What are Collateralized Debt Obligations?

Written by Upstox Desk

Published on July 31, 2025 | 6 min read

Collaterals are cornerstones of the financial world, especially when it comes to lending practices. Simply put, a collateral is an asset that has been pledged as a security against a loan or debt, which can be forfeited in case of a default or failure to pay the interest levied on the loan.

A collateralized debt obligations or CDOs, as they are commonly referred to in financial parcalence, are a structured financial product backed by a security and traded as a derivative instrument. These derivatives often have complex payoff structures and settlement conditions. Therefore, the trading is limited largely to banks and institutions.

Structured products are pre-packaged baskets of financial assets containing debt portfolio, financial derivatives, equity, corporate bonds or even synthetic positions. The structure would be designed in a way to mimic the pay off or cash flow of a certain asset class, without having any exposure to that particular asset class. For eg. one could open a term deposit in a bank at a fix rate of 7.0% p.a. for a period of 1 year. However, the bank could, in a structured product portfolio, offer a term deposit that could be engineered to deliver rate of return matching returns of Nifty50 Index in that particular year instead of fixed rate.

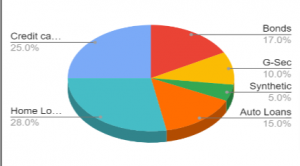

CDOs are just like structured products that comprise diverse varieties of securitised loan or debt portfolios like commercial/corporate papers, bonds, home loans, credit card outstandings, car loans, etc. or it could be a basket of not just one category of loans but of diverse categories.

CDO | |

Portfolio | % Allocation |

Bonds | 17 |

| G-Sec | 10 |

Synthetic | 5 |

| Auto Loans | 15 |

Home Loans | 28 |

| Credit cards | 25 |

Tranches are the interest rate payments or cash flows that are dependent on the performance of the underlying assets constituting the CDOs. The holder or the buyer of the CDO would receive payment in multiple tranches, which are directly proportional to the number of securities constituting that particular CDO.

Because CDOs are based on a portfolio of diverse underlying assets, the performance or the return on investment (ROI) would be different for every component. This difference in return profile allows the holders or investors to customize their return and adjust their risk as well.

CDOs are based primarily on debt instruments thus the pricing of these structured products are based on default risk and interest payment tranches. A CDO containing underlying with high

default risk will be priced more aggressively compared to the CDO containing a low risk stable debt. A higher default risk CDO would have to be offered at a higher interest rate, in order to compensate against the additional risk taken by the investor.

For eg; A CDO consisting of Home Loans would offer lower interest rate (tranches or periodic payments to the holder of CDOs), but would be priced higher than a CDO consisting of Auto loans or Credit Card debt , which in turn offer higher interest rate (tranches payment to holders of CDOs) but are effectively priced cheaper.

Debt with or without secured collateral carry different levels of default risk, therefore CDOs are rated by Rating Agencies based on default and liquidity risk emanating out of them. The risk rating would also vary depending on the asset class carried by the CDO and any change in rating would adversely affect the pricing of the instrument as well.

That being said, two CDOs with similar ratings could also trade at vastly different prices.

How?

Suppose there are two CDOs belonging to the same financial institution or bank and both have managed to obtain AAA rating from the agencies. The first CDO consists of the Home Loans and the other of Auto Loans. Now, despite being evenly rated and despite being backed with collateralized securities, the CDO consisting of Auto loans shall always trade lower in price compared to the CDO with Home loans, as investors would always act on common knowledge that there are lesser defaults in Home Loans, compared to Auto Loans.

CDOs and the Global Financial crisis of 2008

The financial meltdown that hit the world economy in 2008 had its roots and trigger in the US housing mortgage market. The US home sales and mortgage had peaked during 2006-07, so after the home owners had difficulty in flipping houses at higher rates. When the price appreciation stopped the demand collapsed and the cash flow emanating out of the mortgage loans also slowed down.

The crisis was an accident waiting to happen for a long time. The home mortgage or lending practices in the US at that time were not subjected to stringent credit regulations. Therefore, even borrowers with very risk profiles or low credit scores were able to secure multiple mortgages and become owners of expensive properties overnight. These mortgages were then “re-packaged” into CDO’s and combined with some stable or highly rated debts like US treasury bonds, etc. because of inclusion of US Treasuries in the portfolio the rating agencies were not able to accurately rate the CDOs. In some cases the banks were able to put together CDOs wherein, there was no collateral backing. These CDOs were later known as “Subprime debt” which were eventually the single biggest reason for sending the entire banking industry in a tailspin, leading to a nationwide bailout of the banking industry.

Advantages of CDO

- CDOs offer the most versatile structure for investments. They can be based upon either cash flows or market value, they can be structured either to hedge the balance sheet or capitalize on arbitrage opportunities.

- The diverse pool of loan portfolios helps investors customize their cash inflows by shuffling the tranches (interest received by investor). Tranches can also be traded over-the-counter, similar to coupons on bonds.

- CDOs offer instant liquidity to institutions like banks by monetizing their loan portfolio. Also the grouping of various types of loans protects banks from facing default risk arising from a single asset portfolio.

Conclusion

- A collateralized debt obligation is a complex structured finance product that is backed by a pool of loans and other assets.

- These underlying assets serve as collateral if the loan goes into default.

- Though risky and not for all investors, CDOs are a viable tool for shifting risk and freeing up capital.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.