Upstox Originals

Non-convertible debentures: Your gateway to safe and steady returns!

.png)

6 min read | Updated on October 17, 2024, 13:55 IST

SUMMARY

Looking for a safer alternative to traditional fixed deposits with better returns? Non-Convertible Debentures (NCDs) might be the answer. Offering fixed interest and higher yields than FDs, NCDs provide stable income. Often secured and backed by company assets, they’re a reliable investment even in challenging times. In this article, discover how NCDs can diversify your portfolio, enhance returns, and offer peace of mind for investors of all ages.

NCDs are becoming a preferred investment due to their fixed returns and relatively low risk.

NCDs are becoming a preferred investment in India due to their fixed returns and relatively low risk. They are fixed-income instruments that cannot be converted into equity and are typically issued by corporations, particularly non-banking financial companies (NBFCs), to raise capital.

NCDs provide an alternative to traditional bank loans, especially for organisations looking to diversify their funding sources.

Investors lend money to the issuer for a fixed term and earn interest until maturity when they receive their principal back. Traded on exchanges or OTC, NCDs offer competitive returns, making them an appealing option for investors seeking predictable income with lower risk than other debt instruments like fixed deposits.

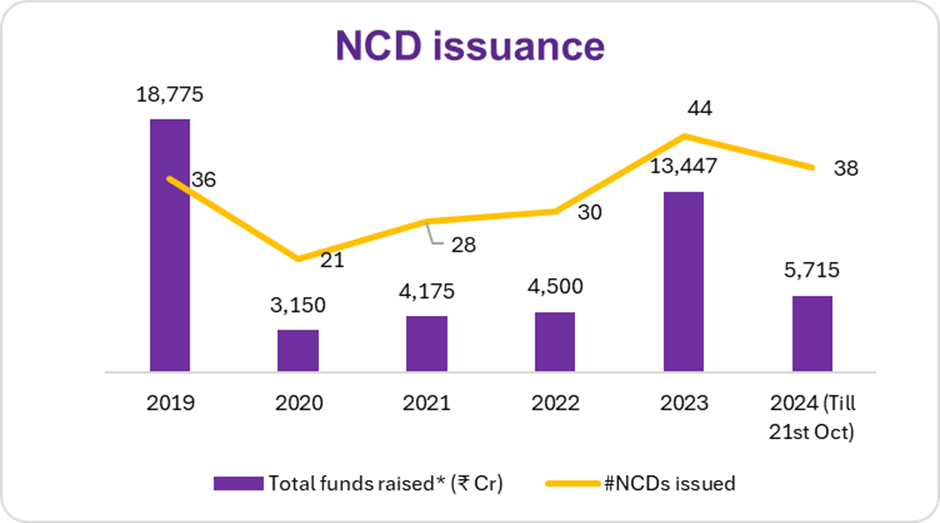

Source: Chittorgarh.com; *Total funds raised are calculated on base issue size

How does it work?

The table below summarizes the key features and financials of an NCD issued by ABC Ltd, making it easy to understand how the instrument works.

| Aspect | Details |

|---|---|

| Company | ABC Limited |

| Purpose | Raise ₹100 million for expansion and technology investment |

| NCD face or par value | ₹1,000 |

| Total NCDs issued | 100,000 units |

| Total amount raised | ₹100 million |

| Interest rate | 8% per annum |

| Interest payment frequency | Annually |

| Maturity period | 5 years |

| Annual interest payment | ₹80 per NCD (8% of ₹1,000) |

| Total interest paid (5 years) | ₹400 per NCD (₹80 x 5 years) |

| Principal repayment at maturity | ₹1,000 per NCD |

| Investor's total return (after 5 years) | ₹1,400 (₹400 interest + ₹1,000 principal) |

| Credit risk consideration | Investors should assess ABC Limited’s creditworthiness |

Key features of NCDs

-

Interest rate: Most NCDs offer fixed interest rates, providing steady returns. However, some also come with floating rates, which adjust based on market benchmarks like government bonds. Fixed-rate NCDs are more common and preferred for their predictability, while floating-rate NCDs offer the potential for higher returns if interest rates rise.

-

Credit rating: NCDs are rated by agencies such as CRISIL, ICRA, and CARE, with ratings ranging from AAA (highest safety) to D (default). Higher-rated NCDs are considered safer investments.

-

Secured vs. unsecured: NCDs can be classified as secured (backed by specific assets) or unsecured (not backed by collateral), which influences their risk levels and interest rates.

-

Liquidity: NCDs may be traded on markets, offering a degree of liquidity, although they tend to be less liquid compared to stocks.

-

Fixed tenure: NCDs come with a predetermined maturity period up to 20 years. This allows investors to plan their investments and cash flows accordingly.

