Upstox Originals

Sovereign Wealth Funds make their presence felt in India

.png)

4 min read | Updated on July 09, 2024, 18:33 IST

SUMMARY

Almost 50%, is how much investments by Sovereign Wealth Funds (SWFs) increased in India over the past year. Overall foreign investment in India is surging, with companies across the globe aligning their resources with India's promising growth trajectory. This article delves into this specific and crucial segment: Investments from SWFs.

Stock list

SWFs.webp

SWFs are government-owned funds, typically created by countries with large excess capital reserves. Their primary purpose is to invest and manage these financial assets. Globally, they manage ~$12 trillion in assets. Interestingly, around 68% of this AUM is concentrated in just five countries, as seen in the table below.

| Countries | SWF Size (USD Bn) | Share in Total SWF (%) |

|---|---|---|

| China | 2,357 | 20% |

| UAE | 2,090 | 17% |

| Norway | 1,668 | 14% |

| Saudi Arabia | 1,062 | 9% |

| Singapore | 1,057 | 9% |

| Total | 8,234 | 68% |

Source: Global SWF

Sovereign Wealth Funds increasing India focus

SWFs are increasingly investing in India. Their holdings in Indian stocks and bonds jumped nearly 46% YoY to a record ₹4.9 lakh crore by May 2024, compared to ₹3.3 lakh crore a year earlier. The data suggests growing confidence from major investors in the Indian market.

Sovereign funds including the Government of Singapore, ADIA, Kuwait Investment Authority and Norwegian pension fund are major players in the Indian market.

Here's a closer look at where these SWFs are channelling their capital in India

Top holdings of select major SWFs in India*

| Fund | Investment Philosophy | Company | Holding value (INR Cr) | Holding (% of their AUM) |

|---|---|---|---|---|

| Norway Pension Fund | Maximize long-term returns with moderate risk through global diversification. | HDFC Bank | 15,868.4 | 1.4 |

| Zomato | 2,002.9 | 1.1 | ||

| Apollo Hospitals | 1,152.7 | 1.3 | ||

| Juniper Hotels | 184.0 | 1.8 | ||

| Abu Dhabi Investment Authority (ADIA) | Long-term focus with flexibility, information-driven decisions. | Triveni Turbine | 193.8 | 1.0 |

| Welspun Corp | 163.1 | 1.2 | ||

| Samhi Hotels | 114.1 | 2.8 | ||

| Government of Singapore | Sound governance, clear investment policy, and robust risk management. | InterGlobe Aviation | 3,062.1 | 1.8 |

| Apollo Hospitals | 1,925.3 | 2.1 | ||

| Data Patterns (India) | 1,117.8 | 6.7 | ||

| Entero Healthcare | 231.1 | 5.0 | ||

| Kuwait Investment Authority | Achieve long-term returns exceeding benchmarks with a diversified portfolio. | Zomato | 2,209.2 | 1.3 |

| Max Financial Services | 379.9 | 1.1 | ||

| PG Electroplast | 87.8 | 1.0 |

Source: Trendlyne, *as on June 2024

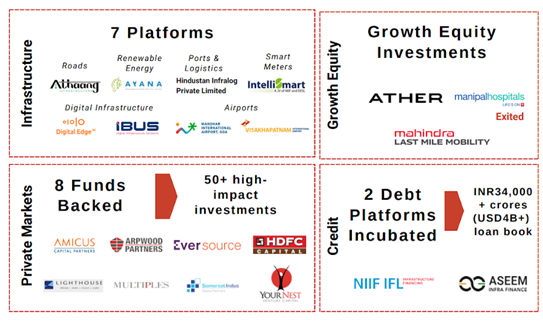

Indian Sovereign Wealth Fund: National Infrastructure Investment Fund (NIIF)

The NIIF is a sovereign-linked alternative asset manager that invests in infrastructure and related sectors in India with an AUM of ~$5 billion. The Government provides 49% of the capital with the remaining 51% coming from a diverse group of investors, including:

- Large global institutional investors: ADIA, Temasek, Ontario Teachers, Australian Super

- Multilateral Institutions: AIIB

- Indian domestic financial institutions: HDFC, Kotak Mahindra Bank, Axis Bank, ICICI Bank

Source: Digital Newsletter NIIF 2nd Edition - June 2024

To attract more investment in infrastructure projects, the Indian government extended a tax break. SWFs and pension funds can now invest in these projects completely tax-free until March 31, 2025. This makes the projects more profitable, increasing their appeal and potentially leading to more investment in India's infrastructure development.

How can this help investors?

The surge in global investment in India signifies the resilience and growth potential of the economy. Companies are attracting capital from around the world, creating a robust environment for further FDI. This trend can be a valuable guide for domestic investors seeking promising sectors or companies.

However, while aligning with global investors can be insightful, thorough due diligence remains crucial. Understanding the motivations behind each fund's investment is essential. Investors should ensure these funds are driven by sound economic rationale, not solely by political or other non-financial considerations.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story