Market News

Dixon Technologies,Trent Ltd and Max Healthcare posted consistent growth in sales and profit for past 3 years

.png)

4 min read | Updated on December 17, 2024, 12:10 IST

SUMMARY

In this article, we have highlighted 3 companies with an average growth of at least 25% in sales and profits over the past 5 years. Additionally, all these companies have maintained positive free cash flow in the last 3 years. Only companies with a market capitalisation above ₹1,00,000 crore were considered for the analysis.

Stock list

Three stocks with good sales growth and profits of 25% in five years and positive cash flow in the past 3 years

As the calendar year 2024 draws to a close, we have analyzed to filter companies showing consistent growth in sales and profits. The analysis was based on three key metrics: average sales growth and average profit growth of at least 25% over the past 5 years, along with positive free cash flow for the last 3 years.

The query included only companies with a market capitalisation exceeding ₹1,00,000 crore to further narrow the selection. As a result, 3 companies stood out, meeting these criteria, and showcasing excellent financial performance over the past 5 years.

Here is the list of the top 3 companies that have met the criteria.

| Name | Current Price | Market Capitalization | Sales growth 5 Years | Profit growth 5 Years |

|---|---|---|---|---|

| Trent | 6979.85 | 248124.88 | 36.3 | 56.5 |

| Max Healthcare | 1181.3 | 114838 | 26.17 | 780.3 |

| Dixon Technologies | 18665.95 | 112128.61 | 42.75 | 42.34 |

Source: Screener, Data as of December 16, 2024

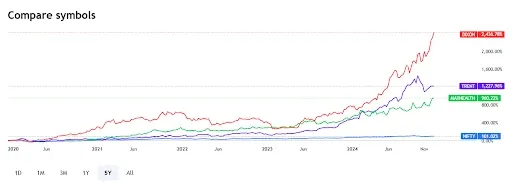

5 Year Share Price Performance against Nifty 50

Max Healthcare Institute Ltd

Q2 FY25 Performance

In Q2 FY25, revenue grew 22% YoY to ₹2,228 crore, operating EBITDA rose 19% YoY to ₹591 crore, and net profit increased 13% YoY to ₹383 crore. Average occupancy improved to 81% (from 77% in Q4 FY24). Management expects higher ARPOB and occupancy as TPA empanelments and insurance certifications conclude by January 2025.

Trent

Zudio which caters to the value format of the apparel segment has been the major contributor to the sales & profit growth of Trent.

Q2 FY25 Performance

In Q2 FY25, revenue jumped 39% YoY to ₹4,157 crore from ₹2,982 crore. EBITDA increased 41% YoY to ₹643 crore with a 20 basis points expansion in EBITDA margin to 15.5% margins, and net profit saw an uptick of 47% YoY to ₹335 crore.

Management noted that new beauty segments and expansion into the UAE will drive future growth.

Chairman Noel Tata noted that the company showed strong performance across brands and categories, despite muted consumer sentiment. The company expects new beauty segments and expansion into the UAE to drive future growth.

Dixon Technologies

Dixon’s strong ties with marquee clients like Samsung, Motorola, Xiaomi, Acer and Lenovo are one of the reasons for its strong financial performance.Another major reason is the advantage of government incentives, such as the PLI scheme. With the PLI scheme, Dixon has been able to increase its revenue from mobile phone production from 12% in FY20 to 62% in FY24.

Q2 FY25 performance

Dixon Technologies revenue from operations took a huge jump from ₹4,943 crore in Q2 FY24 to ₹11,534 crore showing a growth of 133%.

The EBITDA stood at ₹426 crore, marking a 114% YoY increase from ₹199 crore. EBITDA margin declined by 30 basis points to 3.7%.

The bottom line surged over 3.5 times to ₹412 crore, which is 265% higher as compared to ₹113 crore in Q2 FY24.

Management noted that it has a healthy order book from brands including Motorola, Xiaomi, and Oppo. Management is confident about capitalising on India's consumption narrative and Make in India initiative, aiming for industry-leading growth.

The above companies have displayed excellent growth in the past 5 years and it is also reflected in the share price returns of the companies.

About The Author

Next Story