Market News

Trade setup for Feb 10: NIFTY50 tests 21-EMA, 23,800 poses stiff resistance

.png)

4 min read | Updated on February 10, 2025, 01:51 IST

SUMMARY

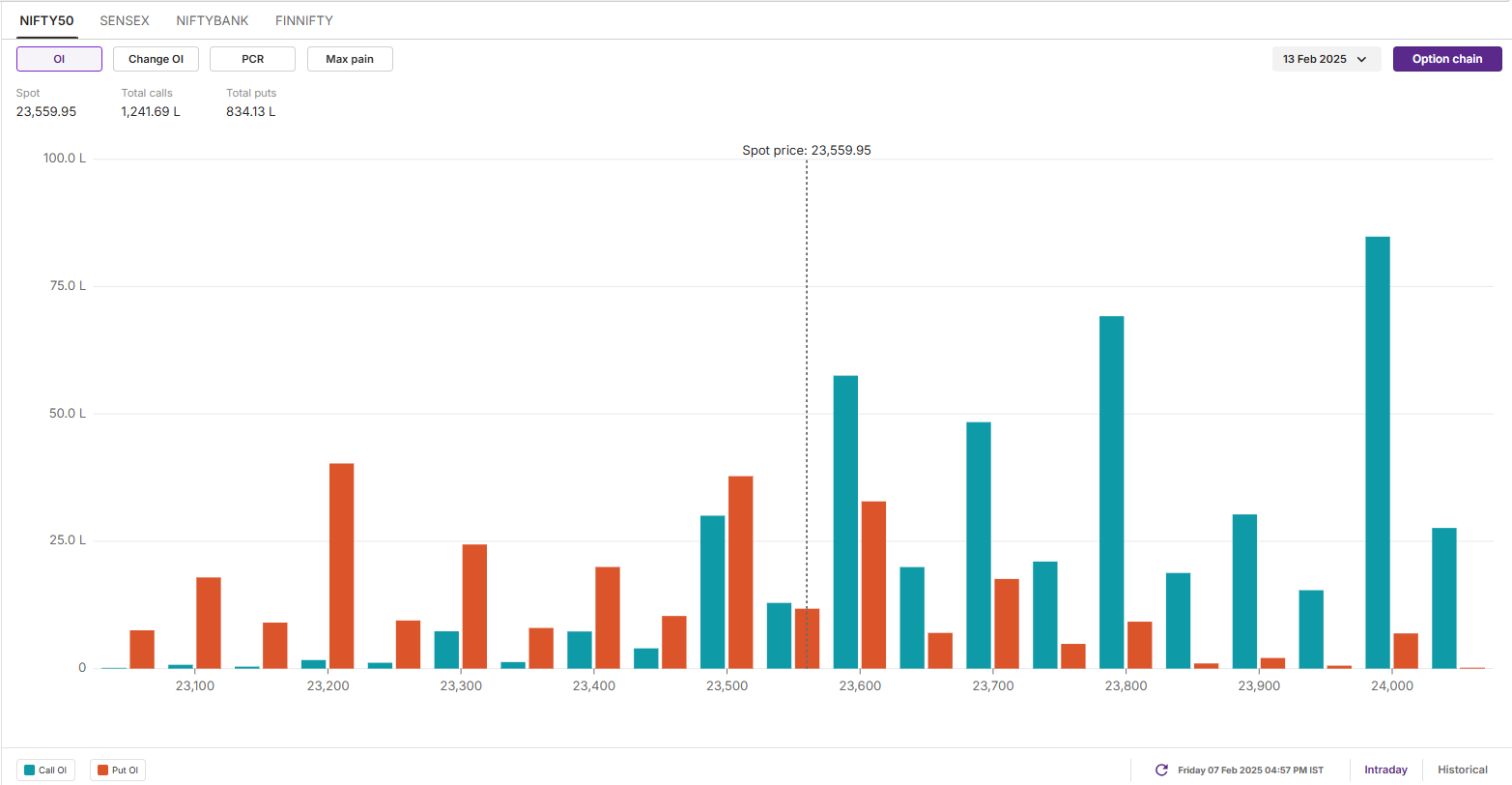

The NIFTY50 index saw significant call build-up at 24,000 strike for the 13 February expiry. This indicates that the index may face resistance around this zone.

Stock list

The NIFTY50 index extended the losing streak for the third consecutive session and ended the February 7 on the negative note. | Image: Shutterstock

Asian markets @ 7 am

- GIFT NIFTY: 23,564 (-0.09%)

- Nikkei 225: 38,824 (+0.10%)

- Hang Seng: 21,223 (+0.43%)

U.S. market update

- Dow Jones: 44,303 (▼0.9%)

- S&P 500: 6,025 (▼0.9%)

- Nasdaq Composite: 19,523 (▼1.3%)

U.S. indices ended lower on Friday as investors grappled with fresh tariff threats from the Trump administration and rising inflation expectations. President Donald Trump, during a meeting with Japan’s Prime Minister Shigeru Ishiba, hinted at imposing reciprocal tariffs on American imports, with Japan potentially in focus.

