Market News

Axis Bank Q4 preview: Can strong earnings push the stock to a new all-time high?

.png)

3 min read | Updated on April 23, 2025, 09:13 IST

SUMMARY

Axis Bank shares have jumped over 13% in the past five trading sessions, forming a bullish candle on the weekly chart. A close above the high of this pattern would confirm the breakout, suggesting further upward momentum.

Stock list

Axis Bank shares in focus as the private lender will announce its Q4FY25 earnings today.

Private sector lender Axis Bank will announce its March quarter results on 24 April. After HDFC Bank and ICICI Bank's upbeat quarterly results, investors are expecting a similar performance from Axis Bank.

According to experts, Axis Bank may report mixed Q4 results. The bank's net interest income (NII) is expected to grow by 5-8% on an annual basis to ₹13,750-13,930 crore. Meanwhile, its net profit may decline by 6-8% YoY between ₹6,670 crore to ₹6,870 crore.

Axis Bank investors will be watching key metrics such as net interest margin, growth in advances, gross and net non-performing assets (NPAs), management commentary and dividend announcement during the quarterly earnings announcement.

Ahead of the Q4 earnings announcement, Axis Bank shares are traded flat-to-positive at ₹1,225 per share on Wednesday, 23 April. So far this year, Axis Bank shares have returned over 14% to investors.

Technical view

Shares of Axis Bank have surged over 13% in the past five trading sessions, reclaiming key support levels at the 21-week and 50-week exponential averages. The stock also closed above the March swing high (₹1,123), siganlling strong buying interest from lower levels.

It's now approaching a critical resistance zone near ₹1,281. A close above this level could open the door for further upside. On the flip side, ₹1,123 now acts as a key support. As long as the stock holds above this on a closing basis, the bullish trend is likely to continue.

Options outlook

Open interest data for the 29 May expiry shows a high concentration of put options at 1,200 strike, suggesting crucial support base for the bank around this level.

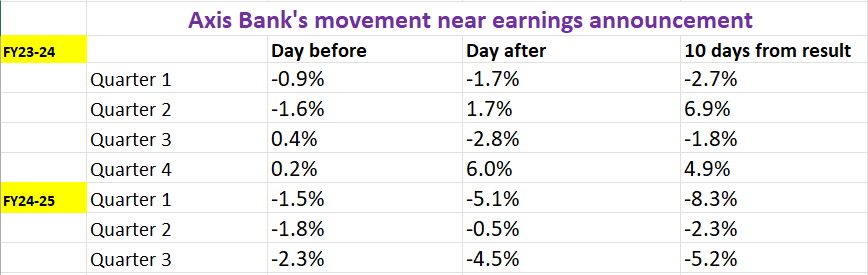

Axis Bank's 29 May expiry at-the-money (ATM) strike is 1,220, with both call and put options priced at ₹92. This indicates an expected price movement of ±7.6% ahead of 29 May’s expiry. To make more informed trading decisions, let's look at Axis Bank's historical price behaviour during previous earnings announcements.

Options strategy for Axis Bank

Based on options data suggesting a potential price movement of ±7.6%, traders have the opportunity to engage in either a long or short volatility strategy.

For those looking to capitalise on the sharp price movement in Axis Bank, the Long Straddle strategy is appropriate. This involves buying both an at-the-money (ATM) call and put option with the same strike price and expiry of Axis Bank. This strategy aims to profit from a move of more than ±7.6% in either direction.

Conversely, the Short Straddle strategy is suitable for scenarios where volatility is expected to fall. In this approach, a trader would sell both an ATM call and put option with the same strike price and expiry, implying that the price of Axis Bank will remain within a range of ±7.6% after the earnings release.

Meanwhile, traders who anticipate Axis Bank to continue its bullish momentum and test the crucial resistance zone of ₹1,281 can consider Bull Call Spread. The strategy involves buying a call option and selling a higher strike call with the same expiry, helping lower the cost while limiting upside.

Disclaimer Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story