Market News

Trade Setup for Dec 26: Will NIFTY50 break the two-day inside candle range?

.png)

4 min read | Updated on December 26, 2024, 07:22 IST

SUMMARY

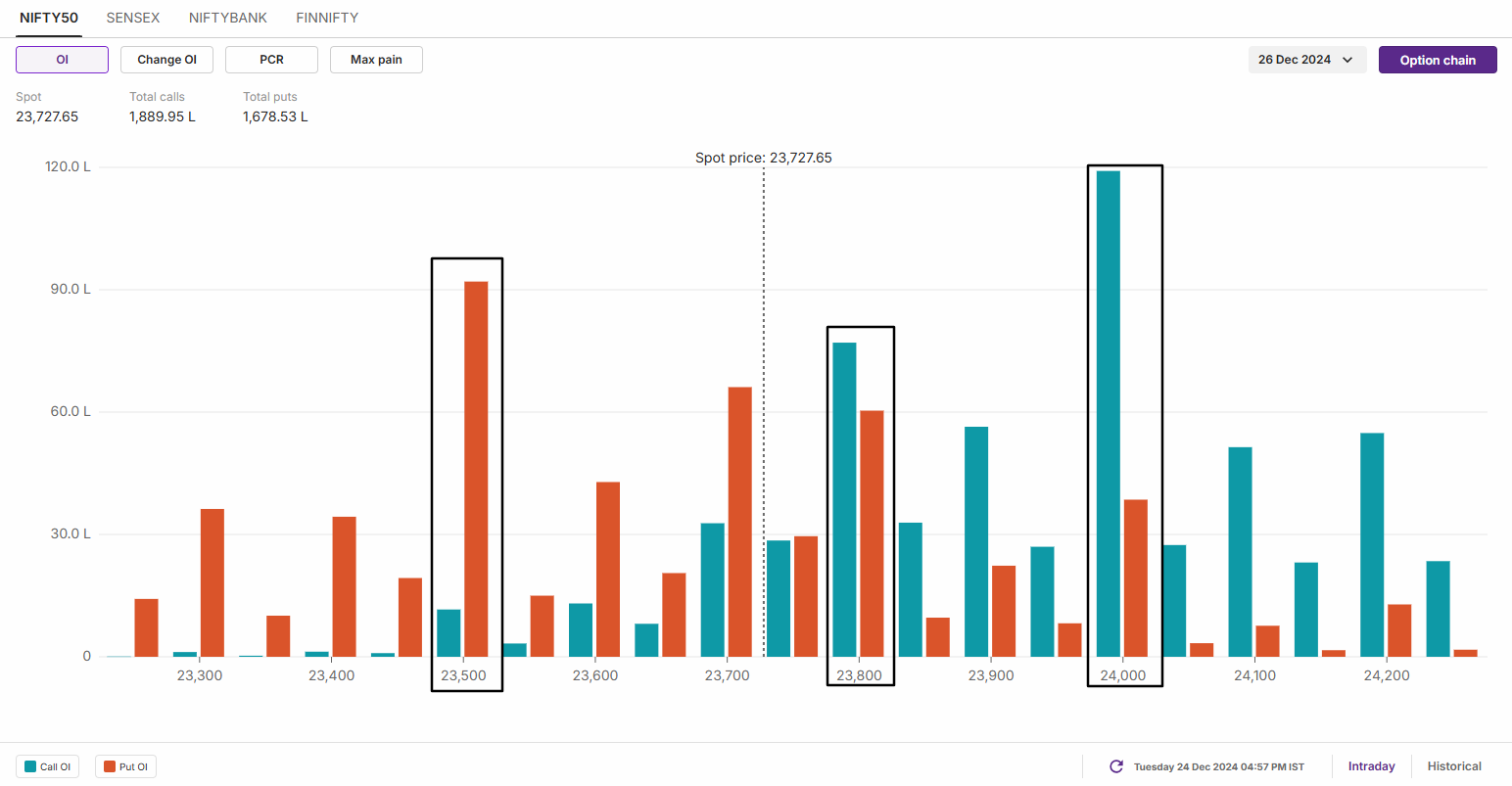

As per the options data of today’s monthly expiry, traders are expecting the NIFTY50 index to consolidate between 23,600 and 23,900 zones. However, it is important to note that the index has been consolidating in this range for the past two sessions. A break above or below this range will provide directional clues.