Meanwhile, markets also reacted to a decline in consumer sentiment. The survey revealed that Americans expect Inflation to surge to 4.3% for the next year, up a full percentage point from the previous month, adding to investor concerns.

NIFTY50

- February Futures: 23,614 (▼0.2%)

- Open interest: 2,23,480 (▼0.1%)

The NIFTY50 index extended the losing streak for the third consecutive session and ended the February 7 on the negative note. The index witnessed profit booking from higher levels after the Reserve Bank of India reduced the key repo rate for the first time in nearly five years by 25 bps from 6.5% to 6.25%.

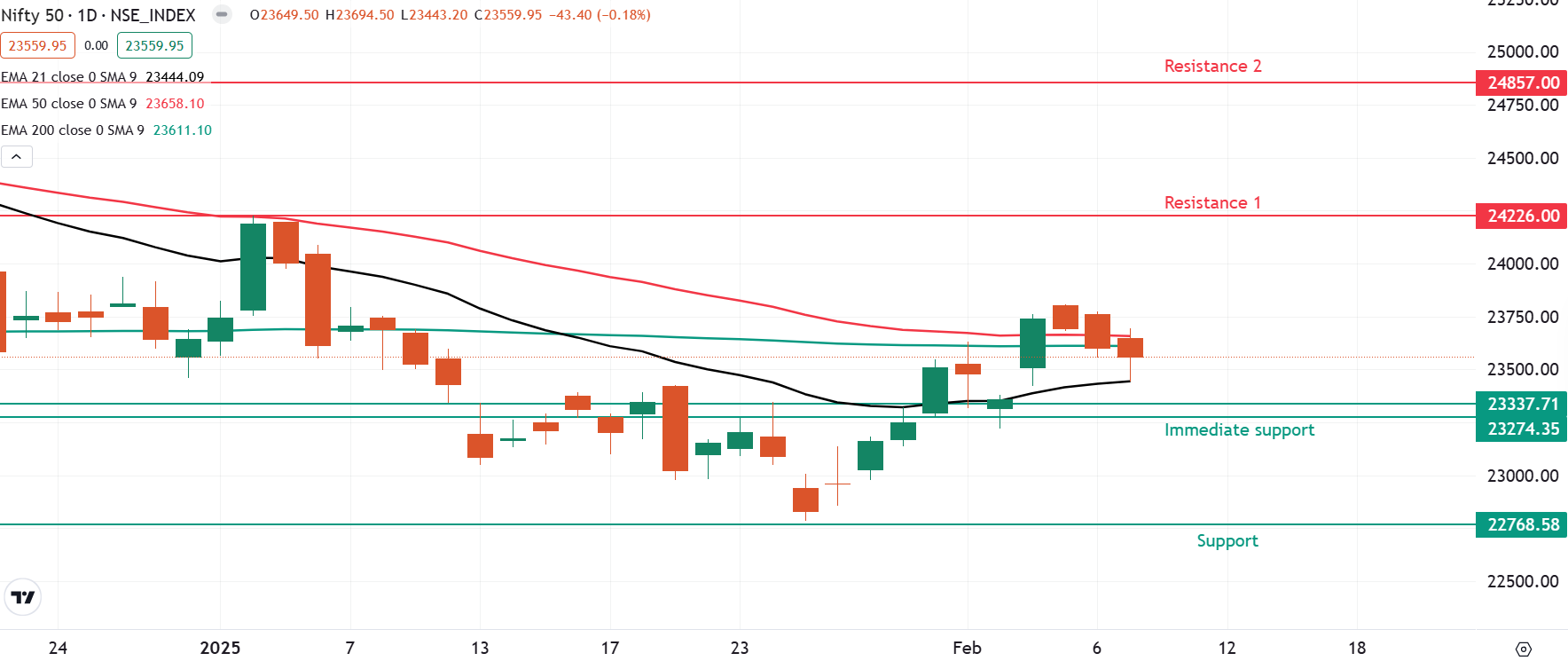

On the daily chart, the index slipped towards the 21-day exponential moving average (EMA) support zone but held the crucial 23,400 zone at the close. Meanwhile, resistance remains firm around 23,800. Traders can watch this range in the coming sessions, as a breakout on either side could set the next directional move.

