Upstox Originals

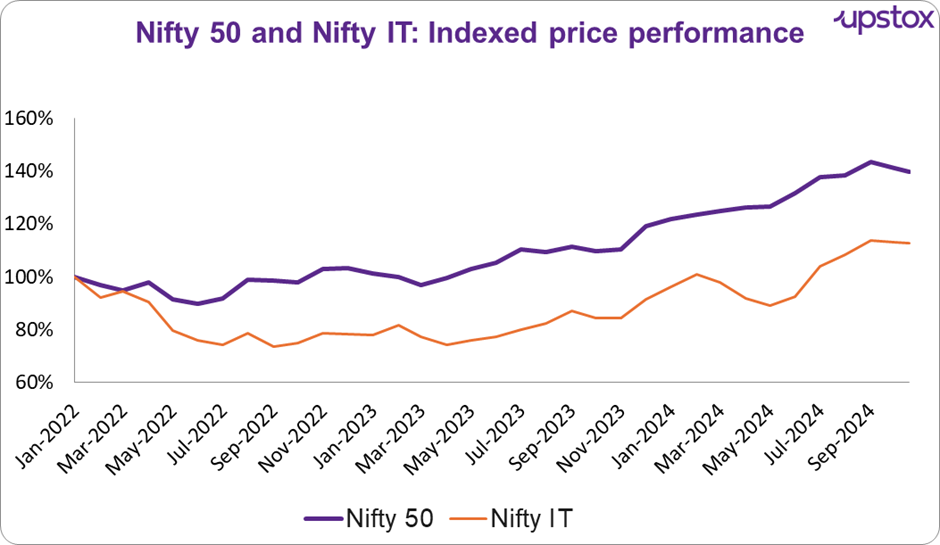

IT earnings in focus: Rebound or more of the same?

.png)

6 min read | Updated on October 22, 2024, 00:07 IST

SUMMARY

The latest earnings reveal a mixed picture for the IT sector. Revenues have increased but profitability remains flat. Discretionary spending is yet to pick up and cost optimisation remains a key focus. While there are definite sectoral or regional green shoots, the sector still has challenges to overcome. At the same time, AI and digital transformation continue to offer new avenues of growth.

Profitability of the Indian IT companies remained flat in Q2FY25

Source: Investing.com

As we dive into the results season, we note that the setor had quite the mixed bag this quarter.

As can be seen from the tables below, while the companies were largely able to increase their quarter-on-quarter (QoQ) revenue, it did not translate into any meaningful increase in operating marketing or PAT growth - both of which were largely flat.

These could indicate that pricing and cost pressures continue to weigh the industry.

IT sector: Trend in revenue performance

| Revenue (in ₹ Cr) | Revenue (in ₹ Cr) | Revenue (in ₹ Cr) | Rev growth (%) | Rev growth (%) | |

|---|---|---|---|---|---|

| Companies | Q2FY24 | Q1FY25 | Q2FY25 | YoY | QoQ |

| TCS | 59,692 | 62,613 | 64,259 | 8% | 3% |

| Infosys | 38,994 | 39,315 | 40,986 | 5% | 4% |

| HCL Tech | 26,672 | 28,057 | 28,862 | 8% | 3% |

| Wipro | 22,516 | 21,964 | 22,302 | -1% | 2% |

| LTI Mindtree | 8,905 | 9,143 | 9,433 | 6% | 3% |

| Total | 1,56,7779 | 1,16,092 | 1,65,842 | 6% | 3% |

Source: Screener

IT sector: Profitability trend

| OPM (%) | OPM (%) | OPM (%) | PAT (in ₹ Cr) | PAT (in ₹ Cr) | PAT (in ₹ Cr) | PAT growth (%) | PAT growth (%) | |

|---|---|---|---|---|---|---|---|---|

| Companies | Q2FY24 | Q1FY25 | Q2FY25 | Q2FY24 | Q1FY25 | Q2FY25 | YoY | QoQ |

| TCS | 26% | 27% | 26% | 11,380 | 12,105 | 11,955 | 5% | -1% |

| Infosys | 24% | 24% | 24% | 6,215 | 6,374 | 6,516 | 5% | 2% |

| HCL Tech | 22% | 21% | 22% | 3,833 | 4,259 | 4,237 | 11% | -1% |

| Wipro | 18% | 20% | 20% | 2,667 | 3,037 | 3,227 | 21% | 6% |

| LTI Mindtree | 18% | 18% | 18% | 1,162 | 1,135 | 1,252 | 8% | 10% |

| Total | 23% | 24% | 24% | 25,257 | 26,910 | 27,187 | 8% | 1% |

Source: Screener

Performance - Actuals versus analyst expectations

While a lot can be said about analyst expectations, the truth is - the street actually tracks performance against expectations. A strong beat on expectations can lead to a bump in prices, while a miss on expectations can dampen the price performance.

