Market News

Stock Market Weekly Recap: NIFTY gains 2% ending 3-week losing run, SENSEX rises 1,134 points

.png)

6 min read | Updated on March 08, 2025, 11:19 IST

SUMMARY

The stock markets are likely to remain volatile next week amid increased uncertainty due to US tariff impositions and counter threats from its trade partners. Foreign investors are likely to remain key moving factors in stock markets.

Stock list

FIIs have remained net sellers since September 2024 due to a host of reasons. | Image: PTI

- On a weekly basis, SENSEX rose 1.54%, while NIFTY advanced 1.93%.

- Coffee Day Enterprises shares surged more than 40% this week

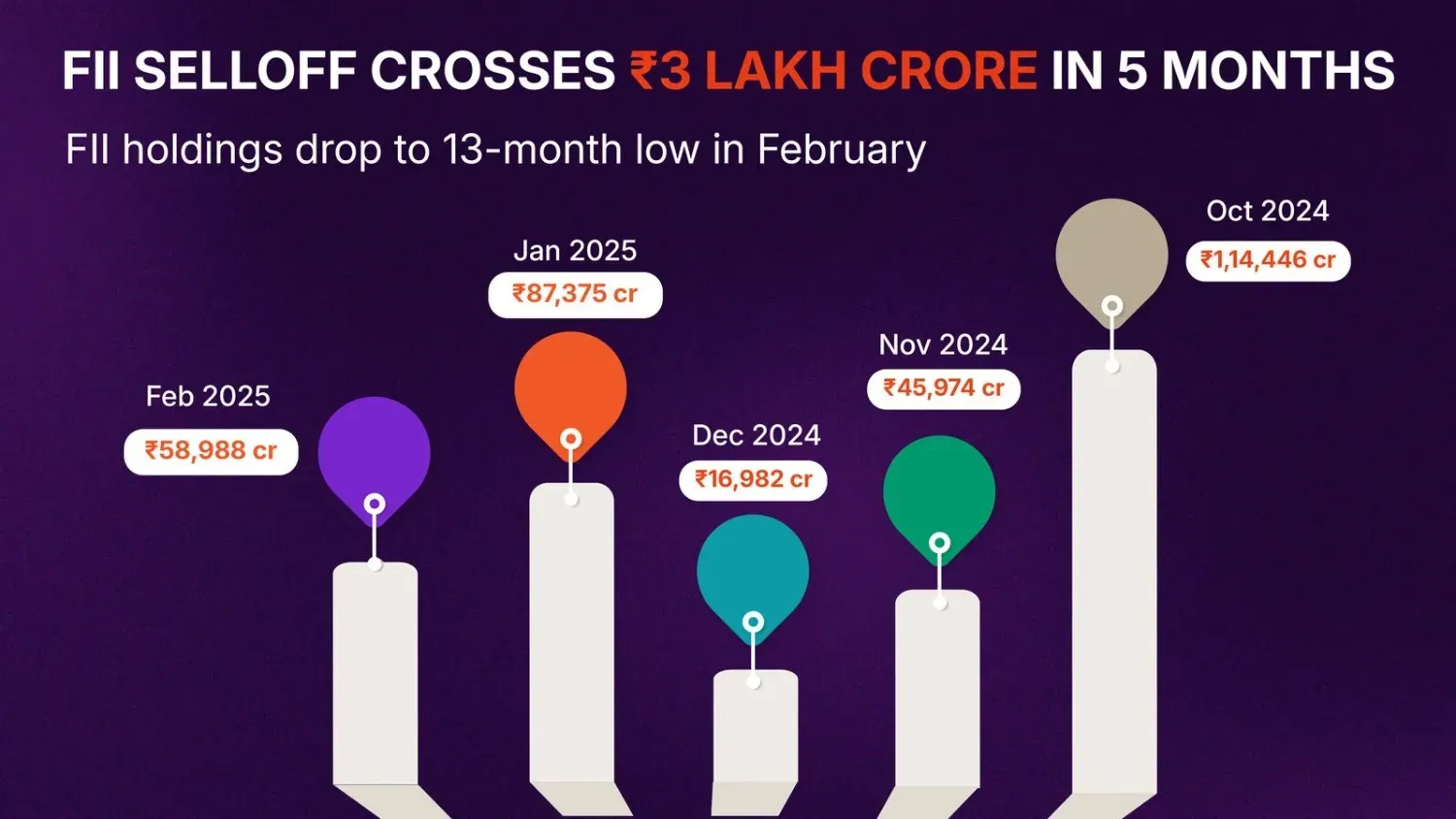

- FII selling surpasses ₹3 lakh crore in the past five months since October 2024.

- Gensol Engineering crashed nearly 40% in five sessions.

It’s that time of the week again. We are back with another quick recap of stock markets in a week, marked by volatility triggered by global factors.

Key stock indices gained up to 2% this week amid heightened uncertainty over the US tariffs that plagued the stock markets globally. The ambiguity over the US tariff actions against trade partners led to risk aversion hitting the appeal of stocks and emerging market assets this week.

Fall in crude oil prices due to increasing US inventories and growth concerns came as a booster for stock markets this week. China announced keeping its growth target at 5%, which boosted metal shares despite US tariff threats. FIIs remained net sellers in Indian equities this week, pulling out more than ₹13,000 crore on a net basis in the cash segment.

