Market News

Trade setup for March 26: NIFTY50 faces resistance at 23,800, consolidation on cards ahead of expiry?

.png)

4 min read | Updated on March 26, 2025, 01:51 IST

SUMMARY

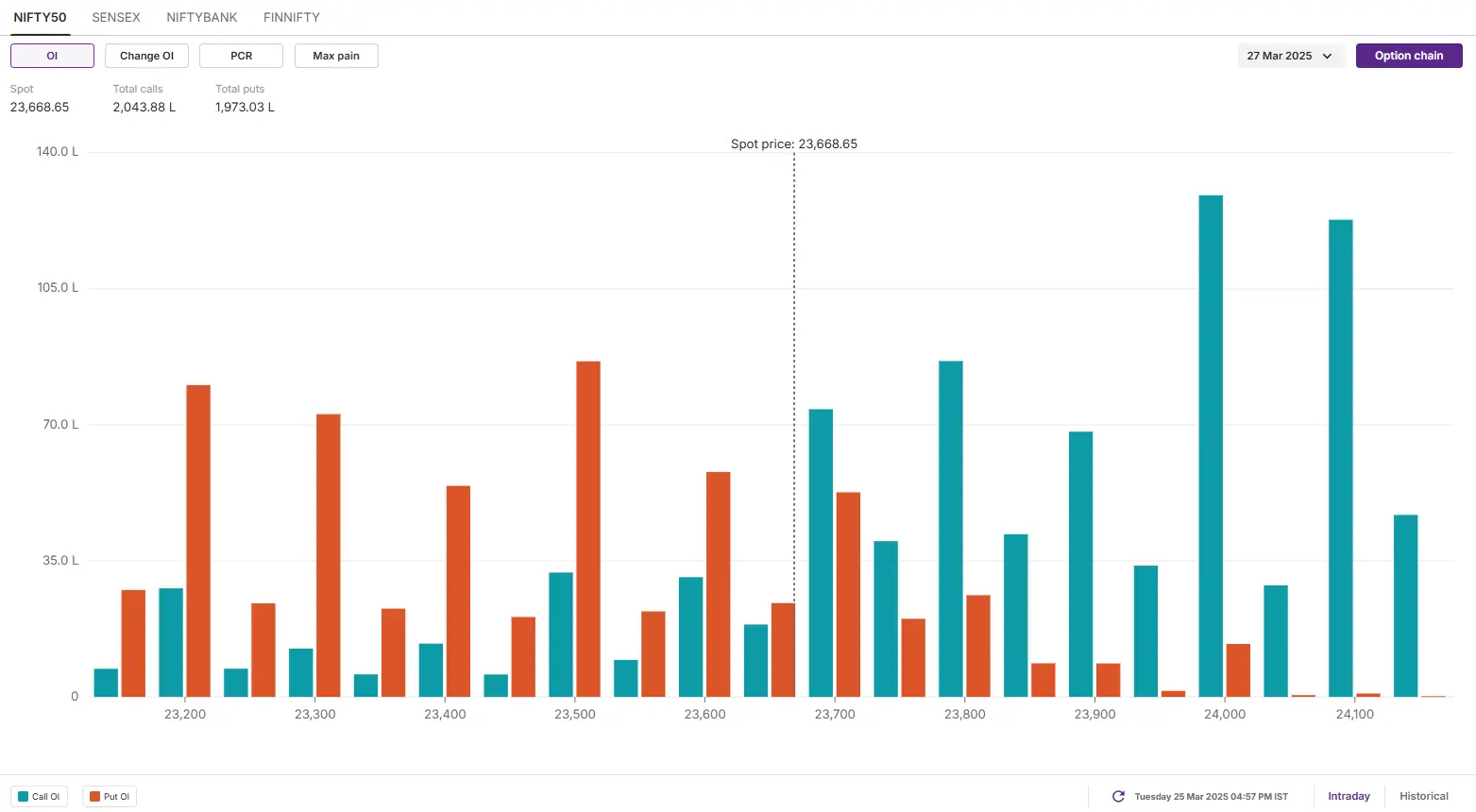

The options data for the March 27 expiry saw significant call options base at 24,000 strike and put base at 23,500 strike, indicating range-bound movement within this range.

NIFTY50 index continued its winning streak for the seventh consecutive session on Tuesday. | Image: Shutterstock

Asian markets @ 7 am

- GIFT NIFTY: 23,757 (+0.33%)

- Nikkei 225: 37,916 (+0.36%)

- Hang Seng: 23,485 (+0.61%)

U.S. market update

- Dow Jones: 42,587 (▲0.0%)

- S&P 500: 5,776 (▲0.1%)

- Nasdaq Composite: 18,271 (▲0.4%)

U.S. indices ended the Tuesday’s session on a flat note which was largely amid hopes of U.S. tariffs being in a narrower in scope. Meanwhile, investors largely shrugged off Tuesday’s March consumer confidence data, which showed a sharp decline in U.S. consumers' outlook on income, business, and job conditions.

The reading fell to 92.9, missing the street estimate of 93.5. Meanwhile, the expectations index dropped to 65.2—the lowest in 12 years and well below the 80 threshold that typically signals a potential recession.

NIFTY50

- Max call OI: 24,000

- Max put OI: 23,500

- (Ten strikes to ATM, 27th March Expiry)

NIFTY50 index continued its winning streak for the seventh consecutive session on Tuesday. However, the index witnessed resistance around the February’s swing high, encountering profit booking at higher levels. Additionally, index has also recovered 38% of the correction from the record high levels made in September 2024, indicating some consolidation at the current levels.

