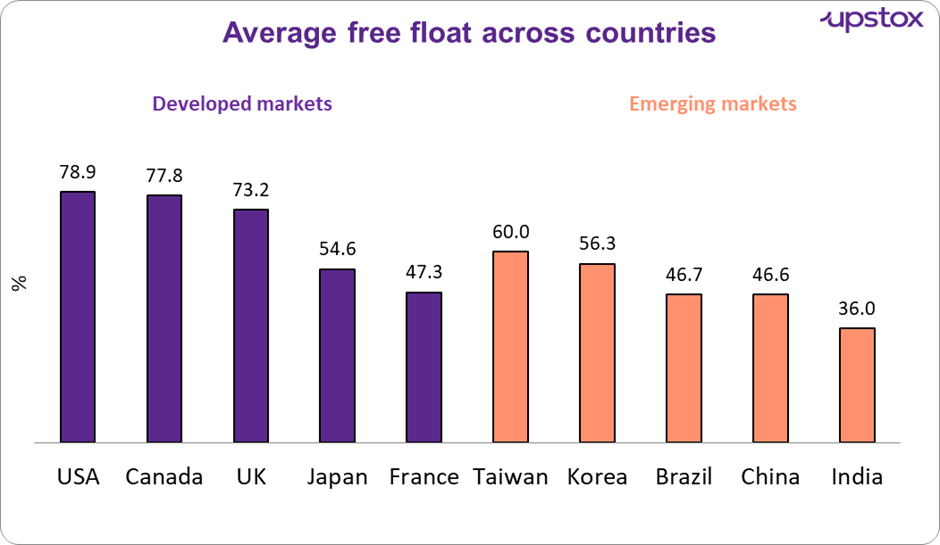

In most of the websites we get to see the total market cap. Lets compare differences in average free float percentages across various developing and emerging markets.

Source: MSCI.com

As you can see from the chart, emerging markets tend to have a lower average free float compared to developed markets. This is because, in countries like India, a large portion of shares is often held by company promoters or the government. On the other hand, in developed countries, more companies have a bigger percentage of their shares available for the public to trade.

Why isn't the free-float market cap discussed as much?

Free-float market capitalisation is less talked about because it's a more specific concept that mostly matters for index calculations and trading strategies.

Longer-term and fundamental investors often focus on the complete market cap to gauge the size and strength of a company, while free-float is more technical and relevant for understanding how a stock impacts an index like the Nifty 50. But for traders, free-float is critical since it shows how much of a company’s stock is liquid and easy to trade.

Fun fact

Large cap companies also known as blue chip companies, the term “blue chip” comes from the game of poker, where blue chips are the highest value pieces.

Outlook

Why is this topic important? Many investors don’t realise that the Nifty 50’s weightage isn’t based on total market cap but on free-float market cap, which excludes privately held shares. This makes it a more accurate measure of a stock’s influence on the index. For investors, understanding free float can help assess a company’s liquidity and trading impact, leading to smarter decisions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story