Top EV (Electric Vehicle) Stocks in India

Written by Dev Sethia

Published on November 19, 2025 | 3 min read

Top EV (Electric Vehicle) Stocks in India

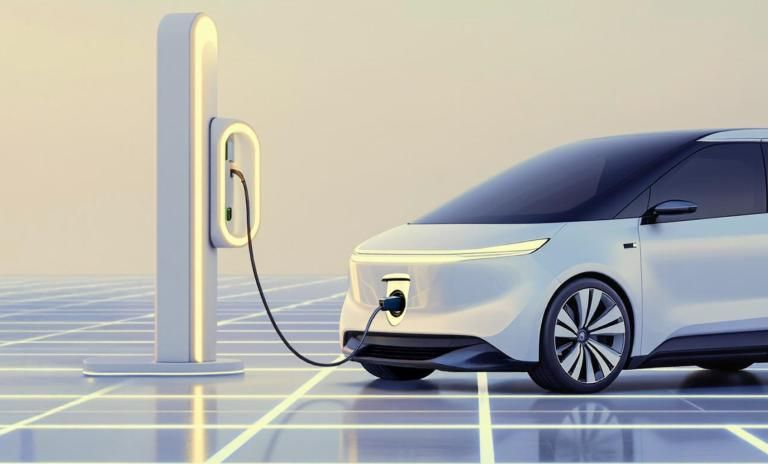

The word EV refers to Electric Vehicle and EV stocks represent shares in companies that manufacture electric cars or components that are used to build electric vehicles. Unlike conventional internal combustion engine vehicles, EVs utilise batteries and electric motors and are considered a cleaner, sustainable alternative for transportation.

Electric vehicles are seeing unprecedented traction in many parts of the world as a result of government subsidies and sustainability measures and infrastructure supported by costs incurred in infrastructure, such as charging stations for electric vehicles.

Companies engaged with electric vehicles include traditional automotive manufacturers, such as Tesla, General Motors, and Nissan, as well as companies associated with producing or supporting components for electric vehicles, batteries, electric motors, charging components, etc.

In India, EV stocks have the potential to generate strong returns and are considered a commoditised investment theme that appeals to the investor and trades in a hot space associated with automotive stocks and renewable energy initiatives.

Why Investing in EV Stocks in India Could Be Smart

Here are the top 10 factors to know why it will be a smart choice to invest in Indian EV stocks

Growth Potential

Compared to the next best established market, EV adoption is still in the early adopter phase for most of India. This means that there is a large opportunity for the mass adoption of EVs in the near future and companies serving the market will benefit.

Competitive Advantage

Some of the largest Indian auto manufacturers are already established in the EV market and will hold an advantage in efficiently developing and manufacturing products.

Low Production Costs

India has low production costs, making it an attractive place to build EVs, reducing costs on the overall vehicles.

Rising Fuel Prices

As fuel costs are increasing quickly in India, especially due to events such as the Russian conflict and various supply chain issues and EVs provide an economic stability advantage over normal combustion engines and vehicles.

Better Infrastructure

The government is allocating resources towards EV infrastructure, such as charging stations, that help support businesses associated with EVs.

International Partnerships

Indian companies are establishing important partnerships with global companies as a way to develop advanced technology and knowledge.

Government Supported Policies

The government intends to make India a global EV manufacturing location, as per a government report, including a target for 30% of all vehicles to be converted to electric by 2030.

Environmental Benefits

Transitioning to EVs will lower pollution and greenhouse gas emissions, resulting in a cleaner, more sustainable environment.

Long-Term Investment

As the EV market grows over the coming decades, this may benefit investors who are positioned to capitalise in support of advancing sustainable transportation solutions globally.

Top EV Stocks in India

As the EV market in India expands, investors are looking for stocks with the highest growth potential.

Here are some of the best EV stocks in India:

Factors to Consider Before Investing

The EV world looks like it could grow a lot, but if you're going to put money into EV companies in India, here's what you should think about:

Market Potential

See if the Indian EV market is likely to grow and whether the company can get a good slice of it.

Company Financials

Check if the company's income is growing, if they're making money, how much debt they have, and if they have enough cash to stay healthy.

Competitive Landscape

See if the company can beat out the other companies, both old and new.

Government Policies

Think about how rules, free money, and other good stuff from the government could help the company grow.

EV Infrastructure

Look at what the company plans to do about charging spots, battery swaps, and other things people driving EVs will need.

International Partnerships

See how good it is that the company is working with others around the world and getting new tech.

Investing in electric vehicle (EV) stocks in India has the potential to generate massive returns over the long term however, it requires diligence in researching and analysis. The growth potential in the market, financial stability, competitive landscape, government policies, infrastructure, global tie-ups, sustainability, and innovation all play a pivotal role in determining success.

With the potential for exponential growth in India’s EV market, investors who properly evaluate these factors and invest in companies with solid fundamentals and a long-term aim can profit from the adoption of sustainable transportation.

FAQs

What are EV stocks?

They are the shares of electric vehicle and battery manufacturing companies, along with investments in charging stations for clean transport.

Why are electric vehicle stocks getting so hot in India?

The government is giving incentives that attract investors and thus, EV stocks are getting a lot of attention. Fuel prices are constantly rising, the EV infrastructure is becoming more extensive, and people are gradually accepting green transportation.

What are the top EV stocks in India?

The EV stocks in India include the major ones like Tata Motors, Mahindra & Mahindra, Hero MotoCorp, Ashok Leyland, Bharat Forge, Exide Industries, HBL Power Systems, and Ather Energy.

What is the government actually doing to support EVs in India?

Incentives and tax breaks to consumers and lowering import taxes are the main conduits through which the Indian government intends to popularise EVs.

What factors should you take into consideration before investing in EV stocks?

The following factors are market, the company's financial health, competitive position, government policies, EV strategies, innovations, and corporate social responsibility, before you direct your funds into EV stocks.

About Author

Dev Sethia

Sub-Editor

a journalism post-graduate from ACJ-Bloomberg with over three years of experience covering financial and business stories. At Upstox, he writes on capital markets and personal finance, with a keen focus on the stock market, companies, and multimedia reporting. When he’s not writing, you’ll find him on the cricket pitch

Read more from DevUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.