Upstox Originals

Lessons from the rise and fall of Big Bazaar

.png)

7 min read | Updated on March 27, 2025, 20:44 IST

SUMMARY

Big Bazaar’s rise was built on bold expansion and smart marketing, but its fall exposed the dangers of high debt and failure to adapt. This article details the fascinating journey of Big Bazaar, once a household name, and key lessons for investors such as prioritising sustainable growth over rapid growth, financial discipline, and the importance of staying ahead of market trends.

At its peak, Big Bazaar had close to 300 stores across the country.

They say - failure teaches us a lot more than success. Over the years, many businesses have come and made their mark on the society and customers. While many have thrived, some unfortunately have not.

One such giant was Big Bazaar, a company and a brand that was synonymous to grocery and utility shopping in India. Whether you were entertaining guests at home or going abroad, Big Bazaar was that one-stop shop where you went and ‘loaded up’ on all kinds of necessities. At its peak, the company had close to 300 stores across the country.

What happened to this brand? It's said that all successful stories are the same, but each failure has its own unique learning. In this article, we deep dive to gather insights that investors and business managers of today can learn from the saga of Big Bazaar

Big Bazaar’s bold vision

Back in 2001, Kishore Biyani had a vision to create a shopping destination that offered everything under one roof at unbeatable prices. Inspired by the "low margin, high turnover" model of local stores like Saravana, Big Bazaar aimed to be India's answer to Walmart.

With its catchy slogan, “Isse sasta aur achcha kahin nahi” (Nothing is cheaper and better than this), the brand promised affordability and quality, winning the trust of millions of Indian shoppers.

Source: Company annual report, news articles

Big Bazaar opened their first 3 stores in 3 metro cities i.e. Kolkata, Bangalore, Hyderabad. Within 8 years of operations, it opened up 100+ stores. By 2018, it had 290+ stores by 2018 (including Hypercity) across almost all Indian states, covering ~10 million sq. ft. with 244 million annual footfalls. That is not all, Big Bazaar became the house of many brands.

So during its heyday how big was Big Bazaar?

Here’s a breakdown of its reach during its heyday:

- FBB: around 100 standalone stores in 46 cities, plus a presence in every Big Bazaar.

- EasyDay/Heritage Fresh: 1,007 stores across 335 cities, drawing 94 million footfalls.

- Foodhall: 12 stores in 5 cities.

- E-Zone: Around 100 stores.

- WH Smith: Integrated into over 1,100 small-format stores.

Please note these are the total number of stores for each of the Brands. For example, EasyDay had 1007 stores across India and includes standalone stores not part of Big Bazaar.

Overall, Future Retail (the company that owned Big Bazaar) generated an annual revenue of ₹20,000+ crore and operated around 1,511 stores in 428 cities, covering approximately 16.14 million sq. ft. of retail space and welcoming 351 million customer visits annually.

How did Big Bazaar grow into a retail giant with millions of customers and a massive store network? Let’s understand the key factors behind its meteoric rise.

Factors behind the rise of Big Bazaar:

-

A bold vision and hypermarket advatnage– Big Bazaar introduced the hypermarket model to India, offering everything under one roof at fairly competitive prices. It combined groceries, apparel, and electronics in one place, saving shoppers time and money. This coupled with its aggressive store opening spree made it a household name.

-

Value for money – Its "low margin, high turnover" strategy made it the go-to store for budget-conscious shoppers.

-

Smart targeting – Focused on the middle and lower-middle class, offering essentials, festive discounts, and convenient store locations.

-

Innovative marketing & deals – Campaigns like "Sabse Sasta Din", "Wednesday Bazaar", and "Great Exchange Offer" drove massive sales and customer loyalty.

-

First-mover edge – As one of India’s first large supermarket chains, it faced little competition early on and built strong brand loyalty.

Big Bazaar changed Indian retail, but behind the success some cracks began to show.

Where did Big Bazaar go wrong?

