FinNifty Index – All you need to know

What is the FinNifty index?

The Nifty Financial Services Index (FinNifty) reflects the performance of India’s financial sector including banks, non-banking finance companies, housing finance companies, insurers (general and life), asset management companies, credit card companies and other financial services companies. It consists of 20 stocks that are listed on the National Stock Exchange (NSE).

The NSE launched this index in September 2011 with a base date of 1 January 2004. It’s important to note that this index, like its peers, is rebalanced every six months. The cut-off dates for the rebalancing of the index are 31 January and 31 July of each year.

Constituents of FinNifty Index

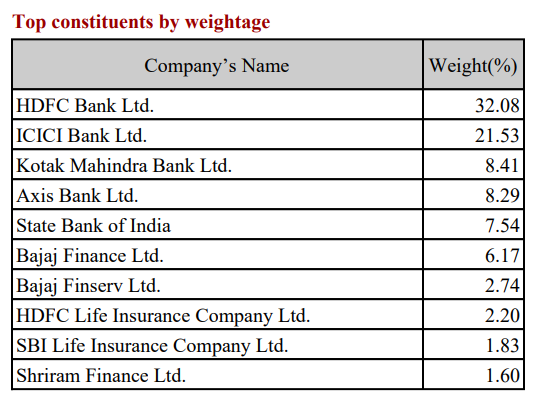

Financial services companies from the Nifty 500 universe are eligible to be a part of the FinNifty Index. No single stock shall be more than 33% and the weightage of the top three stocks cumulatively shall not be more than 62% at the time of rebalancing, according to the index methodology.

Here are the top constituents by weightage:

Source: NSE

Source: NSE

India’s largest private bank HDFC Bank has the highest weightage in the FinNifty Index, followed by ICICI Bank, Kotak Mahindra Bank, Axis Bank and State Bank of India. Some of the other key constituents are Bajaj Finserv, Bajaj Finance, HDFC Life, SBI Life and Shriram Finance.

Nifty Financial Services (FinNifty) F&O

In January 2021, NSE introduced futures & options (F&O) contracts for Nifty Financial Services Index. Simply put, the underlying index for these derivatives is FinNifty. These derivatives are settled on the last Tuesday of the expiry period. And, if Tuesday is a trading holiday, then the expiry day is the previous trading day.

Also, FinNifty Index Options have weekly and monthly expiry. Whereas, FinNifty Index Futures are settled on a monthly basis.

And, note that the lot size for FinNifty is 40 currently.