Stock list

Asian markets @ 7 am

- GIFT NIFTY: 23,801 (-0.06%)

- Nikkei 225: 39,325 (+0.50%)

- Hang Seng: Closed

U.S. market update

- Dow Jones: 43,297 (▲0.9%)

- S&P 500: 6,040 (▲1.1%)

- Nasdaq Composite: 20,301 (▲1.3%)

U.S. indices ended Tuesday's truncated Christmas Eve session on a higher note and rallied over 1%. The sharp gains in the indices was led by broad-based rally across sectors with technology stocks and Tesla gaining the most.

NIFTY50

- December Futures: 23,770 (▲0.0%)

- Open interest: 2,28,871 (▼37.9%)

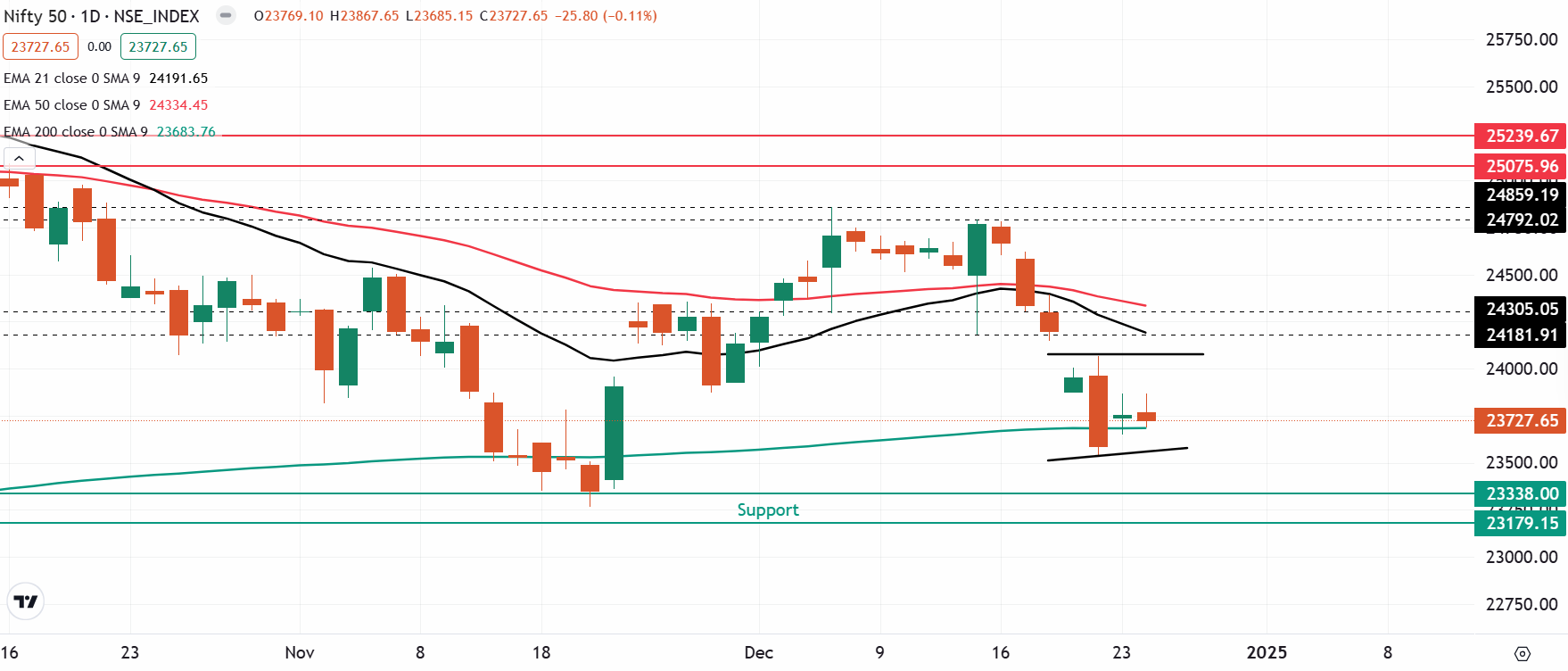

The NIFTY50 extended its range-bound movement for the second consecutive day on the 24th, forming the second inside candle on the daily chart. In addition, the index is currently hovering around the important 200-day exponential moving average, which is seen as an important psychological support.

On the 15-minute time frame, the NIFTY50 index is encountering resistance from the downward-sloping trend lines over the past three trading sessions. A decisive breakout above this trendline, accompanied by a strong candle, could signal a move toward the 24,000 zone. Conversely, if the index slides below the 23,600 zone, it may potentially retest the 23,300 zone.

The open interest data for the monthly expiry of NIFTY50 saw significant call build-up at 24,000 strike, signalling resistance for the index around this zone. On the flip side, the put base was seen at 23,500 strike, suggesting support for the index around this zone.