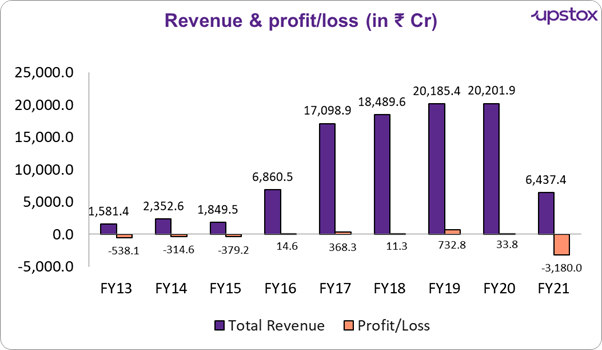

- Slim margins Big Bazaar expanded too fast, which led to a series of cascading problems. The company saw aggressive revenue growth, as can be seen below…

Source: Moneycontrol

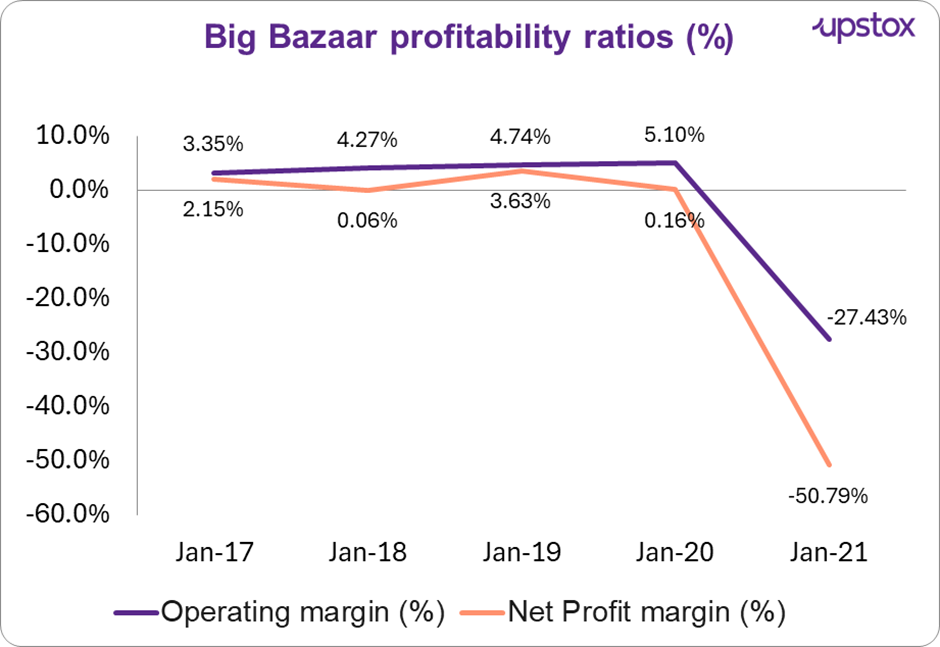

…but, its profitability was always slim, typically single-digit margins.

Source: Moneycontrol

As can be seen above, the final nail in the coffin was when lockdown was implemented and the company's revenue fell substantially but due to its high fixed costs which included interest payments for the loans, it made a loss of ₹3,180 crores.

High rental costs

High rental costs and shrinking sales made it difficult to keep all stores profitable. The group's annual rental costs were approximately ₹1,500 crore—amounting to around 7.4% of their sales. In April 2020, Future Group sought to cut rental costs across 1,700 stores by negotiating revenue-sharing, rent deferrals, and waivers due to COVID-19.

On top of financial strain, its inventory issues further weakened its position—popular products frequently ran out, while slow-moving stock piled up, leading to supply chain inefficiencies that drained profits.