Starting the week on slippery ground, NIFTY fell for the ninth consecutive day on Monday. The barometer hit a day’s low of 22,004.7 but recovered losses towards the end of the session and closed 5.4 points lower at 22,119.3. SENSEX shed 112 points. Reliance, HDFC Bank and Adani Ports were among the major drags.

Stock indices remained in the red on Tuesday, with the SENSEX falling by 96 points to end below 73,000 at 72,989.93. NIFTY dropped for a record 10th day as the US's imposition of tariffs on Canada, Mexico, and China roiled global markets. While blue-chips fell due to FII selling, selective buying limited the downside.

Stock markets found solace in reports that the Trump administration might reverse some tariffs. NIFTY broke its 10-day losing streak, rising by 254.65 points or 1.15% to end the day at 22,337.30. SENSEX spurted 740 points to end at 73,730.23.

Key indices continued their gains on Thursday as crude oil fell to six-month lows, lifting oil and paint shares. Backed by gains in Reliance Industries and Asian Paints, NIFTY jumped nearly 1%, or 207.4 points, to close at a two-week high of 22,544.7. SENSEX jumped 610 points to settle above 74,000.

On Friday, SENSEX and NIFTY closed on a mixed note after trading in a range during. The indices retreated from the day’s high levels to close flat due to ma ixed trend in heavyweights. SENSEX closed lower by 4.51 points at 74,332.58. NIFTY settled up by 7.8 points at 22,552.5.

On a weekly basis, SENSEX rose by 1.54%, or 1134 points, while NIFTY advanced 427 points or 1.93%.

FIIs remain sellers since September, pull out over ₹3 lakh crore

FIIs have remained net sellers since September 2024 due to a host of reasons. Foreign investors have pulled out more than ₹3 lakh crore from Indian equities in the cash segment in five months to February. FIIs were net investors in September when they poured in ₹12,612 crore.

Relentless selling also reduced the assets under custody (AUC) of foreign institutional investors to a 13-month low of ₹62.38 lakh crore in February 2025. FIIs AUC had hit a low of ₹61.99 lakh crore in January 2024. It was at a peak of ₹77.96 lakh crore in September 2024.

Top gainers and losers

| Gainers | Losers |

|---|---|

| BEL (9.7%) | IndusInd Bank (-10.5%) |

| Hindalco (9.4%) | Bajaj Auto (-8%) |

| Tata Steel (9.3%) | Tech Mahindra (-6%) |

Top sectoral gainers & losers

| Gainers | Change |

|---|---|

| NIFTY Metal | +8.6% |

| NIFTY Media | +7.3% |

| NIFTY Oil & Gas | +5.3% |

US markets

| Index | Change |

|---|---|

| S&P 500 | +0.55% |

| Dow Jones | +0.52% |

| Nasdaq Composite | +0.70% |

Commodities (MCX)

| Commodity | Price | Change |

|---|---|---|

| Gold | ₹85,970/10g | +2.08% |

| Silver | ₹97,948/kg | +3.84% |

Currency gainers/losers (USD, GBP)

| Currency/Index | Change |

|---|---|

| US Dollar Index | -3.56% |

| GBP | +2.7% |

Castrol India shares rally 10% as Aramco mulls takeover

Castrol India shares soared more than 10% on Thursday after reports that Saudi Arabia’s national oil company Aramco is mulling to buy the BP-owned lubes maker. The stock soared 10.15% to settle at ₹245.88 on NSE. Aramco is considering acquiring BP's lubricant business under the Castrol brand, which is valued at around $10 billion. Aramco runsa lubricants business under the Valvoline brand.

Crude fall triggers buying in RIL, paints stocks

Crude oil prices dropped below $70 per barrel levels this week, triggering buying in Reliance Industries and paint shares like Asian Paints. Reliance Industries shares tanked to a 52-week low of ₹1,156 on Monday but snapped the three-day slide on Wednesday, rising by over 2.5%. The stock closed the week with a gain of 4%. Among paint shares, Asian Paints surged by nearly 5% to hit a three-year high on Thursday and emerge as the biggest NIFTY50 gainer. The stock closed the week higher by nearly 4%.

Gensol Engineering shares hit lower circuit after credit rating downgrade

Gensol Engineering shares traded at 52-week lows and tanked 10% to hit lower circuits on Wednesday, Thursday and Friday after rating agencies ICRA and CARE downgraded the company’s credit ratings following delays in debt servicing. In the last five sessions, the stock plunged 40%. The company clarified that it was committed to addressing the concerns raised by the downgrades. Its promoters would buy company shares from the open market soon.

Coffee Day Enterprises shares surge over 40% after NCLAT action

BSE shares slide as NSE shifts contracts expiry to Monday

What lies ahead?

The stock markets are likely to remain volatile next week amid increased uncertainty due to US tariff impositions and counter threats from its trade partners. Even as India and the US are engaged to finalise a trade deal, Trump has trained guns on India to seek favourable duties for his country. Foreign investors are likely to remain key moving factors in stock markets. Investors will also eye key data releases on the home as well as global fronts. The US data on core and consumer inflation and jobless claims would be under watch for further cues.

About The Author

Next Story