What is Box Spread trading Strategy

Written by Upstox Desk

Published on October 17, 2025 | 4 min read

A box spread is a multi-leg, risk-defined, neutral options strategy with limited profit potential. Long box spreads look to take advantage of underpriced options and create a risk-free arbitrage trade. The long box spread consists of buying a bull call spread and buying a bear put spread centered at the underlying security price. The two spreads have the same strike prices and expiration dates, which creates a “box” around the security price.

This strategy is executed when the spreads are underpriced. The bullish spread will incur profit when the price of the underlying is closed at the higher strike price whereas the bearish spread will generate profit when the underlying is closed at a lower strike price. The profit potential is limited.

As box spread is based on arbitrage it is considered risk-free. Any up move in any one of the spreads is balanced by the down move in the other spread. This leads to no loss and makes the box spread in options strategy as a delta-neutral strategy.

Illustration

Since the spread is a combination of bull call spread and bear put spread. The structure is deployed by buying an In-the-Money call and put options at the same strike price and selling out-of-the-money call and put options at the same strike price. Nifty is currently trading at 17,670.

| Strategy | Index | Action | Strike | Premium |

| Box Spread Option Strategy | Nifty50 | Buy Call | 17,600 (strike 1) | -106 |

| Sell Call | 17,800 (strike 2) | 38 | ||

| Sell Put | 17,600 (strike 3) | 40 | ||

| Buy Put | 17,800 (strike 4) | -110 | ||

| Net Premium | -138 |

The combination of spread results in net out flow of premium amounting to ₹138.

Box value at expiry = (strike 2 -strike 1) = (17,800 -17,600) = 200

Max potential profit = (Box value at expiry – net premium paid) * Lot size = (200 -₹138) * 50 = ₹62 * 50

= ₹3,100

In theory, the Long box spread is risk free and therefore the opportunity of risk-free arbitrage arises.

The spread is typically deployed when interest rates are low. There is a variation in this strategy, where the combination of buying and selling is reversed, leading to inflow of premium, this is also known as short box spread. However, the short box is vulnerable to early exercise if the underlying is based on American style options.

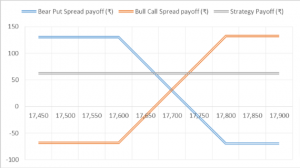

Payoff Schedule

| Nifty50 @ Expiry | Bear Put Spread payoff (₹) | Bull Call Spread payoff (₹) | Strategy Payoff (₹) |

| 17,450 | 130 | -68 | 62 |

| 17,500 | 130 | -68 | 62 |

| 17,550 | 130 | -68 | 62 |

| 17,600 | 130 | -68 | 62 |

| 17,650 | 80 | -18 | 62 |

| 17,700 | 30 | 32 | 62 |

| 17,750 | -20 | 82 | 62 |

| 17,800 | -70 | 132 | 62 |

| 17,850 | -70 | 132 | 62 |

| 17,900 | -70 | 132 | 62 |

Payoff Chart

| Trivia: There is an infamous case of an anonymous trader whose entire margin account and net worth amounting to $60,000 was wiped out in just one day. The trader had initiated multiple short box option strategies on a single stock, using American-style options. When the price moved on the lower side, the counter party decided to exercise the call options and collect shares before the expiry. This led to a complete breakdown of spread leaving the trader unhedged on the surviving position. |

Conclusion

- Box spreads are used by traders to synthetically borrow or lend for cash management purposes.

- The profit earned is very minimal and may get eliminated by high maintenance margin requirements and commission on four legs. Also, it is important to keep the position open till the expiry.

- Box spread is an advanced option strategy and therefore not easy to deploy. Novice traders and investors should exercise caution while deploying this strategy.

- There is hidden risk to this box option strategy that converts the risk-free or limited risk nature of strategy to potential unlimited risk. When a short box option strategy is deployed using American-styled options - there is always the risk of exercising those options by counterparty, thus leading to immediate collapse of the spread.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.