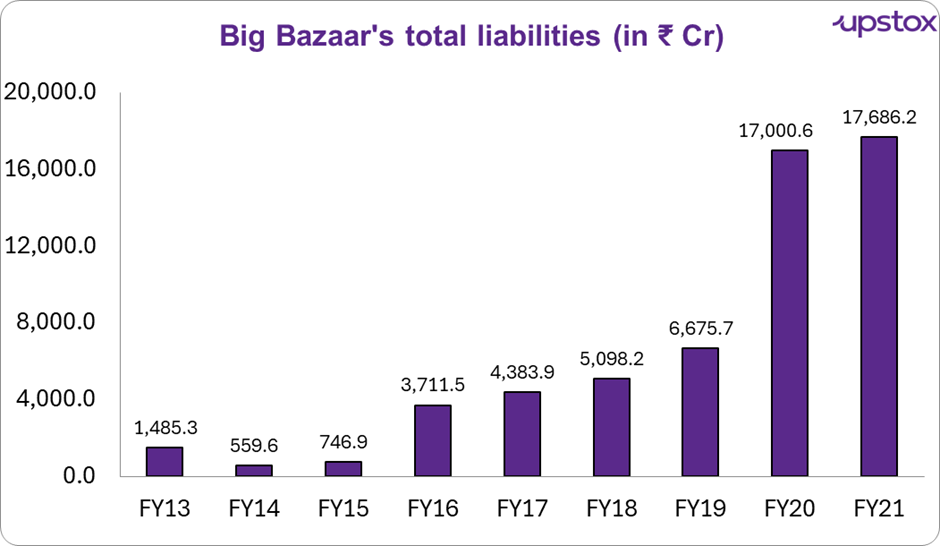

High debt burden

The company supported its aggressive expansion by heavy borrowing, which skyrocketed to over ₹17,000 crore, by FY21 – a debt to equity ratio of 9.1x

Source: Moneycontrol

Without a solid balance sheet and single digit margins, it was unable to support this aggressive expansion and financial pressure mounted. With so much debt, there was little room left for investment in technology or innovation, leaving the business vulnerable when times got tough.

Online retail

Big Bazaar’s slow move to e-commerce proved costly. While Flipkart, Amazon, and JioMart expanded aggressively, it only launched FuturePay and Big Bazaar GENIE in 2020—too late to compete with established players. JioMart gained traction by integrating Kirana stores, an opportunity Big Bazaar never fully leveraged.

Meanwhile, in-store shopping came with long queues, inconsistent pricing, and below average customer service, especially during Sabse Sasta Din, pushing frustrated shoppers to Amazon Pantry and Blinkit.

The COVID-19 lockdown sealed its fate—85% of revenue came from physical stores, and with footfall crashing, cash flow dried up. Store closures and unpaid rent deepened Big Bazaar’s financial crisis. Consequently, Reliance took over 200+ locations in 2022 over lease defaults.

Reliance and Amazon’s role in Big Bazaar

As financial trouble deepened, Future Group looked for a way out. In 2020, it agreed to sell Big Bazaar and other retail assets to Reliance for ₹24,713 crore. However, Amazon, which had previously invested in Future Group, challenged the deal in court, leading to a drawn-out legal battle.

The company revealed in March 2022 that it had received termination notices from Reliance for unpaid rent on several of its sub-leased properties. How many, you ask? 342 large-format stores (including Big Bazaar and FBB) and 493 smaller outlets (like Easyday and Heritage). That was a massive chunk of Future Retail’s footprint!

Big Bazaar’s collapse was a mix of internal missteps and external challenges, but the final blow came with the high-stakes corporate battle between Reliance and Amazon.

Key lessons for investors

-

Prioritise sustainable growth over aggressive expansion - Invest in companies with a measured growth strategy that balances expansion with profitability.

-

Conduct thorough market analysis - Investors should conduct a thorough market analysis to ensure that a company is keeping up with industry changes and developments, as well as staying aware of its competitors' activities.

-

Embrace technological advancements - Look for businesses that proactively adopt technology to stay relevant in the digital era.

-

Maintain financial discipline - Investors should assess a company’s debt/equity ratio, profit margins, ROE, and interest coverage to avoid over-leveraged businesses. Strong financial discipline ensures sustainable growth and prevents the risks of excessive debt, poor capital allocation, and shrinking profitability.

-

Focus on customer experience - Support companies that prioritize customer satisfaction, as loyal customers drive long-term growth.

-

Monitor competitive landscape - Invest in businesses that adapt effectively to market competition and emerging trends.

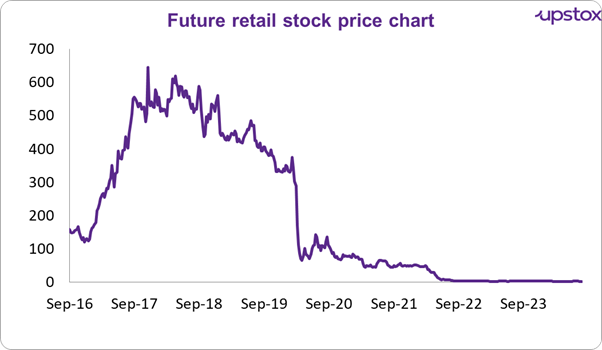

Source: Investing.com

Big Bazaar, and perhaps Future Retail—the stock listed on the exchange—was once a favourite in the market. The investor community was highly confident about the company, but when the story sold to them began to show flaws, it was reflected in the stock price as well.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story