The technical structure of the index continues to remain bullish as the index is currently trading above the 200-day EMA (around 23,400) on the daily chart. However, experts believe that index will resume next leg of rally if it reclaims Tuesday’s high ( 23,869) on closing basis.

On the open interest (OI) front, 24,000 holds the highest call OI, indicating resistance for the current expiry. On the flip side, 23,500 holds the highest open interest on the put side, acting as a support for the current monthly expiry.

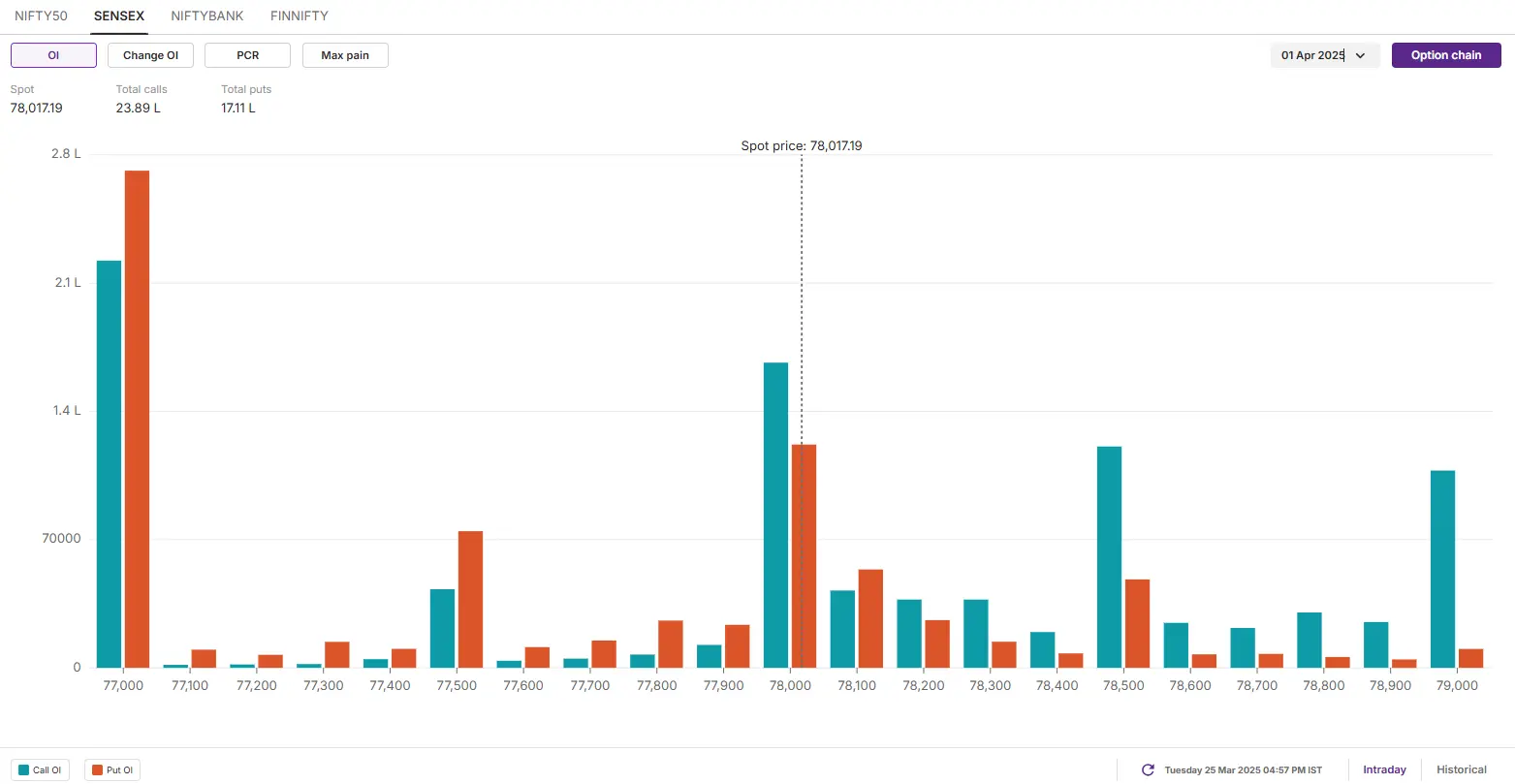

SENSEX

- Max call OI:78,500

- Max put OI:77,500

- (Ten strike to ATM, 01 April Expiry, initial build-up)

Similar to the NIFTY50, the SENSEX continued its winning streak for the seventh consecutive session on Tuesday. The index witnessed high volatility throughout the day and gave up initial gains to trade in the red in the afternoon session. However, heavy FII buying at lower levels kept the index in the green.

Meanwhile, the technical structure shows that, the index faced resistance around the February month swing high of 78,735. Despite the volatile trade, the index managed to hold 200-day EMA on a closing basis.

On the open interest (OI) front, the initial build-up for the 1st April expiry suggests resistance at 78,500 levels as it holds the highest OI. On the other hand, the 77,500 level holds the highest open interest on the put side, indicating a near-term support at these levels.

FII-DII activity

Stock scanner

- Long build-up: Trent

- Short build-up: IREDA, Dixon Technologies, Zomato, MCX and Hindustan Copper

- Top traded futures contracts: HDFC Bank, ICICI Bank, Reliance Industries, Bajaj Finance and Tata - Consultancy Services

- Top traded options contracts: HDFC Bank 1,840 CE, Ultratech Cement 11,500 CE, Trent 5,200 CE and TCS 3,700 CE

- Under F&O ban: IndusInd Bank

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story