Market News

Trade setup for 31 July: BANK NIFTY inside candle signals key levels at 20 and 50 DMA for today’s expiry

.png)

5 min read | Updated on July 31, 2024, 07:45 IST

SUMMARY

The BANK NIFTY has formed an inside candle on the daily chart before the monthly expiry of its futures and options contracts. The index is currently trading between its 20-day and 50-day moving averages (DMA). Unless the index breaks out of this range, traders should consider range-bound strategies.

Stock list

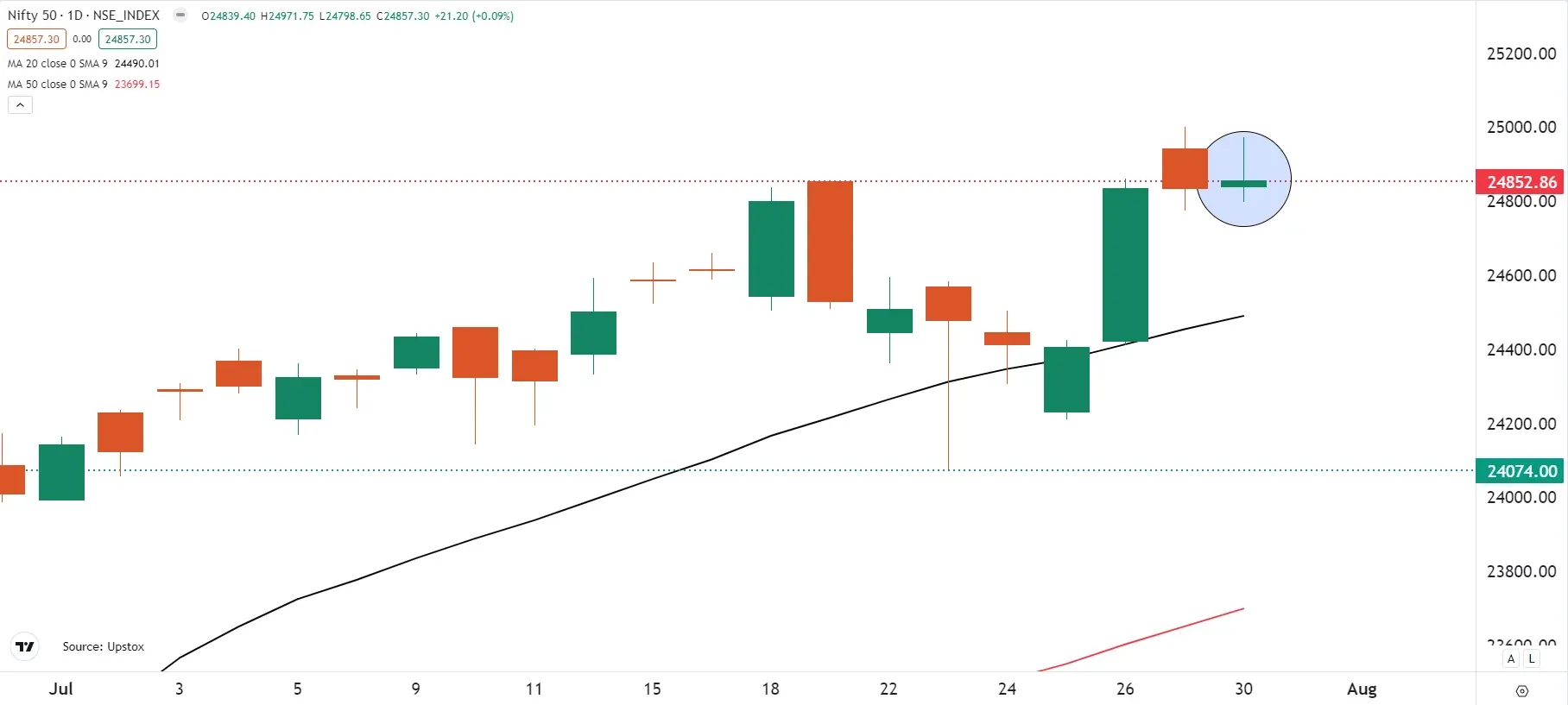

Looking for a fresh catalyst around the 24,800 zone, the NIFTY50 index formed an inside candle on the daily chart, signaling further consolidation and contraction of the range.

