Upstox Originals

From hype to reality: 2023’s most subscribed IPOs in review

.png)

8 min read | Updated on November 30, 2024, 09:26 IST

SUMMARY

The article reviews 2023 IPOs with high subscription rates, highlighting their initial performance and current status. Analysing factors behind their gains and losses offers insights and lessons for investors considering IPO investments in a dynamic market. In this article, we look at 4 of the most oversubscribed IPOs and track reasons for their oversubscription and the latest performance.

Exploring the performance of some of 2023's highly subscribed IPOs

2023 brought a rush of IPOs that captured investor attention with impressive subscription rates. But how have these stocks fared since then? This article dives into some of last year’s most popular IPOs, examining their initial buzz and their performance today.

Below is the summary of the stocks we have selected

| Utkarsh Small Finance Bank (USFB) | ideaForge Technology Limited (IDEF) | Motisons Jewellers Limited (MOTN) | Netweb Technologies India Limited (NETE) | |

|---|---|---|---|---|

| IPO date | July 21st, 2023 | July 07, 2023 | December 26, 2023 | July 27, 2023 |

| Issue size (₹ crore) | 500 | 567.3 | 151.1 | 631 |

| Subscription | 110.8x | 106.1x | 173.2x | 90.6x |

| Listing day performance (at close) | 91.8% above the offer price | 92.8% above the offer price | 83.9% above the offer price | 82.1% from above the offer price |

| Current price* | ₹ 36 | ₹ 571 | ₹ 28 | ₹ 2,880 |

| % change from listing day close | -24% | -126% | 171% | 216% |

Source: Chittorgarh, NSE, news articles; * as of September 26, 2024

Now, let’s look at each of these stocks

Utkarsh Small Finance Bank (USFB)

Why was the IPO “hot”?

Varanasi-based USFB was in great demand, and multiple brokers had a subscribe rating on this stock, citing the following reasons:

-

Rapidly growing small finance bank sector

-

Healthy financials - improving asset quality, and reducing exposure to unsecured micro banking segment

-

Attractive valuations.

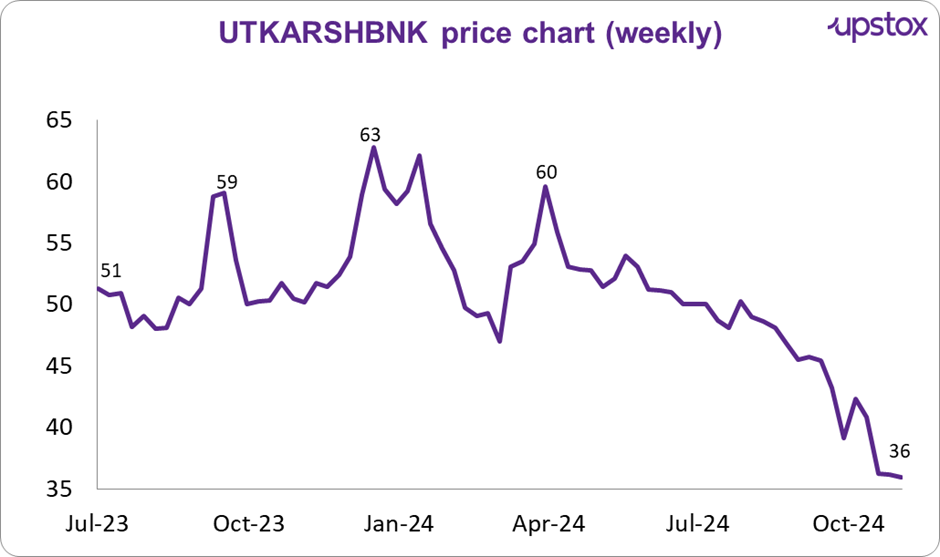

How has the stock performed?

Source: Investing.com

What went wrong?