SENSEX

- Max call OI: 80,000

- Max put OI: 78,500

- (Expiry: 27 Dec)

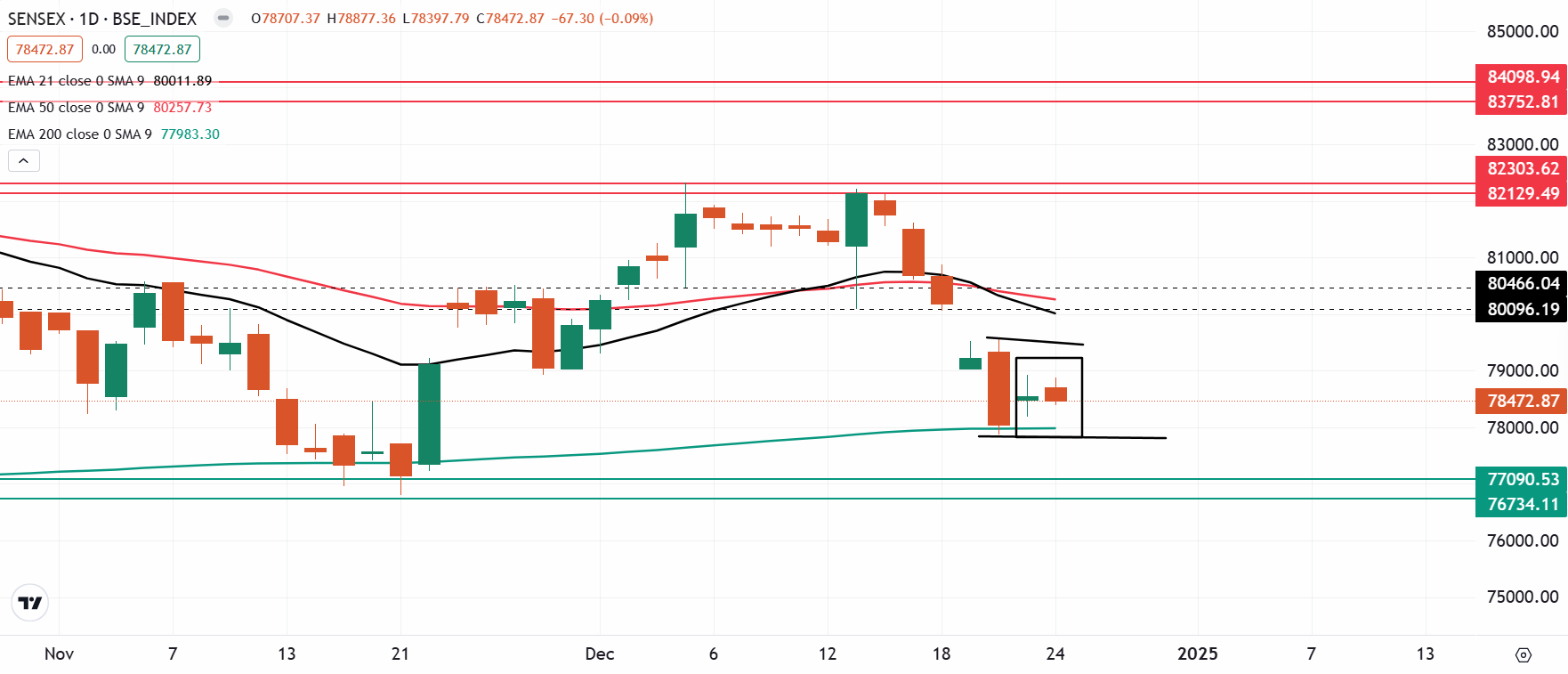

The SENSEX also extended its sideways movement for the second consecutive day and consolidated within the range of 600 points. The index also formed second inside candle on the daily chart, signalling compression of the trading range.

From the technical standpoint, the SENSEX protected its 200 day exponential moving average on 20 December and is currently consolidating around the crucial support zone. For the upcoming sessions, traders can focus on the high and low of the 20 December’s candle. A break above the high or low of this candle on a closing or intraday basis, will provide further clues.

Meanwhile, the open interest data for the 27 December expiry saw significant call build-up at 79,000 strike, indicating resistance for the index around this zone. On the other hand, the put base was seen at 78,500 strike, suggesting support for the index at this level.

FII-DII activity

Stock scanner

- Long build-up: Tata Chemicals, Interglobe Aviation (Indigo) and Hindustan Petroleum

- Short build-up: PB Fintech (Policy Baazar), Siemens, BSE and Delhivery

- Under F&O ban: RBL Bank

- Out of F&O ban: Bandhan Bank, Granules India, Hindustan Copper and Manappuram Finance

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story