Asian markets update at 7 am

The GIFT NIFTY is flat, suggesting a subdued start for the NIFTY50 today. Meanwhile, other Asian markets are trading in positive territory. Japan's Nikkei 225 and Hong Kong's Hang Seng Index have each added 0.3%.

U.S. market update

- Dow Jones: 40,743 (▲0.5%)

- S&P 500: 5,436 (▼0.5%)

- Nasdaq Composite: 17,147 (▼1.2%)

The U.S. market ended Tuesday's session mixed, dragged down by the sell-off in technology stocks. Microsoft's results, released after hours, fell 5%. The tech giant's Q2 revenue and profit beat expectations, but its Azure cloud business, a central part of its AI business, grew 29%. The growth was lower than Q1's 31% and below expectations.

Meanwhile, the focus will now shift to the results of the Meta Platforms, which will be announced on Wednesday. In addition, the U.S. Federal Reserve will conclude its two meetings tomorrow. The Fed has kept interest rates unchanged in a range of 5.25% to 5.50% since July 2023.

With inflation slowing and employment data normalising, traders will be watching for a change in the statement, which would suggest consensus for a rate cut in September. According to Fed Funds futures, the market is pricing in an 86% probability of a 0.25% rate cut in September, with 14% pricing in a half point cut.

NIFTY50

- August Futures: 24,929 (▲0.0%)

- Open Interest: 5,84,140 (▲1.9%)

The NIFTY50 index started the day on a flat note, hovering around the 24,850 mark. For the second consecutive day the index witnessed profit-booking in banking and FMCG stocks near the all-time high zone, ultimately closing the day flat.

Looking for a fresh catalyst around the 24,800 zone, the NIFTY50 index formed an inside candle on the daily chart, signaling further consolidation and contraction of the range. The inside bar formation near the 25,000 mark is significant, especially ahead of the U.S. Fed policy announcement and press conference by Fed chairman Jerome Powell on 31 July.

With market pricing in status quo in interest rate between 5.25%-5.5%, traders will closely monitor the central bank’s post meeting statement for any hints of a rate cut in September. Meanwhile, the Indian markets will react to these developments on 1 August, coinciding with the expiry of NIFTY50’s weekly options contracts. For directional insights, traders should watch for a break of the low or high of the inside candle formed on 30 July on a closing basis.