So, how did the companies perform?

| Company | Expectations | Results |

|---|---|---|

| TCS | Strong revenue growth and stable margins | Achieved revenue growth, with a rise in net profit, but faced contraction in margins. |

| HCL Technologies | Healthy performance across the board | Delivered a solid increase in net profit and revenue, reflecting consistent performance. |

| Wipro | Moderate growth | Saw a rise in net profit, but revenue growth was minimal. |

| Infosys | Strong financials meeting street estimates | Reported profit and revenue growth, but fell short on key metrics like EBIT and PAT. |

Source: Press release, news articles

Attrition has been a major challenge for these companies recently, which has also remained unchanged

| OPM (%) | |||

|---|---|---|---|

| Companies | Q2FY24 | Q1FY25 | Q2FY25 |

| TCS | 26% | 27% | 26% |

| Infosys | 24% | 24% | 24% |

| HCL Tech | 22% | 21% | 22% |

| Wipro | 18% | 20% | 20% |

| LTI Mindtree | 18% | 18% | 18% |

Source: Press release, company reports

What does the future hold: management expectations (select companies)

Wipro

Outlook from CEO Srini Pallia.

-

Acknowledged global economic uncertainties

-

Optimistic about the long-term potential in key sectors like BFSI, Technology, and Communications, especially in the Americas.

-

The focus is on large deals, vendor consolidation, and AI-powered solutions.

TCS

Outlook from CEO K Krithivasan.

-

Expressed cautious optimism, highlighting the focus on cost optimization, vendor consolidation, and efficiency improvements over large-scale discretionary spending.

-

Financial services in North America are showing early signs of recovery

-

AI is becoming integral across industries, providing growth opportunities.

HCL Tech

Outlook from CEO C. Vijayakumar.

-

Noted an improving demand environment but emphasized caution due to macroeconomic and geopolitical uncertainties

-

Cited a noticeable improvement in discretionary spending in sectors like Financial Services and Technology.

-

Reiterated AI and digital transformation as key growth drivers

The table below summarises the performance of some of the key stocks in the sector over the past 3 years.

| # | Name | Market Cap ₹ Cr. | 3Y Profit Growth (%) (FY19-24) | 3Y stock return (%) (FY19-24) | EV / EBITDA | ROE (%) |

|---|---|---|---|---|---|---|

| 1 | TCS | 14,82,674 | 14 | 6 | 21 | 52 |

| 2 | Infosys | 7,65,220 | 15 | 3 | 18 | 32 |

| 3 | HCL Technologies | 5,04,226 | 13 | 16 | 18 | 23 |

| 4 | Wipro | 2,88,881 | 13 | -7 | 15 | 14 |

| 5 | LTIMindtree | 1,77,790 | 42 | -3 | 24 | 25 |

| 6 | Tech Mahindra | 1,66,828 | 11 | 4 | 25 | 9 |

| 7 | Oracle Fin.Serv. | 99,366 | 9 | 37 | 28 | 29 |

| 8 | Persistent Sys | 85,465 | 33 | 42 | 45 | 24 |

| 9 | Mphasis | 58,015 | 11 | -2 | 21 | 18 |

| 10 | L&T Technology | 55,826 | 20 | 4 | 27 | 26 |

| 11 | KPIT Technology | 47,674 | 34 | 76 | 41 | 31 |

| 12 | Coforge | 46,686 | 25 | 10 | 32 | 24 |

| 13 | Tata Elxsi | 45,663 | 25 | 7 | 37 | 34 |

| 14 | Tata Technology | 42,989 | 29 | - | 41 | 22 |

| Average | 2,76,236 | 21 | 15 | 28 | 26 |

Source: Screener

Conclusion

The IT sector's recent earnings results show a cautiously optimistic outlook. A key theme across the sector is the emphasis on cost efficiency, AI integration, and digital transformation. As clients continue to prioritize operational efficiency, there is some shift away from discretionary spending on large-scale projects. The focus is now on embedding AI capabilities, automation, and cloud solutions to enhance service offerings and drive long-term growth.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story