Market News

Market Highlights | NIFTY50 forms third doji as volatility kicks in ahead of Fed policy

.png)

3 min read | Updated on September 18, 2024, 18:12 IST

SUMMARY

According to weekly options data on the NIFTY50, the index has a significant put base at the 25,000 strike, suggesting support around this level. On the other hand, the call base has been added at the 25,500 strike, suggesting resistance for the index around this area.

Stock list

On the daily chart, the NIFTY50 has formed a doji candle for the third consecutive day.

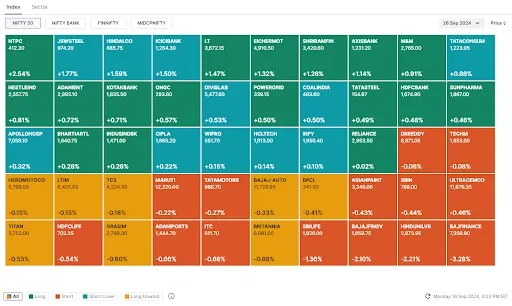

Markets hit a fresh all-time high ahead of the US Federal Reserve’s interest rate decision but saw profit-booking at higher levels, ending the day on a negative note. The NIFTY50 index formed third consecutive doji candle on the daily chart, indicating indecision ahead.

With the exception of Private Banks (+0.9%), all the major sector indices ended the day in the red and saw profit-taking. IT (-3.0%) and Pharmaceuticals (-1.5%) were the biggest losers.

On the daily chart, the NIFTY50 has formed a doji candle for the third consecutive day. In addition, the volatility index jumped 6% to 13 ahead of the US interest rate decision, causing the NIFTY50 to move sharply in both directions. The index extended its trading range and traded in the 200 point range.

For the coming sessions, the immediate support for the index remains between the 25,100 and 25,150 zones. As long as the index does not fall below this zone on a closing basis, the trend could remain positive. However, a close below it could lead to weakness.

-

Top gainer and loser in NIFTY50: Shriram Finance (+4.2%) and TCS (-3.5%)

-

Top gainer and loser in NIFTY Midcap 100: Torrent Power (+8.4%) and Oracle Financial Services Software (-8.4%)

-

Top gainer and loser in NIFTY Smallcap 100: Graphite India (+9.2%) and Glenmark Pharmaceuticals (-4.1%)

Key highlights of the day

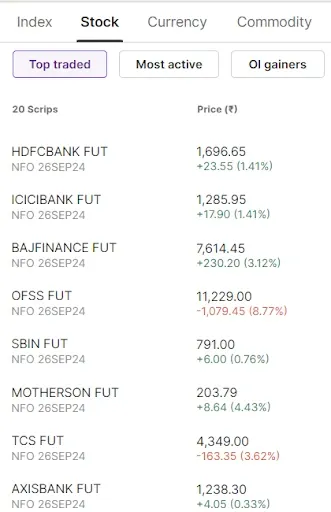

Top traded futures contracts

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Oracle Financial Services Software, TCS, HCL Technologies, Infosys and Tech Mahindra

📈Open=Low (Bull power): ICICI Bank

🏗️Fresh 52 week-high: BSE, Torrent Power, Shriram Finance, ICICI Bank and Cholamandalam Investment

⚠️Fresh 52-week-low: N/A

See you tomorrow!

About The Author

Next Story