Why You Shouldn’t Panic When Markets Fall

Written by Mariyam Sara

Published on October 31, 2025 | 3 min read

Do you find yourself constantly monitoring the market?

Many novice investors panic-sell during market downturns, booking a loss and regret when the market recovers. Here’s why you should not let your emotions dictate your investment decisions when markets fall.

Market Volatility Is Normal

Every minute, every second the market is changing. You will never see the prices being constant, so accept that volatility is a part of the market and is completely normal. Volatility is inevitable, but you can decide if it's a boon or a bane for you by having a comprehensive investment plan in place.

You should know how and when to take advantage of the market volatility to make profitable investment decisions.

Panic Selling Will Impact Your Long-Term Growth

When markets fall during significant events like it did during the pandemic, many investors panic sell at an already lower price and book a loss. You may think you’re reducing your potential losses but this can make it difficult for you to recover. Because when the market recovers, which they always do, you will miss out on significant gains which you could have received.

Recovery will not be immediate, but not panicking gives your investments the time to recover and maybe hit new highs.

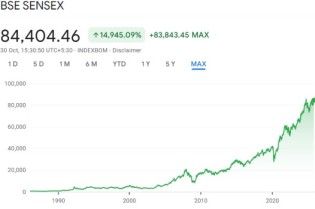

Long-Term Uptrend In the Market

Let’s look at the BSE Sensex. Founded in 1986, right from its inception, the index has always been in a steady uptrend. You can observe some major falls around the Global Financial Crisis in 2008 and the COVID-19 Pandemic in 2020, and both times the market bounced back and only went up. So don’t sweat the market volatility, look at the bigger picture.

Stick to Your Financial Plan

When markets fall, controlling your emotions isn’t easy. Every news channel is blaring the siren that the markets are falling, people panicking and selling may influence you, but don't let it.

Yes, your portfolio is in the red, and nobody knows when the market will bounce back. But you need to stick to your financial plan, and after the storm, the sky will clear up and the markets will start rising.

So continue investing regularly, even during downfalls. Stay updated about the market, but don’t let it guide your investment decisions, and review and balance your portfolio periodically.

Rise, fall, and recover, that’s the market’s cycle. You need to understand the market and plan an investment strategy that will not quiver during market downturns. Market downfalls can be stressful, but with patience and discipline, you can weather the storm.

About Author

Mariyam Sara

Sub-Editor

holds an MBA in Finance and is a true Finance Fanatic. She writes extensively on all things finance whether it’s stock trading, personal finance, or insurance, chances are she’s covered it. When she’s not writing, she’s busy pursuing NISM certifications, experimenting with new baking recipes.

Read more from MariyamUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.