Meanwhile, the open interest data for the 13 February expiry saw a significant call base at 24,000 strike. This indicates that the index may witness resistance around this zone. Conversely, the put base was seen at 23,000 strike, suggesting support for the index around this level.

SENSEX

- Max call OI: 79,000

- Max put OI: 76,800

- (30 Strikes from ATM, Expiry: 11 Feb)

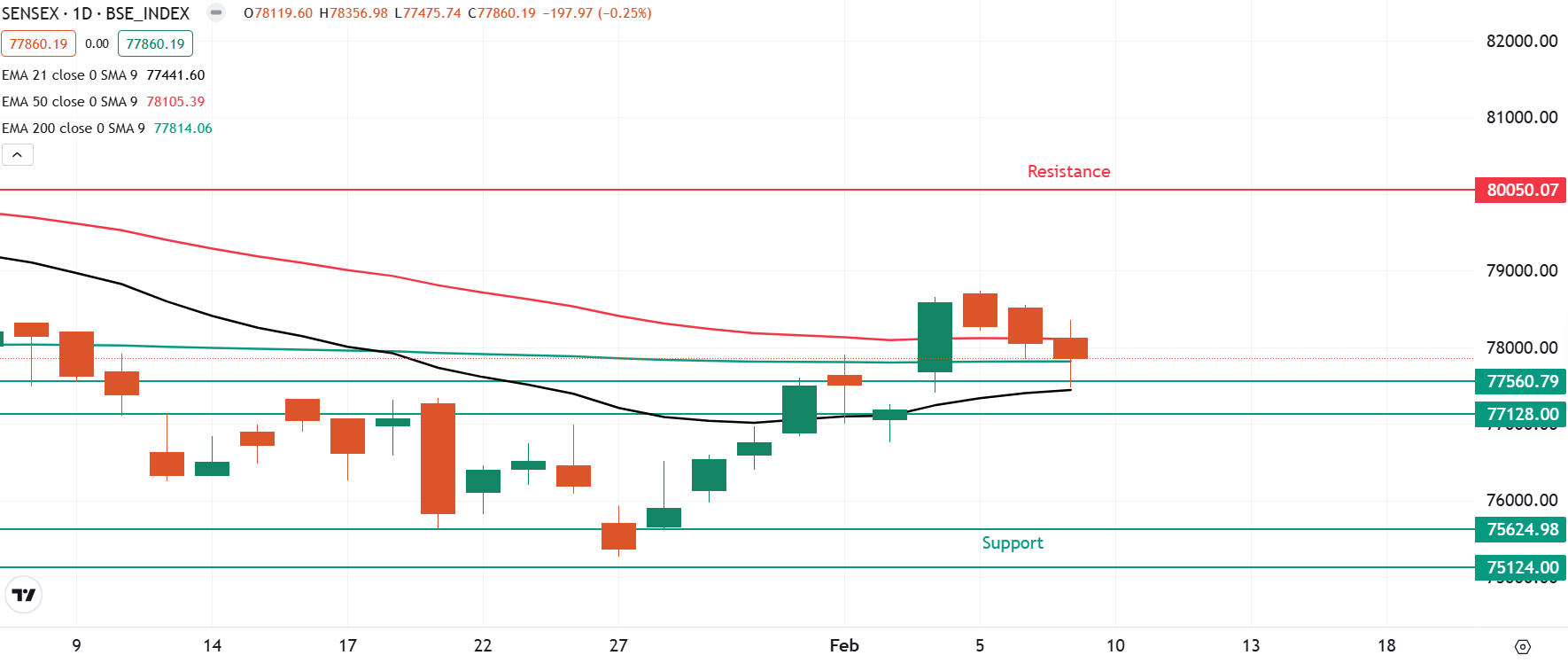

The SENSEX also extended the downtrend for the third consecutive day and slipped towards the crucial support zone of 21-day and 200-day EMAs. The index protected the crucial support zones on the closing basis and rebounded from the zone of 77,400.

The technical structure of the index remains positive and is currently consolidating within the range of 77,600 and 77,000. For the upcoming sessions, traders can monitor this trading range. A break above or below this range on a closing basis will provide further clues.

FII-DII activity

Stock scanner

- Long build-up: Chambal Fertilisers, Glenmark Pharmaceuticals, Kotak Mahindra Bank and Abbott India

- Short build-up: NCC, State Bank of India, ITC, Varun Beverages and Godrej Properties

- Top traded futures contracts: State Bank of India, HDFC Bank, Bharti Airtel, Mahindra & Mahindra and Bajaj Finance

- Top traded options contracts: Bharti Airtel 1700 CE, Bharti Airtel 1680 CE, M&M 3200 CE, SBI 750 CE and SBI 740 CE

- Under F&O ban: Manappuram Finance

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story