Market News

Zinka Logistics IPO Day 2: Issue subscribed 30% so far as retail investors lead; check lot size and key dates

2 min read | Updated on November 14, 2024, 13:38 IST

SUMMARY

Zinka Logistics IPO is a mix of new equity shares worth ₹550 crore and an offer-of-sale (OFS) component valued at ₹565 crore by promoters and existing shareholders.

Zinka Logistics, established in 2015, is the largest digital platform for truck operators in India.

Zinka Logistics IPO: The initial public offering of Zinka Logistics Solutions Ltd was subscribed 30% so far on Thursday, the second day of bidding.

The IPO got bids for 66,90,060 shares against 2,25,67,270 equity shares on offer, as per data on the NSE website.

Retail investors led the demand as quota reserved for them was subscribed 78%. The qualified institutional buyers (QIBs) category mopped up 26% subscribed, while the non-institutional investors (NIIs) part fetched 3% subscription.

The initial share sale, which has set a price range of ₹259-₹273 per share, will conclude on Monday, November 18.

The ₹1,115 crore IPO is a mix of new equity shares worth ₹550 crore along with an offer-of-sale (OFS) component valued at ₹565 crore by promoters and existing shareholders.

The money generated will be used for sales and marketing initiatives, investment in its NBFC subsidiary Blackbuck Finserve, fund product development expenditure, and serve general corporate purposes.

Before the IPO, Zinka Logistics Solutions Ltd collected more than ₹501 crore from anchor investors, including SBI Mutual Fund (MF), Invesco MF, Bandhan MF, Nomura, ICICI Prudential Life Insurance Company, Steadview Capital Mauritius, Hornbill Orchid India Fund and TIMF Holdings.

Zinka Logistics IPO: Lot size

Investors can apply for a minimum of one lot size or 54 shares, taking the transaction value to ₹14,742.

Zinka Logistics IPO: Allotment and listing date

- Bidding period: November 13-November 18

- Allotment finalisation: November 19

- Refund initiation: November 20

- Demat transfer: November 20

- Listing on NSE and BSE: November 21

Zinka Logistics IPO: About the company

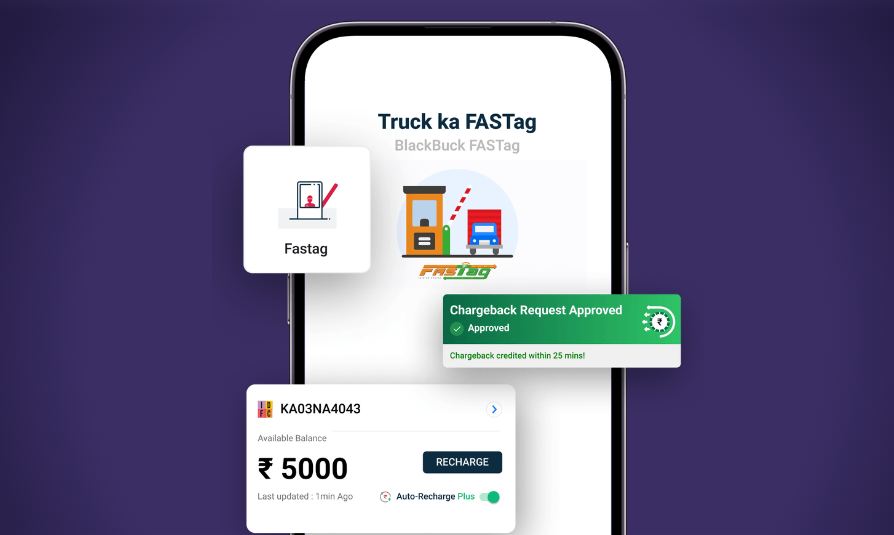

Zinka Logistics, established in 2015, is the largest digital platform for truck operators in India as of the financial year 2023-24. The company's BlackBuck app is a comprehensive platform that offers solutions for payments, load management, telematics, and vehicle financing.

The company partners with FASTag banks and oil marketing companies (OMCs) to provide efficient and secure tolling and fueling solutions, earning revenue through commission margins based on transaction values.

Morgan Stanley India Company, Axis Capital, IIFL Capital Services, and JM Financial are the book-running lead managers to the issue, while KFin Technologies is the registrar.

About The Author

Next Story