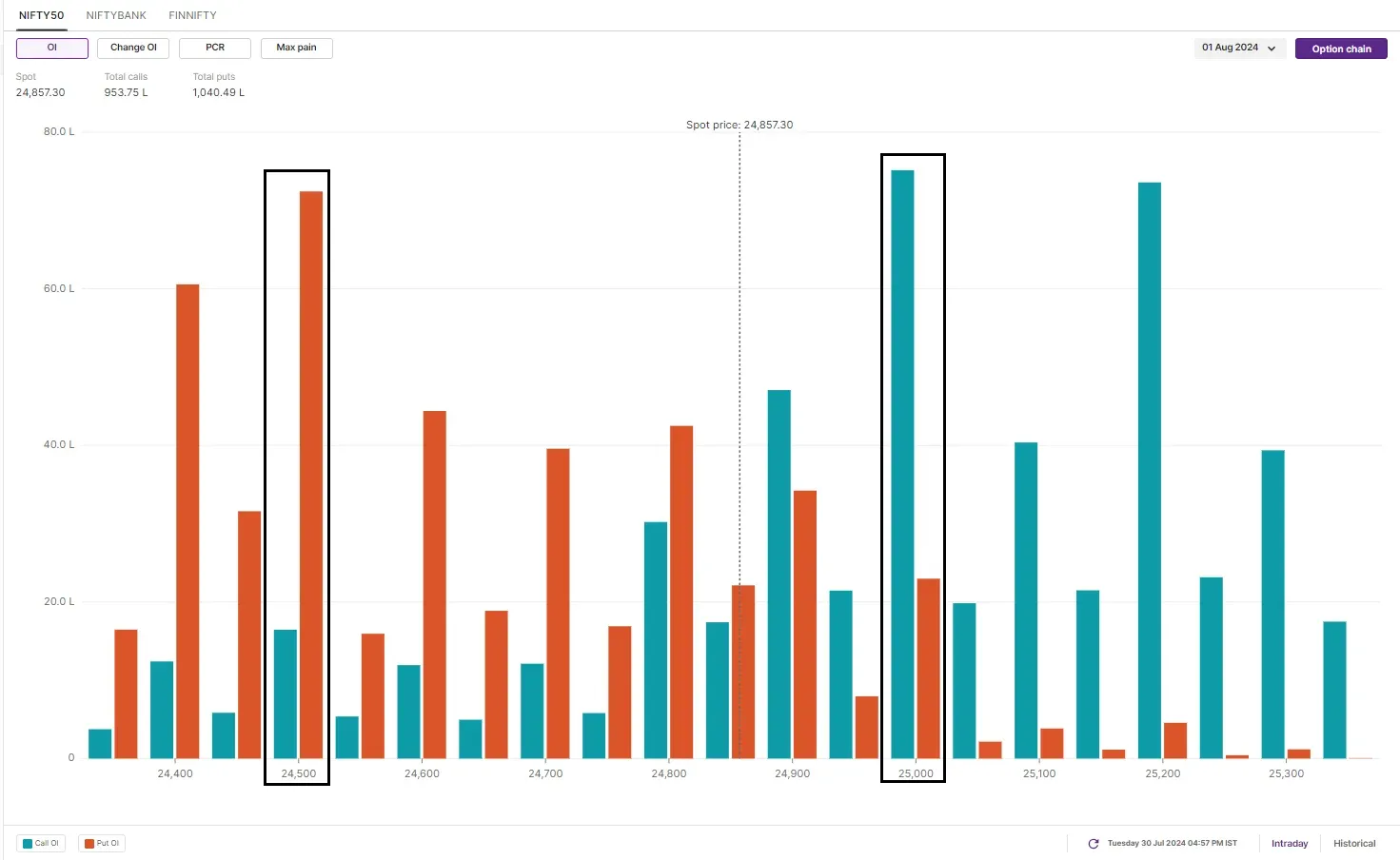

Open interest data for the 1 August expiry shows the highest call options base at 25,000 and 25,200 strikes, indicating resistance in this zone. Conversely, the 24,500 and 24,000 strikes have the highest put options base, making these as crucial support zones for the index. Ahead of the Fed policy outcome, markets may remain range-bound around 24,800 mark, with broader trend remaining bullish unless the NIFTY50 breaks below 20-day moving average on closing basis.

BANK NIFTY

- August Futures: 51,770 (▲0.0%)

- Open Interest: 1,28,896 (▲0.8%)