As seen from the chart above, the stock has had a volatile journey, in its ~1.5 years on the market. But since, April 2024, the stock has been on a continuous downtrend, owing to performance not living up to investor expectations:

-

The company has seen a gradual build of stress on its loan book. Heatwave early in the financial year followed by floods saw a rise in stress on its microfinance book (decreased from 96.2% to 92.3% in collection efficiency)

-

In Q1FY25, it reported a ~2.7% QoQ rise in the gross loan portfolio. While this was still a ~30% YoY jump, the number was below the street’s expectations, which led to a fall in price

-

The problem was further exacerbated in Q2FY25 when USFB reported a ~55% YoY drop in net profit, due to increased provisions (₹83 crore to ₹208 crore YoY) and adverse credit costs. The management projected these costs would rise from the previous ~2% to between 3.5% - 4.5%, impacting future profitability.

-

Finally, the bank cut its loan growth outlook from an ambitious 30% to a more conservative 18-20%, signaling caution amid a more challenging financial environment.

USFB financial performance

| Financials (₹Crore) | Mar-23 | Jun-23 | Sep-23 | Dec-23 | Mar-24 | Jun-24 | Sep-24 |

|---|---|---|---|---|---|---|---|

| Revenue | 691 | 720 | 756 | 806 | 896 | 966 | 987 |

| EBITDA | 208 | 221 | 238 | 256 | 282 | 311 | 276 |

| EBITDA margin (%) | 20% | 18% | 17% | 21% | 18% | 21% | 18% |

| PAT | 134 | 108 | 114 | 116 | 160 | 137 | 51 |

Source: tijorifinance.com

ideaForge Technology Limited (IDEF)

Why was the IPO “hot”?

IDEF was one of 2023’s most successful IPO debuts, because:

-

It is one of the largest drone players in India - a segment considered by many investors as a sunrise industry in the defence sector

-

Investors opined that the company’s technology stack would lead to continued order wins and translate into better performance

-

It was seen as one of the Indian army’s key suppliers.

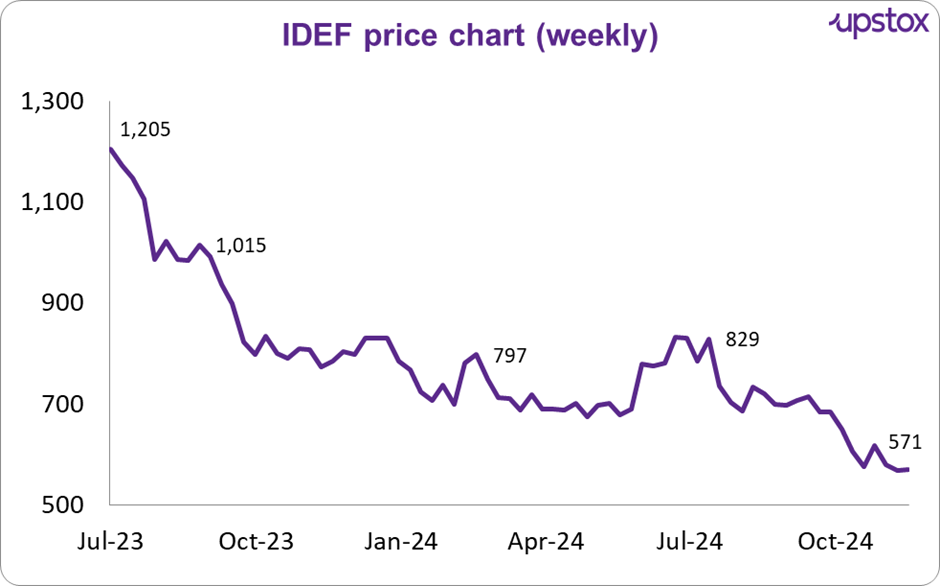

How has the stock performed?

Source: Investing.com

What went wrong?

As one can see from the chart above since listing the stock has only been on a downtrend. Multiple reasons have been cited for the same, including:

-

Overvaluation: At listing, the stock delivered a ~100% gain. At that price, it was trading at 87.5x its past earnings, leading to questions about the sustainability of the company’s valuations

-

Financial performance

- Despite the high subscription and robust listing, investors were already questioning its order book status. For example - its order book declined from ₹310 crore in FY22 to ₹192 crore in FY23.