Benefits of NCDs

*Returns are based on recent offerings and subject to change

Tax Benefits

Interest on NCDs is taxed at slab rate. The table below describes tax on sale of NCDs.

| Asset Type | LTCG | STCG | |||

|---|---|---|---|---|---|

| Holding period | Tax rate | Holding period | Tax rate | ||

| Non Convertible Debentures | Listed | >1 year | 12.5% without indexation | ≤ 1 year | As per income tax slab rate |

| Unlisted | Any | As per income tax slab rate | Any | As per income tax slab rate |

Open and upcoming NCD issues in India

The process of purchasing NCDs begins when the issuing company launches a public issue for a designated period. Investors can buy them through registered brokers.

| Company Name | Issue Open | Issue Close | Issue Size - Base (₹ Cr) | Rating |

|---|---|---|---|---|

| Indel Money | Oct 21, 2024 | Nov 04, 2024 | 75 | CRISIL BBB+/Stable outlook |

| UGRO Capital | Oct 10, 2024 | Oct 23, 2024 | 100 | IND A+/Stable outlook by India Ratings & Research Private Limited |

| Muthoot Fincorp | Oct 11, 2024 | Oct 24, 2024 | 75 | CRISIL AA-/Stable outlook |

| Edelweiss Financial Services | Oct 07, 2024 | Oct 18, 2024 | 100 | CRISIL A+/Watch Negative outlook |

Source: Chittorgarh.com

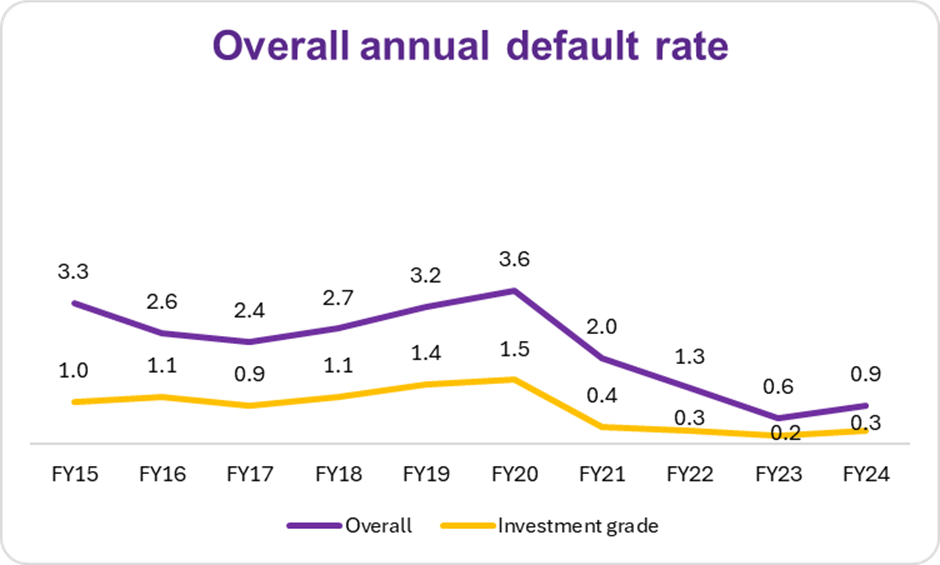

NCD are safer than ever

NCDs have become an increasingly attractive investment option, largely due to their enhanced safety. Historically, default rates on high-rated NCDs have been low, these rates have fallen even further, attributed to improved credit conditions, stronger risk management, and stricter regulatory oversight.

Overall annual default rate

Source: Ind_Ra

Here are a few reasons why default rates on NCDs have dropped:

-

Stricter credit evaluations: Credit rating agencies are now applying more rigorous standards when assessing potential issuers.

-

Improved financial health: Many companies have strengthened their balance sheets, reducing the likelihood of defaults.

-

Tighter regulation: Enhanced regulatory frameworks and transparency requirements are holding issuers accountable, ensuring they follow sound financial practices.

Are NCDs for investors across ages?

Secured NCDs provide peace of mind due to the backing of company assets, and AAA-rated instruments are widely considered low-risk. For younger investors, NCDs can also serve as a safe, fixed-income portion of a diversified portfolio. By choosing well-rated NCDs, investors can mitigate credit risk while benefiting from steady returns.

Let's discuss the difference between NCDs and FDs - another investment asset that is considered safe by many investors.

| Particulars | Non-convertible debentures (NCDs) | Fixed deposits (FDs) |

|---|---|---|

| Nature of Investment | Debt securities, loan to issuer | Savings instrument, term deposit |

| Investment tenor | Upto 20 years | 7 days–10 years |

| Interest rate* | 7-12% | Between 4-7% |

| Minimum investment | ₹10,000 | ₹1,000–₹10,000 |

| Degree of safety | Rated by agencies | Insured up to ₹5,00,000 by Deposit Insurance and Credit Guarantee Corporation (DICGC) |

| Early redemption | The outcome is subject to market conditions, which can lead to either profit or loss. | Subject to penalty. |

| Taxation | As mentioned in the table above | Interest income is taxed at an individual’s slab rate |

Note: *Interest rates are given based on current returns and are likely to be reset periodically

Conclusion

NCDs offer a compelling blend of safety and regular income. Their low default rate, particularly for highly rated NCDs, makes them a suitable investment choice for individuals across age groups seeking steady income with relatively low risk. When investing in NCDs, it is important to focus on credit ratings, tenure, and the issuer’s financial health to ensure maximum safety.

As the market evolves, NCDs remain a valuable addition for anyone aiming to achieve steady, reliable returns while mitigating risk.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story