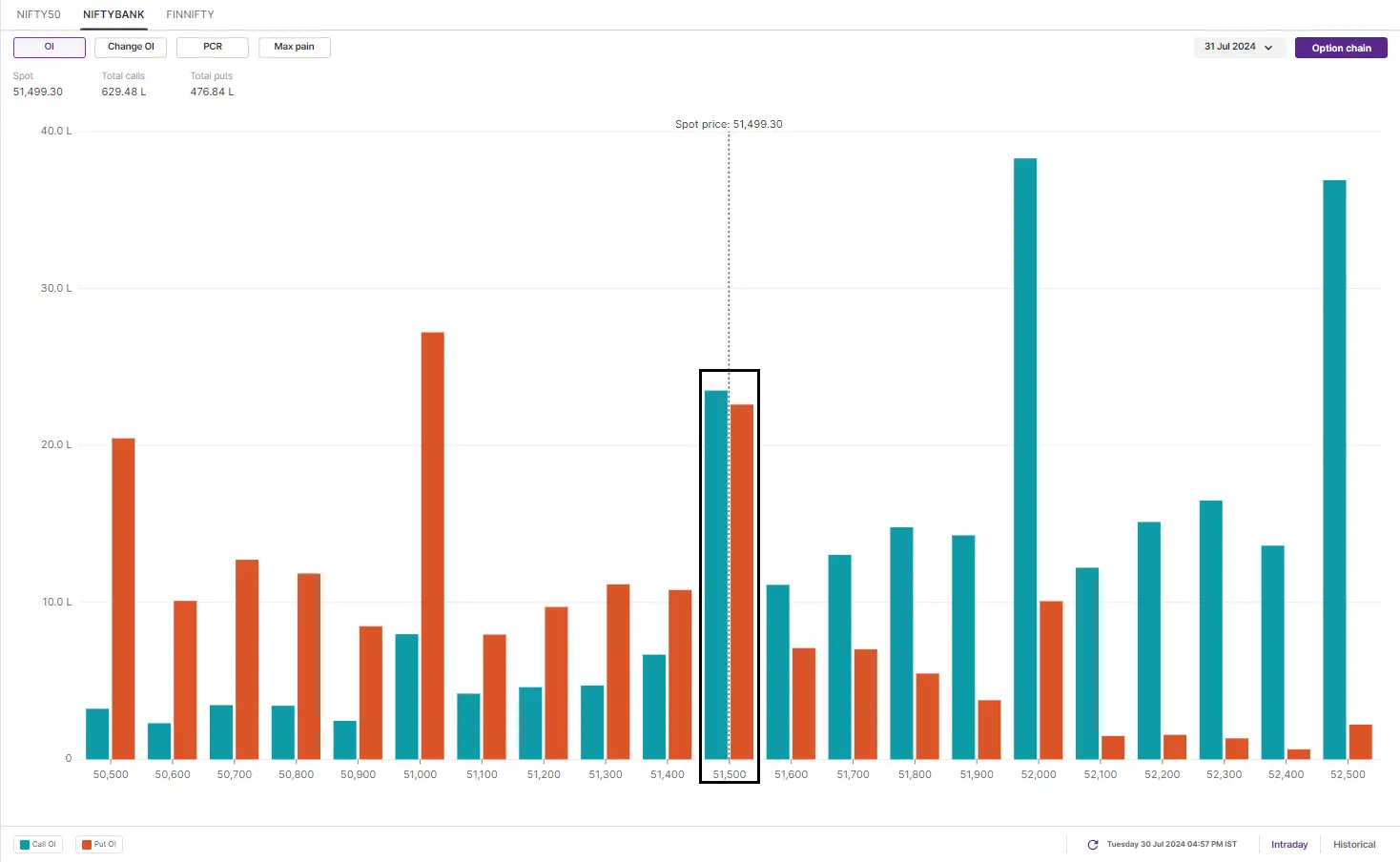

The BANK NIFTY index closed in the green for third consecutive day, despite heightened volatility. The index tarded with a positive bias throughout the day, gradually moving higher towards the 52,000 mark. However, towards the end of the session, BANK NIFTY fell nearly 500 points, surrendering the majority of its gains.

As shown in the chart below, the index has been moving higher on intraday basis for the last two days, but it faces stiff resistance around its 20-day moving average. Additionally, ahead of the monthly expiry of its futures and options contracts, BANK NIFTY has formed an inside candle on the daily chart. For directional clues, traders should monitor the break of the high or low of the inside bar of 30 July.

Before initiating aggressive bearish trades, traders should also consider that the BANK NIFTY’s 50-day moving average, around 51,800 zone, may act as a support if the low of the inside bar is broken. For better understanding, we have highlighted key levels on the 15-minute time frame for today’s expiry. Until the index decisively breaks this range, traders should plan for range-bound strategies. A break of this range will provide further directional insights.

For today’s expiry, BANK NIFTY has the highest call options base at 52,000 and 52,500, indicating resistance around these levels. Conversely, the put options base is established at 51,000 and 51,500, suggesting potential support in this range. This build-up broadly indicates potential range-bound activity around the 51,500 mark.

FII-DII activity

The Foreign Institutional Investors (FIIs) remained net sellers for the second day in a row and sold shares worth ₹5,598 crore in the cash market. On the other hand, the D

Stock scanner

Under F&O ban: India Cements

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story