- In Q1 FY24 results (first since its IPO) - its consolidated profit declined ~54%. The order book decreased significantly to ₹54.2 crore at the end of June quarter, leading to questions about future performance.

- Since then, the company’s results have mostly disappointed the street, culminating in an operating loss in Q2FY25

IDEF financial performance

| Financials (₹Crore) | Mar-23 | Jun-23 | Sep-23 | Dec-23 | Mar-24 | Jun-24 | Sep-24 |

|---|---|---|---|---|---|---|---|

| Revenue | 39 | 97 | 24 | 92 | 105 | 86 | 37 |

| EBITDA | 1 | 28 | -8 | 21 | 17 | 3 | -14 |

| EBITDA margin (%) | 3 | 29 | -33 | 21 | 15 | 3 | -43 |

| PAT | -5 | 19 | 1 | 16 | 12 | 2 | -12 |

Source: Screener

Below are a few that were oversubscribed and are doing well

Motisons Jewellers Limited (MOTN)

Why was the IPO “hot”?

The stock had a subscription of almost 173x, so what was it that appealed to investors?

-

The company had a very strong presence in Rajasthan’s jewellery market (predominantly in Jaipur). It has strategic showroom locations enhancing revenue per square foot

-

Attractive P/E multiple of 16.1x FY23 earnings, favourable compared to industry standards. Provides risk mitigation due to attractive valuation.

-

Strong revenue growth and doubling of net profit over the last two years.

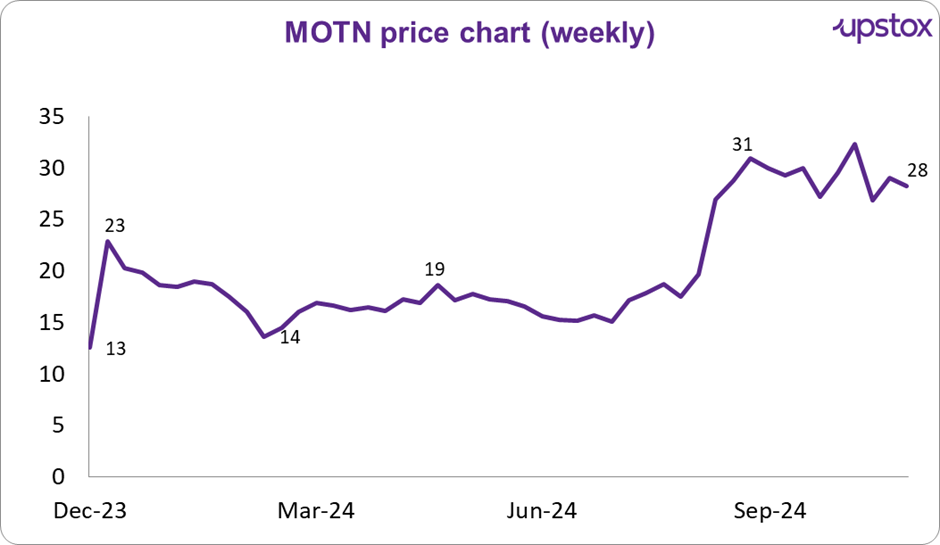

How has the stock performed?

Source: Investing.com

What has been driving performance?

-

Rising gold prices: To a certain extent the company has benefitted from rising gold prices. Most jewellery players have seen a strong run, which has also helped MOTN’s price performance.

-

Strong financial performance: Besides macro support, MOTN has delivered good financial performance. In Q3 FY24 results (first since its IPO), revenue increased ~37% QoQ. Since then, it has managed to deliver strong performance. As of September 2024, MOTN’s PAT has grown 2x, compared to September 2023.

-

Stock Split - In September 2024, MOTN announced a 1:10 stock split, which has since been well-received by investors

MOTN financial performance

| Financials (in ₹ crore) | Mar-23 | Jun-23 | Sep-23 | Dec-23 | Mar-24 | Jun-24 | Sep-24 |

|---|---|---|---|---|---|---|---|

| Revenue | 91 | 87 | 90 | 123 | 117 | 89 | 109 |

| EBITDA | 9 | 13 | 13 | 20 | 18 | 11 | 17 |

| EBITDA margin (%) | 10 | 14 | 14 | 16 | 15 | 12 | 16 |

| PAT | 3 | 5 | 5 | 11 | 11 | 6 | 10 |

Source: Screener

Netweb Technologies India Limited (NETE)

Why was the IPO “hot”

-

NETE is India’s leading high-end computing solutions, providing high-end computing solutions, including supercomputing systems and private cloud infrastructure.

-

It operates in a high-barrier industry (technical skills, R&D capabilities, among others)

-

It was perceived as one of the beneficiaries of the Make In India policy, which supports domestic hardware manufacturing

-

Was one of the few plays that provided AI exposure for Indian investors

-

Strong past performance. With positive future projections, It delivered significant sales growth over FY21-24 (₹69 crore in June-22 to ₹266 crore).

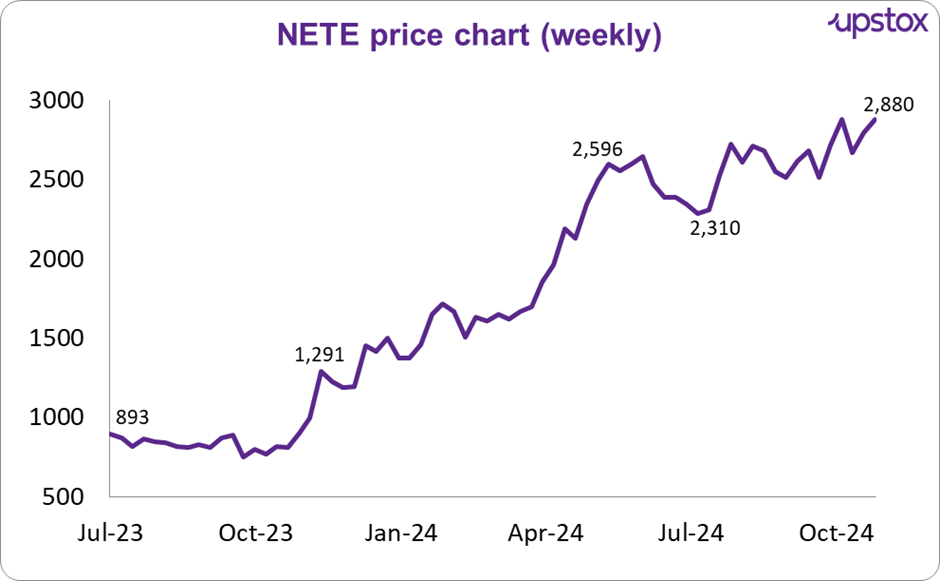

How has the stock performed?

Source: Investing.com

What has driven performance?

- The company announced Collaborations with NVIDIA and ARM to enhance market positioning.

- Since March 2023, the company has delivered strong results, with revenue, operating profit and PAT nearly doubling as of September 2024.

- It is virtually debt-free and has a good ROE track record.

NETE financial performance

| Financials (₹ Crore) | Mar-23 | Jun-23 | Sep-23 | Dec-23 | Mar-24 | Jun-24 | Sep-24 |

|---|---|---|---|---|---|---|---|

| Revenue | 123 | 60 | 145 | 253 | 266 | 149 | 251 |

| EBITDA | 15 | 9 | 19 | 34 | 40 | 20 | 36 |

| EBITDA Margin (%) | 10 | 14 | 15 | 16 | 15 | 12 | 16 |

| PAT | 11 | 5 | 15 | 26 | 30 | 15 | 26 |

Source: Screener

Key lessons for investors

-

Subscription hype vs. long-term success: High demand at launch doesn’t always mean sustained performance. Look beyond initial excitement to a company's fundamentals.

-

Monitor financial health: Post-IPO performance depends on quarterly results. Rising expenses or declining profitability can lead to price drops.

-

Industry and market trends: Assess the broader economic environment and sector outlook to anticipate impacts on stock prices.

-

Importance of diversification: Diversifying investments can reduce risk and stabilise if one stock underperforms.

These lessons highlight the importance of a balanced approach, understanding financials, and evaluating market conditions for informed investment decisions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story